Since the 1970s when big names like Sequoia, Bridgewater and KKR were founded, alternative asset classes have been in the playbooks of institutional investors such as pension funds, endowments, and sovereign wealth funds.

The alternatives universe is still dominated by institutional investors, but retail investors, and especially sophisticated investors, are becoming increasingly interested in the diversification opportunities offered by alternatives. And there are opportunities for financial advisers to guide clients through the expanding universe of alternative investment options.

Alternatives generate cash flows that are uncorrelated to traditional investments such as publicly listed equities and investment-grade bonds. Mirroring these return characteristics, alternatives’ risk characteristics are also different from portfolios with long-only positions in equities and bonds. As COVID-19 continues to reshape traditional investment markets, interest in the alternatives space appears to be set to accelerate.

The alternatives allure

Considered to be Illiquid, risky, complex, and opaque, alternatives have been unattractive to investors with limited knowledge. But financial technology innovation, including distribution and reporting platforms, and regulatory change in the post-GFC era have been improving accessibility as well as transparency of alternative investments, driving heightened interest in the alternatives universe.

On average, alternatives have a record of historical returns exceeding traditional assets. The premium return compensates for risks such as illiquidity. Markowitz’s portfolio theory seems to suggest that adding alternatives to a portfolio would reduce risk without compromising expected returns, but in practice, optimising allocation to alternatives is a complex task.

Due to alternatives’ low correlation to traditional assets there is large performance dispersion between the best- and worst-performing alternatives funds. These factors, and others, render alternatives unappealing to the average retail investor – even though “average investors” may already have exposure to alternatives via their super funds.

Institutionalisation and retailisation

CoreData’s recent alternatives research (1) found that a large majority of wealthy individuals who invest in alternatives invest via alternatives funds or funds-of-funds. The risk of investing directly, or even co-investing in alternatives, is simply too high and only large institutions have the skills to manage.

A World Economic Forum paper2 says the volume of alternative assets under management has been growing rapidly since the 2000s. Large pension funds and sovereign wealth funds have opened to alternatives, allowing asset managers to develop infrastructure and offer the capacity to optimising matches between asset owners and asset classes. Retail investors are venturing beyond traditional investments into the alternatives universe, driven by a search for yield and diversification.

These trends correspond with CoreData’s findings, as most advice businesses targeting HNW clients expect to see more supply of quality opportunities and more demand for premium returns and diversification in the next three to five years.

Getting more sophisticated and more prudent

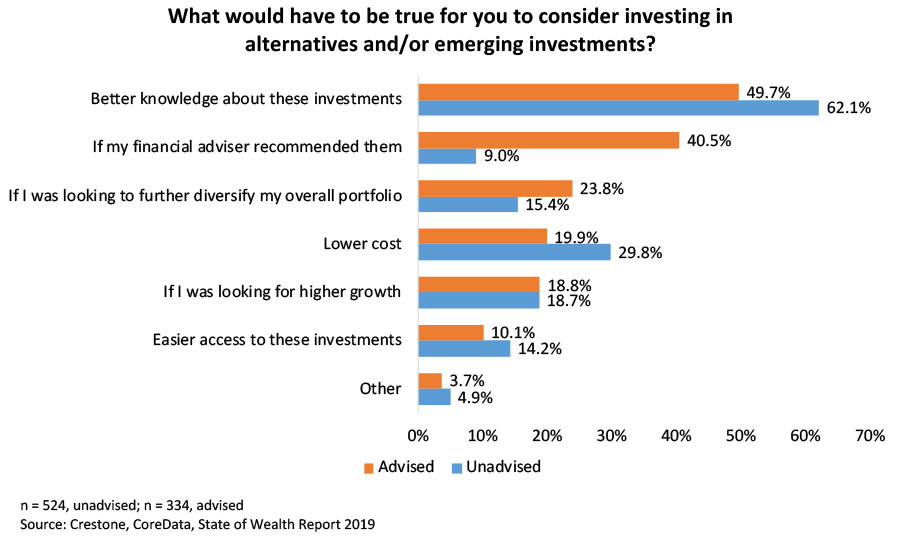

Research3 investigating 858 wealthy Australians reveals their lack of sophistication, with only a minority (14.6%) of Australian HNWIs holding alternatives in their portfolios. The top barrier to investing alternatives is investors’ limited knowledge of the sector. More than half (57.0%) of wealthy Australians say they would consider investing in alternatives if they understood them better.

Approximately a quarter of respondents regard high fees as a blocker, but low cost – benchmarked with traditional assets – of alternative investments is likely to be out of reach for a long time to come, due to heavy due diligence required to overcome information asymmetry in the alternatives universe.

While high fees remain the reality of alternatives investments, there are things that investors could do to improve their portfolio in today’s low-yield and high-uncertainty environment with assistance of advisers and alternatives. About two in five advised Australians would consider alternatives if their advisers recommend them.

This implies the critical role that advisers play in educating investors about alternatives as well as matching supply and demand to facilitate the mainstreaming of alternatives.

But the alternatives universe remains complex. Venturing into the alternatives universe requires advisers to make clear sense of the risks and opportunities, and to make it clear to clients what they are getting into.

- CoreData alternatives research conducted in August 2020

- World Economic Forum, Alternative Investments 2020 http://www3.weforum.org/docs/WEF_Alternative_Investments_2020_Future.pdf

- Crestone, CoreData, State of Wealth 2019