Against a backdrop of the COVID-19 pandemic, economic

uncertainty and the inexorable advance of regulatory reforms, we think there

are five major forces that will shape financial advice in 2021, and most likely

beyond that. These forces will affect licensees, advice practices and

professional advisers alike, and will require a collaborative response from each

of those groups to tackle effectively.

One of the forces is what we describe as the “advice

diaspora” – advisers leaving their “traditional” homes (largely, licensees

owned and controlled by institutions), driven by a combination of the withdrawal

of institutional licensees from the market, and dissatisfaction with

institutional licensee offers.

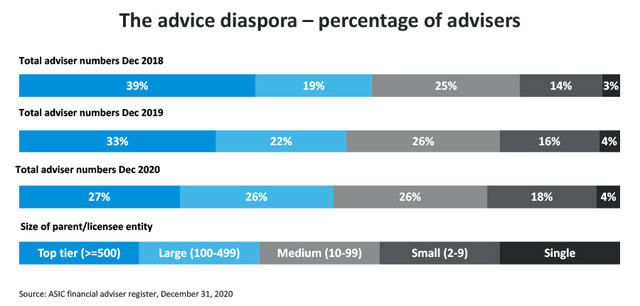

At the same time, we’re seeing the financial advice profession continue to shrink. From a peak of more than 28,000 advisers in December 2018, at the end of 2020 there were 21,000 advisers and the number will decline further as existing advisers retire or opt out of the industry as education standard deadlines roll around. As the market shrinks and advisers leave institutional licensees, there’s been a marked shift in the balance of the licensee industry.

Adviser distribution much more even

In December 2018 the top tier of the licensee industry (licensees or licensee parent entities – mostly institutions – with more than 500 advisers on their licence) accounted for about 40 per cent of all advisers – that is, around 11,200 advisers. Now the distribution of advisers across licensees is much more even – the top, large and medium licensee tiers are broadly equal in size, in an overall smaller market.

This has a range of implications. It’s making life more

difficult for organisations such as regulators, product manufacturers and any

other service providers who rely on interactions or arrangements with licensees

to reach large numbers of advisers. In 2018, these organisations could reach around

11,200 advisers through interactions with 18 licensees. To reach the same

number of advisers now they must deal with 32 licensees. The resources, co-ordination

and market intelligence required just to stand still has increased

significantly.

There are implications for licensees and advisers as well. ASIC

has to date focused much of its enforcement activity on the top tier of the

licensee market. That’s where the bulk of the advisers historically could be

found, and it was dominated by large institutions most able to afford to remediate

consumers for any issues uncovered.

But as the top tier shrinks, the regulator must shift its

attention to smaller licensees or face criticism for focusing its resources on

an ever-dwindling proportion of the adviser market. That means the spotlight

will swing to the large and medium tiers of the licensee industry at a minimum,

and possibly further down the tiers than that.

For licensees unused to the same degree of regulatory attention as institutions, the experience may be uncomfortable. And should the regulator’s attentions reveal incidences of poor advice or substandard processes or record-keeping that ultimately lead to remediation, it could also be financially devastating.

Building trust will be reliant on consumer remediation

That’s why another one of the major forces we think may

shape advice in 2021 and beyond is a requirement for licensees to be adequately

capitalised to fund consumer remediation. This is a clear consumer protection

issue, and it’s critical for building trust and confidence in financial advice that

consumers are not left out of pocket by poor or non-compliance advice. Taking a

complaint to the Australian Financial Complaints Authority may be an option for

consumers, but we know how unpaid determinations can mount up when unscrupulous

operators are prepared to let an advice business or licensee fold and walk away

rather than meet their compensation obligations.

At some point there will be a compensation scheme of last resort for financial advice. Such a scheme would likely be funded by industry, and well-run and well-capitalised licensees should not be required to underwrite the poor practices and processes of substandard or unethical licensee businesses. So unless legislators are happy to create a two-level licensee industry, where some licensees are required to meet minimum capital adequacy requirements while others are not, it means capital adequacy rules must come to own-AFSL firms as well.

The advice diaspora and consumer protection (including

ongoing issues in the professional indemnity insurance market) are only two of the

five factors we think will drive advice in 2021.

We’ll also be watching closely the repricing of licensee and advice services and the issues underlying the public’s continued reluctance to value advice; the increasing role of fund managers and other service providers in supporting advisers and advice practices in a vacuum where licensees aren’t adequately resourced to do so; and the creation of advice practices that are profitable, robust and built to last. We’ll discuss more of these issues in future articles.