It started as a health crisis and quickly became an economic crisis. Now, six months on from the initial COVID-19 lockdown in Australia, we are arguably experiencing one of the biggest mental health crises the country has ever faced.

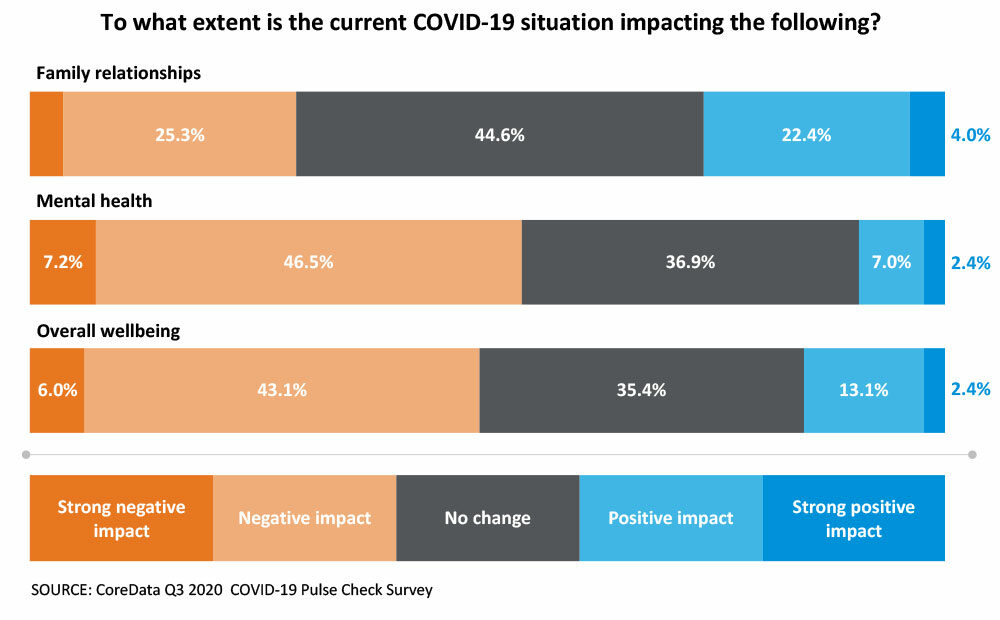

According to CoreData’s latest COVID-19 Pulse Check research, more than half of Australians (53.7 per cent) say COVID-19 is having a negative impact on their mental health, while a further 49.1 per cent say it’s negatively impacted their wellbeing.

Modelling by the Brain and Mind Centre at the University of Sydney and the NHMRC Centre for Research Excellence on prevention of youth suicide, published in May, prior to the most recent lockdowns in Victoria, predicted a 25 per cent increase in suicides as a result of the pandemic. That’s 750 to 1,500 more suicides each year, on top of the 3,000 plus lives already lost to suicide annually.

The literature around “surge capacity” goes a long way to explaining why we are experiencing such severe mental health impacts, and why there is likely more to come.

The term, referenced in an article by science journalist Tara Haelle, describes “a collection of adaptive systems – mental and physical – that humans draw on for short-term survival in acutely stressful situations, such as natural disasters”.

However COVID-19 is not short-term, it’s indefinite and has created a level of uncertainty that is new to all of us.

In Victoria, where rolling lockdowns have been in place since March, the sense of isolation is palpable, with the collective coping mechanism “we’re all in this together” no longer available. Anecdotally, Victorians are telling us that while Lockdown 1 felt like an opportunity to slow down and reflect, Lockdown 2 feels like a slap in the face (with a gloved hand).

The problem with surge capacity is that when it’s depleted, it has to be renewed. And that’s not been possible for many people, as the acute emergency that initially took hold has evolved into a chronic global crisis.

With the ongoing uncertainty chipping away at our resilience, many are turning to professionals and support services to help them cope with anxiety, depression and in some cases post-traumatic stress disorder due to the impacts of the virus. And recent reports suggest women are far more likely than men to be seeking out mental health help.

A perfect storm

The current mental health crisis could not have come at a worse time for Australia’s life insurance sector.

As APRA noted in its Life Insurance Claims and Disputes Statistics December 2019 bulletin (released 21 April 2020), the all-in costs of disability income protection (DII) products exceeded premiums paid in the year to December 2019.

Following the cessation of Agreed Value contracts this year, we’re already seeing a trend towards increasing premiums for DII.

CoreData’s Q3 Adviser Pulse Check found nearly three in five (58.4 per cent) advisers offering risk advice have witnessed higher premiums following the removal of Agreed Value, with this likely to trigger switching activity in the coming months.

Of those who are seeing a trend towards higher premiums, less than one in five (17.9 per cent) have moved clients to a different insurer, but a further three in 10 (30.8 per cent) say they will look to do this.

Disability claim rates are directly correlated to unemployment. Studies have shown that when unemployment rises, so too does the propensity for people to claim on income protection policies.

While Australia’s unemployment rate fell to 6.8 per cent in August, from 7.5 per cent in July, there are 338,000 fewer employed people compared to last year and 206,200 more unemployed Australians, and underemployment is at 11.2 per cent, up 2.7 percentage points on August 2019.

Insurers risk being hit with a triple whammy: claims, lapses and policy switching. The latter is OK if you’re on the receiving end of the switching, but if you’re forking out for increased mental health related IP claims, while at the same time dealing with policy lapses and policyholders voting with their feet on premiums, that spells trouble.

The good news is that COVID-19 has shown us that we’re not invincible and has reinvigorated the concept of saving for a rainy day. Many people are yet to return to pre-COVID-19 spending habits, with nearly half (45.5 per cent) saying it’s because they’ve realised they can do without some of the things they used to spend money on.

A sharper focus on good saving habits could be one of the positive outworkings of the crisis, while greater focus on our own mortality could help break down one of the most significant barriers to life insurance take up in the first place; we don’t think we need it.

Indeed, in the early phases of the pandemic, more than one in five Aussies (22.2 per cent) told us the outbreak had prompted them to discuss mortality with friends or family. A topic traditionally considered taboo, was now featuring at the dinner table.

Life insurance companies have an opportunity to harness the renewed focus on protecting ourselves and our assets; the key will be balancing the needs of cost-conscious consumers, with the profitability and sustainability of the products.

If this article has raised any issues for you, or if you’re concerned about someone you know, call Lifeline on 13 11 14 or Beyond Blue on 1300 22 4636.