Financial advice can play an important role in the financial education of Australians and facilitate the improvement of financial literacy through the wider community. And it’s not only those with lower financial literacy that benefit from advice. It can improve the financial literacy of the vast majority of Australians.

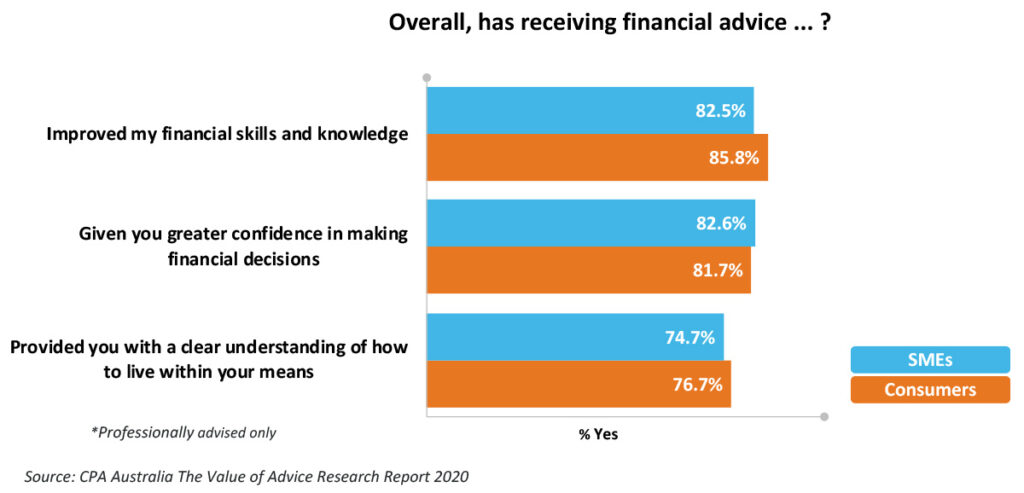

According to CPA Australia’s The Value of Advice research report, more than four out of five consumers (85.8 per cent) and small to medium enterprise owners (82.5 per cent) who received professional advice reported to have improved their financial skills and knowledge. The report defines professional advice as services provided by any qualified professional adviser including accountants, financial advisers, tax agents and mortgage brokers.

Advice not only improves the skills and knowledge of the individual who receives it, but we can see that it also improves the confidence of individuals in making financial decisions. Again, four in five consumers (81.7 per cent) and small to medium enterprise owners (82.6 per cent) say that professional advice has improved their confidence in decision-making.

The key takeaway is that no matter the level of an individual’s financial literacy, advice – from any qualified professional – is highly likely to improve that individual’s understanding, confidence and knowledge on financial matters.

Just how financially literate are Australians?

CPA Australia’s The Value of Advice research report shows the objective financial literacy of Australians is quite split. Objective financial literacy is determined by asking individuals five questions which cover numeracy, inflation, portfolio diversification, risk versus return, and money illusion.

These are questions developed in the Household, Income and Labour Dynamic in Australia (HILDA) survey. Those who scored zero or one were categorised as low financial literacy, two or three as medium, and four and five as high-literacy.

Around two in five consumers (42.9 per cent) and small to medium enterprise owners (41.0 per cent) have high objective financial literacy. A similar proportion have medium objective financial literacy while the minority have low financial literacy.

The important thing to remember is that while objective financial literacy is quite split in the population, the vast majority have indicated that financial advice has improved their financial literacy. Even those in the high-literacy group gain benefits.

These individuals were also asked to rate their own financial literacy on a scale from zero to 10, to determine their own subjective financial literacy. A rating of zero to three was considered low, four to six as medium and seven to 10 as high.

What we found is that SME owners were more likely to rate themselves as high. They suffer from “overconfidence” which can be just as detrimental as low financial literacy. Financial advice can provide a reality check for these individuals, to make sure they stay on track.

Learning by doing

Different people learn things most effectively in differing ways. Financial advice can be a great facilitator for improving Australians’ financial literacy and it works particularly well for those who prefer to learn from experience. By having skin in the game, people often absorb information much better because it has direct relevance and impact on their life.

Improving Australia’s financial literacy my not be the primary objective for financial advisers, but CPA Australia’s The Value of Advice research reports shows it’s a happy side-effect of delivering high-quality, professional advisory services.

New Model Adviser is a website powered by CoreData, showcasing our research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.