The numbers are in and there’s good news for industry super funds. According to CoreData research there’s been no damage to consumer trust from the Royal Commission’s superannuation hearings. The fifth round of hearings, conducted between August 6 and 17, focused mostly on the duties of RSE licensees and governance arrangements.

Now stop and listen. Can you hear clapping? The sound of high-fives in the bright, colourful open-work spaces of industry super funds everywhere?

No? Well, neither can I. That’s because no-one’s high-fiving. Smart super fund executives and trustees are sighing with relief, but they know that there’s little cause for celebration. The main challenges for super funds still lie ahead.

Calm before the storm

“Have You Ever Seen the Rain” was recorded in 1970 by roots rock group Creedence Clearwater Revival. After more than a decade of grind, they were enjoying peak success, with a string of hits that went uninterrupted for three years.

But lead singer and songwriter John Fogerty knew all was not well. He knew that developing tensions between band members were the ‘calm before the storm’, and that despite their huge success, there were difficult times ahead. At the end of the calm, “it’ll rain a sunny day”.

It turned out to be prophetic. Just a few months after the song was written, Tom Fogerty left the band. Within two years, the group had broken up completely, never to formally reunite.

Trust in industry super holds steady

Like CCR in 1970, industry super funds have good reasons to feel successful. While trust in the financial system has fallen since the start of the Royal Commission, the industry super sector remains comparatively well placed.

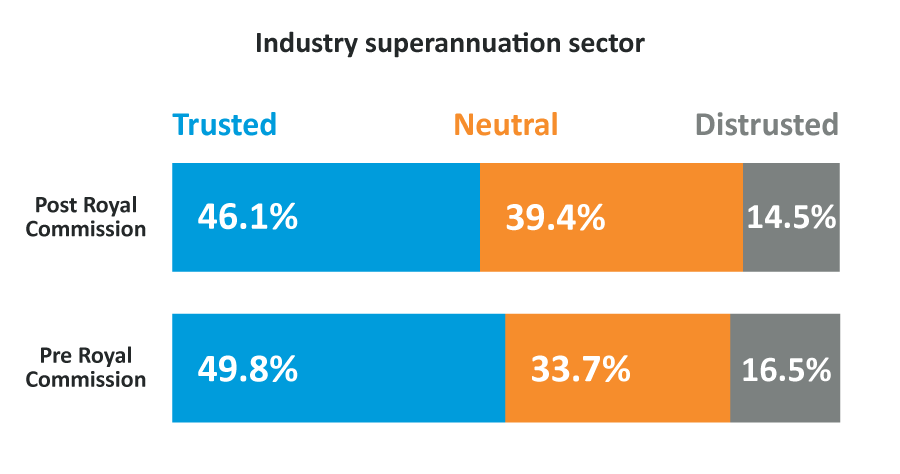

Before the public hearings on super in August, CoreData asked 436 everyday Australians to rate their trust in the industry super sector. A few weeks later, after the hearings, we asked another 469 the same question.

The trust ratings were surprisingly robust. Before the super hearings, the trust rating was 49.8 per cent, and after the hearings it was largely unchanged, falling just 3.7 percentage points to 46.1 per cent. The distrust rating didn’t change much either, falling from 16.5 per cent to 14.5 per cent.

The trust rating is the percentage of people who rate trust as seven or higher on a scale from zero to 10, where zero means complete distrust and 10 means complete trust. Conversely, the distrust rating is the percentage of people who rate trust as three or lower on the same scale.

It’ll rain a sunny day

With the distraction of the Royal Commission super hearings over, funds are again turning their attention to the recommendations of the Productivity Commission, the proposals in the Federal Budget, and their implications on fund scale.

Scale is important to super funds. Members benefit when their fund has enough scale. Scale allows the fund to negotiate better deals with service providers, opens up investment opportunities, enables a better member experience and drives down costs to serve.

But in a world where most super funds are already experiencing net member losses, where will growth come from? When inactive accounts with balances of less than $6,000 are transferred to the ATO next year, what will that mean for economies of scale? And what happens to the funds that fail to access the “best in show” short-list of ten default super funds? Will they be able to attract new members even though super fund brands are homogeneous and largely undifferentiated in the minds of consumers?

And how will super funds stop defections and retain members into the retirement phase? Will financial advice exist in a vertically integrated model post Royal Commission? Even if it does, where will the advisers come from when so many are planning to exit the industry rather than meet the higher FASEA education requirements?

Business models will need to change

There are lots of questions that still need to be answered. And it’s clear that previously successful business models will need to change.

But industry funds have a strong footing from which to adapt to the challenges. In the last few months they’ve overtaken the retail fund sector in size, and there are opportunities to extend the tenure of member relationships with CIPRs. If they get that right, then other players won’t stand a chance.

And they have a strong trust platform from which to launch their new incarnations. That trust has been hard-earned with strong corporate cultures and a track record of behaving well over the long run.

“Someone told me long ago

There’s a calm before the storm

I know it’s been comin’ for some time

When it’s over so they say

It’ll rain a sunny day

I know shinin’ down like water”

– John Fogerty