Describing 2020 as a difficult year is like describing Donald Trump as an unusual President. The stresses placed on advisers and advice businesses have been profound in many cases, and on top of the specific issues caused by the COVID-19 pandemic there have been the underlying, ongoing issues of compliance and education keeping advisers busy.

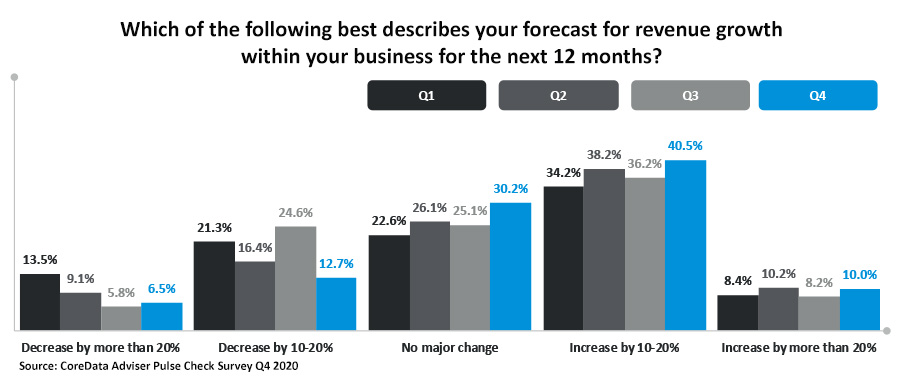

But as 2020 draws to a close, there’s some bright news – a light at the end of what’s been quite a long and dark tunnel. CoreData’s latest Adviser Pulse Survey, conducted this quarter, reveals that a majority (50.5 per cent – a very small majority, but a majority nonetheless) expect revenue growth for their business to exceed 10 per cent for the next 12 months. This includes around one in 10 practices now expecting revenue growth to exceed 20 per cent.

This represents quite an improvement in the overall outlook since the beginning of the year, and it’s testament to a number of things – not least, the remarkable resilience and adaptability demonstrated by the advice community in the face of very difficult conditions.

Over the course of 2020 the proportion of advisers expecting their businesses to suffer a significant (that is, greater than 20 per cent) fall in revenue has declined from more than one in eight (13.5 per cent) in Q1 to around one in fifteen (6.5 per cent) in Q4.

The proportion of practices expecting a smaller drop in revenue (up to 10 per cent) in the year ahead has declined from around one in five (21.3 per cent) to around one in eight (12.7 per cent).

Advisers who responded to the Q4 survey said the greatest concern for themselves or the business in which they work remains the administration and compliance burden they’re under (nominated by more than three-quarters of advisers). But the proportion who say COVID-19 is major concern has declined from almost half (48.7 per cent) to less than a quarter (21.3 per cent).

Partly it reflects an ability simply to live with the changes and the disruption the pandemic has caused, and the way businesses have adapted, but it also potentially reflects an overall decline in community concern about the worst effects of the virus as public health measures continue to keep the outbreak under relative control.

Concerns over mental health remain significant and nominated by more than four in 10 (42.3 per cent) advisers, but the figure is down slightly from Q3 (48.7 per cent).

The improved advice business outlook is reflected in another question we asked advisers, namely what their expectation is for the outlook for the advice industry itself for the first quarter of 2021. Most (52.9 per cent) advisers expect it to be neither better nor worse, but that is up from over a third (36.8 per cent) at the start of the year.

The proportion that expects it to be much worse in Q1 2021 has halved, from 9.0 per cent to 4.8 per cent. And the proportion that expects it to be somewhat worse has declined from four in 10 (40.0 per cent) to just under a quarter (23.4 per cent).

New Model Adviser has previously reported that trust in financial advice seems to have taken a step up in recent months, as the COVID-19 pandemic places individuals and households under financial stress and consumers begin to rethink the value of advice. We’ll keep a close eye on that particular measure as 2021 unfolds.

How the new year will actually play out, of course, remains to be seen. If there’s anything that 2020 has taught us it is that making hard-and-fast predictions about anything can be undone by unforeseen issues and left-field events. But it’s a notable finding of CoreData’s latest adviser-focused research that the pall that seemed to hang over the industry earlier in the year is lifting.

New Model Adviser is a website powered by CoreData, showcasing our research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.