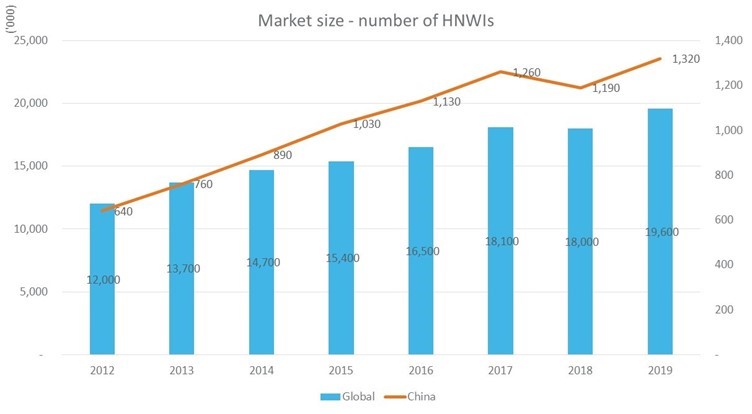

The HNW market in China is booming as the country’s strong economic engine powers wealth creation. In addition to boasting the second-largest economy globally, China is now the fastest-growing wealth market in the world.

How can foreign institutions penetrate this lucrative market and tap into this growing source of wealth? More importantly, how do global wealth managers differentiate themselves from domestic players at a time when the Chinese economy is firing on all cylinders?

Amid the carnage of Covid-19, China performed impressively in 2020. It managed to stage a relatively swift recovery from the pandemic and was the only major economy to register gains for the year. The country also saw its stock market rally, with the CSI 300 index surging 27% in 2020.

China’s recovery and positive fundamentals has seen HNWs gravitate toward their homeland. In line with this, approximately one in three Chinese HNWs are looking to reduce their overseas exposure and refocus on the domestic market. Furthermore, local banks dominate China’s private banking market due to their ability to offer a seamless customer experience and provide onshore-offshore integration capabilities.

But there remain opportunities for foreign institutions, especially with the emergence of China’s new wealthy generation in an environment where loosening regulations facilitate the opening up of the country’s financial markets.

And there are a number of factors driving some Chinese HNWs into the arms of financial institutions other than local banks. Brand reputation and the lure of high returns play a part, as do having a professional team and a good client manager.

But while global asset managers may boast big brands, big balance sheets and the prospect of big returns, the key to unlocking the Chinese wealth market is understanding the investment mindset of wealthy investors. Foreign institutions looking to gain market traction will need to overcome language and cultural barriers and develop a deep understanding of the values, behaviours and attitudes of Chinese HNWs across generations. This will enable them to design solutions and products specifically tailored to HNWs in different age and economic brackets.

Understanding the changing face of the HNW market is therefore vital. More than three in five Chinese HNWs are first generation wealth creators – pioneers who were able to seize business opportunities stemming from the country’s economic reforms. But the new ranks of the rich are professionals and second-generation inheritors who are more likely to have been educated overseas and prefer greater autonomy over their financial affairs.

Wealth managers need to adopt separate and distinct strategies for these demographic cohorts. But equally, they need to develop coherent strategies around intergenerational planning so they are speaking with different generations of the same family. Wealth inheritance planning is one of the core services valued by Chinese HNWs.

Foreign financial institutions will also need to recognize how attitudes to risk tolerance are evolving among different HNWs. Entrepreneurs, for example, display a higher risk tolerance than before the pandemic. But other groups of HNWs – including those gaining their wealth from earnings or investments – have become more risk averse. This suggests entrepreneurs have a greater appetite for products that can capture opportunities arising from black swan events like Covid-19, while other groups want tools providing protection against market volatility and uncertainty.

This more defensive mindset also manifests in attitudes towards investing overseas, where diversification is the dominant driver. This is an area where wealth managers should focus their attention on the very rich (RMB 10 billion and above) – they are far more likely to invest overseas compared to other HNWs. Meanwhile, geopolitics continues to exert an influence on where Chinese HNWs are investing. Hong Kong remains the number one destination but has lost some of its shine following a year of political tensions and concerns around the National Security Law. Other popular countries include the US and Australia, with the likes of the UK, Canada and Singapore also increasingly featuring on the radars of HNW investors.

There is no doubt that foreign financial institutions with powerful global reputations will be better placed to carve out a competitive advantage. But when such organizations are competing against similarly well-established firms it will be less about showcasing their brand and history and more about demonstrating their expertise. Professional expertise is something which is deeply valued by HNWs in China. They highly regard the expertise and professional qualifications of service teams for instance. But this expertise needs to go above and beyond service. It should be about acquiring an in-depth knowledge of the motivations, desires and goals of different HNW types. Such expertise builds trust and trust builds relationships.

Foreign institutions looking to win the HNW market in China therefore need to win the minds of the country’s wealthy investors. In the Year of the Ox – which signifies strength – it will be all about demonstrating their strength of expertise and understanding.