Every quarter for the past 18 years, CoreData has collected information on Australia’s high-net-worth investors and their intentions and mapped them against the investment intentions of our mass affluent.

For the purposes of this research, a high-net-worth investor is someone who has more than $1 million in the stock market or $1 million in debt or is earning more than $450,000 a year.

We exclude superannuation and home ownership from this definition, because neither of those things really change people’s behavior.

Depending on who you ask, there are between 300,000 and 400,000 of these investors in Australia and they are – despite what you might think – somewhat unloved by financial service providers.

They are unloved because they are hard to find. They are unloved because they are time-poor. And they are also demanding and, frankly, the most difficult to serve.

The corollary to this is that for most of them, if you serve them well, they are great clients and happy to pay for a great service.

Today I’m going to take you through our latest high-net-worth investor research and talk to you about how they are feeling.

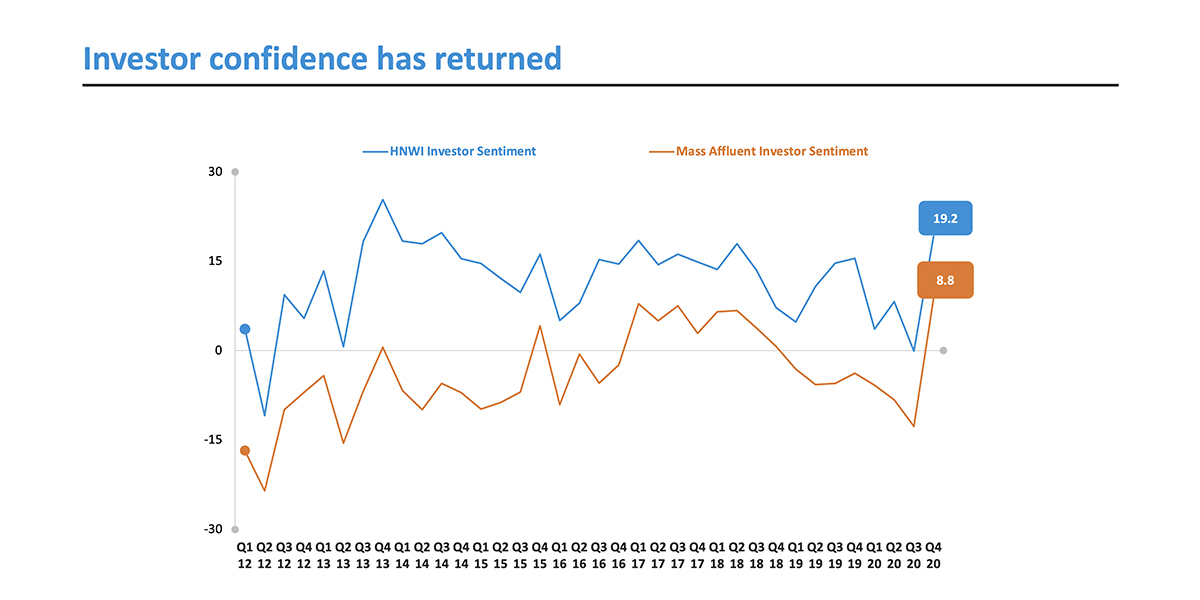

Investor confidence has returned

Critical to understand that in the post-pandemic investor, confidence has started to return to the market. The rich, because they are rich, are much more confident than the mass affluent.

But we should understand that confidence and action aren’t the same thing. Confidence has returned, but as we’ll unpick as we go through this data, action is still some way away.

Property warming up

The property market is starting to warm up again. Particularly mass affluent investors are starting to move back into property as the price of cash falls and property is being repriced.

There is some evidence that this bubble may have already moved through and property is starting to reprice; but there is also increasing demand for this asset class.

If we unpick this even further, it’s non-traditional, non-retail properties – and by retail, I mean residential properties – that people are attracted to.

Industrial properties, distribution properties, properties which have a yield are very attractive to both mass-affluent and high-net-worth investors and there’s a lot of movement in this sector at the moment.

Shares are back

Very quickly, shares have become the most popular thing for the rich to invest in, while mass-affluent investors are only mildly positive on share investment.

Interestingly, the type and shape of share investment has changed; the way in which they’ve invested in the past has changed; but broadly shares are up.

It’s going to be important to examine your portfolios for real opportunity and understand what’s going on.

That said, this type of share intention means the money is flowing into the market and is going to be driven strongly for at least a quarter to come.

What’s critical to understand is that this is not evenly distributed.

They’re not looking for traditional share investments, they’re looking for share investments that are going to ride the change in the economy, that may have been mispriced, or have some macro-economic or demographic tailwind behind them.

The wealthy are cautious

At the moment this is the most important slide in all the research that we’ve collected.

If you can look here you can see very clearly that while the mass affluent – the people earning between $100,000 and $450,000 – have decided the market is improving very quickly, the rich are not yet convinced.

They’re cautious about overheated momentum in the market and making investments fairly cautiously.

So while sentiment is up, and their intention to move into equities is up, their overall sentiment has started to move in a very different way to the mass affluent.

The important thing to understand about this is that the rich are more commonly right than the mass affluent, partly because they have money in the market, partly because they are more exposed to the market, and partly because they’re better at making decisions.

Critically, understand this: that talking to these people now about opportunity now isn’t going to be met well. They are still not particularly confident.

It’s very difficult to move a group when their confidence is low. We’re going to have to start to wait for that to change and ride the wave of that investor intention as it starts to move into the market.

Wealth at two speeds

There are three big drivers in what’s effectively become a two-speed economy.

One chunk of the economy – about 13 per cent, which is constructed by tourism and education – has been stripped of all revenue for the past year, effectively.

That means every other part of the economy which is driving forward is really driving what’s going on.

The first thing to think about is that lending has become the key. For a lot of the rich in Australia, as the cost of money has fallen – and it’s now in the sub-2 per cent world – they are looking to use that debt and invest.

They are looking to profit from the repricing of the market, and they are seeking to profit from the low cost of money.

The second part about this is that the business world has been bifurcated. Some businesses are going incredibly strongly and have had a great 2020; some businesses have had a terrible 2020; and understanding where your clients are and how they’ve been affected is going to be really important.

The next thing to understand is that no matter how good their 2020 has been, they have to turn that into a great 2021.

Understanding how to help people though that process is going to be a significant challenge for the entire industry and something which is going to be very important.

The third thing to think about is that new opportunities are needed. The conversations that we’ve had in the past are not going to survive into the future.

The fastest-growing areas of investment interest are alternatives; not necessarily traditional property; agriculture; medical investments; emerging markets; and growth stocks, not yield stocks.

So making sure you can have that conversation is going to be very important.

Beware the Ides of March!

The final thing to think about is the rich don’t think the worst of this is over yet. Beware the Ides of March!

One of the things that’s really important to understand is that in the middle of last year we asked people when they think the deepest pocket of the recession would be.

There’s a lot of data coming from the ABS and the RBA which suggests the same, which means that they’re going to wait and see what happens for the repricing in that quarter and then move back into the market.

This correlates with some of the data that you’ve seen earlier about them still standing on the sidelines.

They’re waiting for the great repricing to happen after the government stimulus has come off and after the profit announcements for December this year.

So being active and engaged in the first quarter of the new year is going to be very, very important.

Six things on their mind

If we start to think about the things that are on their mind, we can sum them up pretty carefully.

The first thing to think about is you’ve got to understand the next quarter is going to be the difficult quarter and working through that quarter with them is going to be important.

Being great at lending in a less-than-2-per-cent world is also going to be a big driver. This is particularly true of the banking sector, who are pretty choppy in this market at the moment.

Being able to unpack and show them growth assets and mispricing opportunities and alternatives is going to be critical to your growth, because at the moment they’re looking, frankly, for anything that’s better than cash.

Big changes for HNWI management

The reality is that the next quarter is going to be one of big change for high-net-worth investor management in Australia.

COVID-19 has reset the market, but the other thing, is the big change that has swept through the wealth management industry.

Private banking has been vastly affected by that, and I think there are more changes to come.

If you want to find out about those changes, and what they mean for you or your business, contact me at [email protected]

New Model Adviser is a website powered by CoreData, showcasing our research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.

Please read New Model Adviser’s guidelines on posting comments