Just when it looks as if demand for financial advice could be set to escalate on the back of the COVID-19 pandemic, it increasingly looks as if that demand might go unmet. Unless there is a significant paradigm shift, persistent barriers and declining financial planner numbers mean the low penetration of financial advice among Australians is set to continue.

CoreData’s COVID-19 research conducted in August revealed that the pandemic has prompted more than one in four (25.7%) Australians to seek affordable advice and support from a financial planner to help strengthen and protect their financial position post-COVID-19, with demand being highest among Gen Y (32.2%).

The pandemic has focused attention on the need to be better at budgeting and saving to pay the bills. In addition, superannuation, investments and insurance are now more top-of-mind for more Australians than ever before – and these are the very things that a financial planner can help them with.

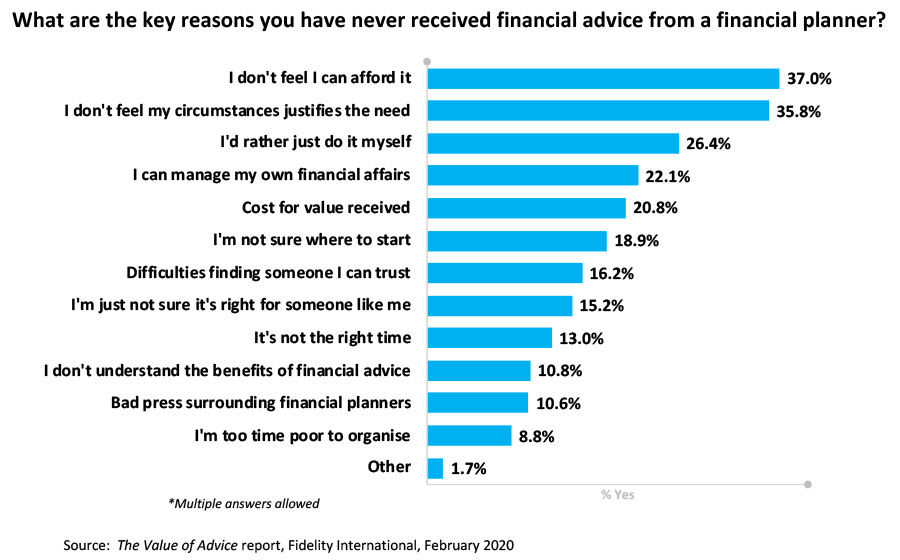

Unfortunately, financial advice from a financial planner is likely to be out of reach, or seen to be out of reach, for many of those who may need it when they may already be struggling financially. CoreData research has consistently found that affordability is a key barrier to seeking financial advice, although there are other barriers besides.

For example, research conducted by CoreData for Fidelity Australia has found that almost four in 10 (37.0%) Australians who have never received financial advice from a financial planner do not feel they can afford it.

Furthermore, while the demand for financial advice may have increased, under current conditions financial planners may be in short supply. Recent CoreData analysis has revealed that the number of financial planners on the ASIC register has fallen by more than 25% in just under two years, from 28,500 in December, 2018, to 21,500 in September, 2020. And as basic high school economics would suggest, when demand increases while supply remains unchanged or decreases, price increases, exacerbating the affordability barrier. That barrier is likely to remain unless there is a meaningful influx of new entrants into the financial planning sector. But is there going to be one?

2020 has been a year of paradigm shifts like no other, involving curfews, lockdowns, social distancing, working from home and the seemingly endless Zoom meetings. Many of us are now doing a lot of things very differently compared to 2019. Perhaps this is the time to embark on another paradigm shift, and one that really matters: to make advice from a financial planner more affordable and accessible to more Australians.

Otherwise, advice will continue to exclude, or be perceived as excluding, Australians who may not be wealthy enough to be able to afford financial advice. Advice from a financial planner will remain accessible only to the one in four or one in five Australians who currently receive it.

Although less-wealthy individuals are understandably less attractive for financial planners to service, the advice they need is likely to be less complex (and possibly less costly) but remains highly valuable for them.

The financial planning sector should start adjusting its offer to meet the increased demand from these Australians, including through greater use of technology to better segment and service clients according to their needs. Robo advice may be part of the solution, but it will surely never deliver the holistic value of financial advice that human financial planners can deliver to clients.

Yes, it is not a simple problem to solve, and many great minds in the sector have been (and continue to be) working on it. But the shift has to start somehow, sometime, somewhere, even if only slowly.

Perhaps when we look back at history, more affordable and accessible financial advice could be one of the key legacies of the COVID-19 pandemic, playing a key role in strengthening and protecting the financial position of Australians in the new normal.

New Model Adviser is a website powered by CoreData, showcasing our research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.