CoreData has been tracking the increase in the popularity of ethical investing among Australian investors as a growing number of people seek to align how they invest with their values and principles regarding environmental, social and governance (ESG) issues.

However, the actual uptake of ESG investments is still relatively low in absolute terms, with CoreData’s Investor Sentiment Research in Q4 2019 finding less than in four (24.1 per cent) investors have an ethical investing approach in their portfolio.

Those who do not have this approach most commonly say they have never thought about it (34.4 per cent) or they are not interested (32.9 per cent). Ethical investing appears to be more of a “nice-to-have” luxury rather than a key consideration in investment decisions.

Beyond these reasons, however, it is clear there are still misconceptions about higher fees and lower returns associated with ESG investments.

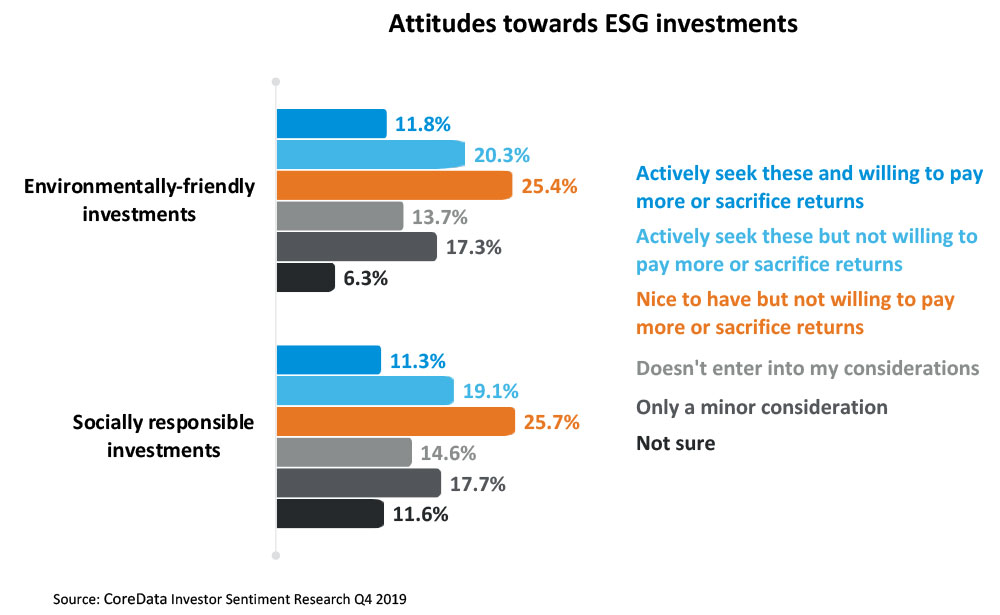

More than two in five investors wouldn’t be willing to pay more or sacrifice returns for environmentally friendly or socially responsible investments (45.7 per cent and 44.8 per cent, respectively). For others, these investments also do not enter into their consideration or are only a minor consideration.

However, there is evidence that interest in ethical investing has grown globally since the COVID-19 pandemic. According to CoreData research in Q2 2020, 51% of global institutional investors (including pension funds, sovereign wealth funds and banks) now fully integrate ESG issues into their investment approaches, up from 36% in Q4 2019.

It appears that the pandemic has further encouraged institutional investors to consider the purpose and impact of their investments. However, this shift could also be explained by the realisation that ESG investments can and do produce competitive returns, particularly at a time when non-ESG investments have struggled amid the broader economic downturn as the pandemic took hold.

Given the encouraging momentum globally, local interest in ESG investments could grow if the misconceptions around fees and returns were clarified and fees and returns were perceived to be more competitive. Indeed, the large majority of investors would consider environmentally-friendly or socially responsible investments if they didn’t have to pay more or sacrifice returns (76.2% and 70.1% respectively).

While the actual uptake of ESG investments is still relatively low in absolute terms, the pandemic could actually prove to be a tipping point that shifts the dial. Perhaps we could soon see ethical investing cross the chasm and become the new normal in the COVID-19 new normal among Australian investors.

New Model Adviser is a website powered by CoreData, showcasing our research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.