As Australia headed into Easter, the original epicentre of the COVID-19 outbreak formally lifted strict lockdowns that had been in place for over two months. Although hardly out of the woods, an apparent fall in the number of new cases locally and internationally aided the prevailing mood, as governments and central banks signalled their intentions to provide support as required.

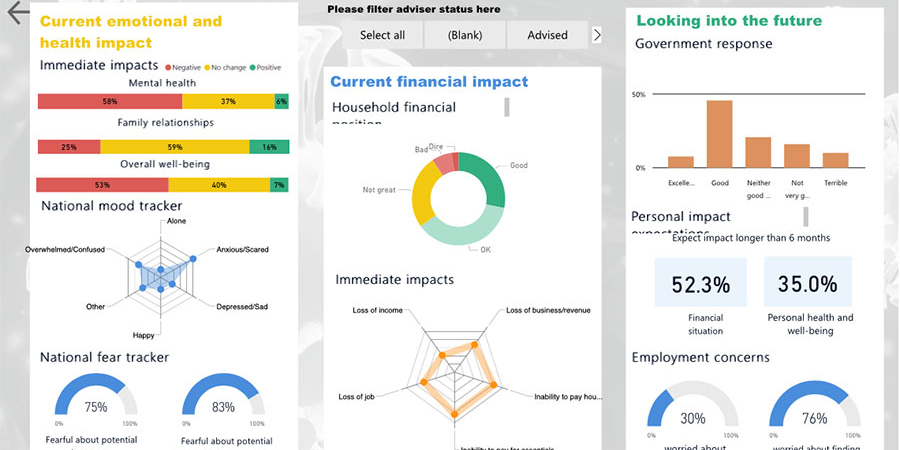

CoreData’s COVID-19 Consumer and Investment Pulse Check is tracking the shifting sentiment of Australians throughout the course of the pandemic, revealing the extent to which the stimulus is boosting the public mood. The trends, based on surveys of a combined 1,519 Australians over the last fortnight, can be viewed on our COVID-19 Impact Dashboard, which is updated weekly.

April 8 marked an historic moment in Australian fiscal policy, as the Federal Government successfully pushed through parliament its unprecedented $130 billion wage subsidy package. This followed the Reserve Bank of Australia’s April board meeting, after which Governor Philip Lowe noted that markets were beginning to operate more effectively, signalling a potential wind back in the bank’s inaugural application of Quantitative Easing.[1]

Approval of government response on the rise

These efforts have not gone unnoticed, with CoreData’s research revealing almost two thirds (64.6 per cent) of Australians think the Government response has been good or excellent, up from approximately half (52.4 per cent) a week earlier.

The JobKeeper package has already begun to improve the job market outlook, with the number of Australians worried about losing their job due to COVID-19 falling to 28.0 per cent from 30.8 per cent the previous week. Meanwhile, those without a job also report an improvement in expected prospects, despite almost three-quarters (73.2 per cent) of unemployed Australians still worrying about finding a job in the current market (down from 81.1 per cent).

Australian investors have mirrored the optimism of the RBA Governor, as the local market begins to exude more stability, going into the long weekend on a strong high. The near-term outlook for business conditions, investment markets and the Australian economy have all seen marginal improvements in the eyes of respondents.

Investors are also beginning to feel less vulnerable, with a 10 per cent increase in the number of Australians reporting feeling financially secure (43.7 per cent, up from 33.3 per cent). Similarly, this week saw an approximately 15 per cent reduction in those expecting the financial position of their household to get worse in the next 12 months (48.1 per cent, down from 62.3 per cent).

The improvement in outlook for financial markets is most clearly signalled by the change in CoreData’s Investor Sentiment index, rising to -28.8 from -45.1 a week earlier.

Although many remain anxious and overwhelmed by recent events, the number of Australians feeling happy has risen to almost one in four (22.2 per cent), up from one in seven (14.7 per cent) previously.

Complacency remains the enemy of the good during this pandemic, and a recession still appears all but inevitable. However, the tide appears to be turning in our favour and a continued effort from community and government will see those on the ground begin to feel better about their financial situation and respective ability to survive the crisis.

[1] https://www.rba.gov.au/media-releases/2020/mr-20-11.html