A deep understanding of clients should be a strength of any advice practice. Understanding clients means not only being intimately familiar with their goals, objectives and advice needs, it also means recognising and maximising their value to the practice.

There’s no right or wrong way to go about maximising the value of clients, but there is a strong case for segmenting a client base as a start. Segmentation makes sound business sense. Clients whose needs are complex, who take up more time and who demand a greater range of services and support should pay more than clients whose needs are less complex, who take up less time and who receive a more basic level of service.

Ideally, clients shouldn’t be cross-subsidised and each client should individually be profitable to the practice.

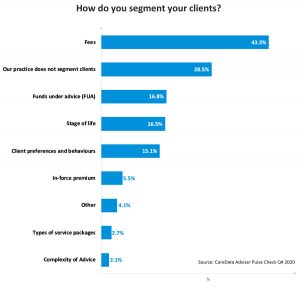

CoreData’s Adviser Pulse Check Q4 2020 found that seven in 10 (71.5%) advisers segment their clients in some way. Of those advisers that do segment their clients, most (81.3%) tailor a service offering to each client segment.

We find that generally, the smaller the practice, the less likely it is to segment its client base. In fact, small practices are around half as likely as larger practices to use segmentation to target their advice services. When we look at it by revenue, almost four in 10 (37.1%) practices with less than $250,000 per annum in revenue do not segment their client base compared with around two in 10 (19.5%) practices with $750,000 per annum or more in revenue. The story is the same if we look at practice size by the number of clients.

The most popular option for segmentation is based on the fees paid by the client (43.3%) followed by funds under advice (16.8%) and then the client’s stage of life (16.5%).

These segmentation options are the most popular irrespective of practice size. In around three quarters (74.5%) of cases, practices divide their client bases into three or four segments.

How do you segment your clients?

CoreData’s work with Netwealth on a ground-breaking, report The Advisable Australian: A new way to think about Australian investors, explores new ways in which segmentation can be tackled, through six dimensions which seek to incorporate behavioural tendencies into a segmentation model.

These dimensions cover an individual’s Financial Capability, Financial Resilience, Financial Wellbeing, Advice Propensity, Technology Adoption and Brand Affinity. The report can help advisers better understand what makes clients tick, in order to segment an existing client base or target prospective clients, and be more effective when providing services, communications and building client engagement.

Six client dimensions

1. Financial Capability: Financial awareness, knowledge, confidence, ability to take control and access financial-related services.

2. Financial Resilience: Financial preparedness and ability to navigate and withstand threats to financial security.

3. Financial Wellbeing: The impact on physical, mental and social health in relation to wealth and finance.

4. Advice Propensity: Openness, amenability and the lack of perceived barriers to using financial advice services.

5. Technology Adoption: Technology savviness, confidence and the value found in digital services.

6. Brand affinity: Brand preferences, attitudes and tendency to stay loyal to one or a few brands, or to use multiple brands.Source: Netwealth, The Advisable Australian: A new way to think about Australian investors

Netwealth’s companion report, The Advisable Australian Volume 2 – The fight for the future market: The Emerging Affluent, looks at segmentation through a more practical lens, by splitting the population into age and wealth groups. However, it also explores how the previous dimensions can combine to produce a more in depth and behavioural look at clients and prospects. It just goes to show that there are many ways to look at segmentation from a simple funds under management split to more involved behavioural segments.

There are positives and negatives to both approaches but, arguably, taking a closer look at the behaviours in your client base will enable you to better understand and service clients.