Australia’s life insurance industry is facing significant headwinds, driven by regulatory reform, margin pressure and the evolving adviser landscape.

The Life Insurance Framework (LIF) review, Protecting Your Super and Putting Members’ Interests First (PMIF) legislation are changing the risk insurance sector, and advisers’ ability to deliver services efficiently and profitably.

Meanwhile, the latest Australian Prudential Regulation Authority (APRA) life insurance statistics show the sector made a $1.1 billion loss on individual disability income insurance (income protection) in the year to June 30, 2019 and a $108 million loss on group disability income insurance. Indeed, the sector lost $349 million on individual disability income insurance in the June 2019 quarter alone.

The decline in net profit after tax is being driven by lower interest rates, and an increase in claims. Further, a product design quirk means those insured can be better off not working.

Bundling of ancillary benefits, while common in the sector, can cause claim benefits to exceed the claimant’s pre-disability income, creating a disincentive for them to return to work and leading to lower termination rates.

In a letter to life insurers in May this year, APRA suggested poorly formed pricing and product development and design decisions had amplified the risks life companies are exposed to within their individual DII portfolio.

However, there is little appetite from life insurers to move quickly to address these risks through more sustainable product design and pricing, as the first mover disadvantage can’t be denied.

While net profit after tax on individual lump sum ($739 million) and group lump-sum ($57 million) fared better during the 12-month period, these results still represented a decline from $791 million and $180 million respectively year-on-year. This was caused by higher net policy expenses and the effective movement in net policy liabilities.

It’s tough out there, and it’s likely to get tougher.

In whom do we trust?

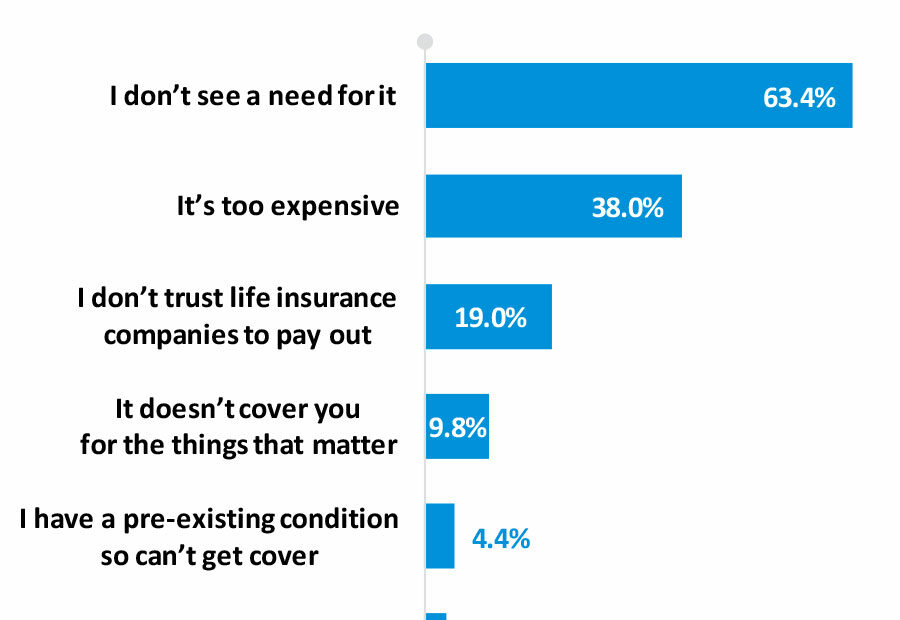

Like their financial services industry counterparts, life insurers are grappling with declining consumer trust, and ongoing perceptions that life insurance either isn’t needed, or isn’t worth the money it costs.

Source: CoreData Research.

Trust in life insurance improved marginally compared to Q2 (27.4 per cent), however is down significantly compared to Q1 2018, prior to the Royal Commission into Financial Services, when around two in five Aussies expressed trust in the sector (42.4 per cent).

More than two in five superannuation members don’t know whether they hold more than the default level of trauma, life, TPD or income protection through their main super fund, and even fewer claim to know what this cover costs them.

The value of insurance advice

All of this lends weight to the importance of the role of the adviser in ensuring Australians are both informed, and adequately insured. However, our research suggests insured Aussies are twice as likely to go directly to a life insurance company to increase their life insurance cover than they are to approach an adviser who offers life insurance advice as part of a broader range of services (38.1 per cent vs. 15.5 per cent). And they’re even less likely to turn to an adviser who specialises in life insurance advice (13.1 per cent).

This is more than just a trust issue. Consumers don’t understand the value of receiving advice on life insurance.

That value comes in many forms. It’s the value of truly understanding what it is you’re protecting and why; the value of making sure you’re not under (or over) insured; the value of knowing someone is there to support you through the claims process, if you ever need it; the value of having someone pick the most appropriate policy for your needs.

Under Best Interests Duty (BID) obligations, advisers are required to balance the type, level and structure of coverage against the affordability of the policy or policies, and the future implications for their clients. And under the Design and Distribution Obligations, life insurance companies are required to include a target market determination for every product issued.

The ultimate challenge facing life insurance companies is to design products that are consistent with the objectives, financial situations and needs of those who will benefit from them, at an affordable price, and in a way that articulates the value to both the adviser and the client.

Rather, what we are likely to see as the practice of cross-subsidisation is unwound and products are redesigned, is a reduction in benefits offered and an increase in prices.