Companies pursue the holy grail of improving customer engagement, but often without fully understanding what the term really means, and sometimes pursuing engagement with customers purely for its own sake. Neither of these approaches is likely to realise the full benefits of engagement, either for a business or for a customer.

Engagement is very much in the eye of the beholder. It can look very different in the world of online retailing than it does in financial services. It is uniquely challenging for sectors like superannuation and insurance, where customers traditionally struggle to engage, despite their own best interests.

Industry super funds are eagerly developing capabilities to encourage members to become more engaged with their super. This encourages additional contributions, offer take-up and retention of members into retirement phase – driving growth that ultimately benefits members.

They are also able to bolster efforts to meet members’ best interests by proactively supporting their journey towards better retirement outcomes. Improved financial wellbeing also has demonstrable benefits for employers. It’s a win-win for everyone.

However, engagement is not a one-size-fits-all proposition. Varying levels of engagement require different tactics to move members up the curve – transforming them from “unconscious incompetence” to “conscious incompetence” and beyond. Super funds need to meet members wherever they are on the journey, and to understand their unique circumstances.

Unpacking engagement

The definition of engagement in financial services varies but it is generally considered to be a positive thing in its own right, due to its assumed association with loyalty and financial wellbeing. While the different elements are usually correlated, they can diverge. Different types of engagement are often used interchangeably despite tapping into somewhat disparate concepts.

Engagement is, among other things:

Behavioural: Measure of different types and frequency of interactions a customer has. This may also be outside communication touchpoints with a given provider and involve monitoring activities and actually taking specific actions.

Intellectual: Decision making confidence and time spent in consideration of needs and options. Receptiveness to self-improvement, learning and doing more.

Sentimental Affection, belonging and sense of connection to a brand suggesting desired relationship.

Internal: Sense of internal locus of control over the outcome of life events, commitment to take control and empowerment to do so.

This disparity can lead to apparent paradoxes and contradictions. For example, sometimes traditionally unengaged financial services customers demonstrate a flurry of behavioural engagement when triggered by a life event – but they don’t look anything like a typically engaged customers.

Sometimes what looks like behavioural engagement is a precursor and best predictor of defection. Sometimes intellectual and sentimental engagement is not supported by behaviours. Sometimes engagement with personal finances more broadly is not reflected in specific engagement with superannuation.

A parade of paradoxes

A common assumption is that “engagement is good” and should be pursued for its own sake. But ignoring the nuances and potential unintended consequences can lead to problems.

The self-fulfilling prophecy

If we seek to only engage those who already exhibit engagement, we are likely to reinforce existing behaviours and ignore those customers who most need to engage and may draw the greatest benefit.

The paradox of active choice

The most engaged customers are often the most informed and active decision makers. These same characteristics often also mean they can be the most mobile and lack sentimental attachment to the brand.

Shaking the tree

Engagement campaigns are ironically notorious for triggering defection among the less engaged, because heightened engagement starts them thinking or prompts them to make some active decisions.

Thanks, but no thanks

Some people actually have a perfectly well-reasoned preference for not engaging that must be respected, even if it is only a phase they are going through or related to some specific life-stage factor. Superannuation is a long-term proposition and often the best discipline is to set up defaulting behaviours (especially in accumulation phase).

Nothing to be done

Sometimes there is a limit to what can be done to support customers. Engagement efforts should not foster false hopes, and create expectations that lead to disappointment.

Overfamiliarity

Analytics and automation have revolutionised how we manage engagement with customers. We get to know them as individuals, and proactively customise support to drive more personal and relevant interactions. But when this intimacy crosses the line it can be perceived as creepy, and even possibly stray into perceived personal advice territory.

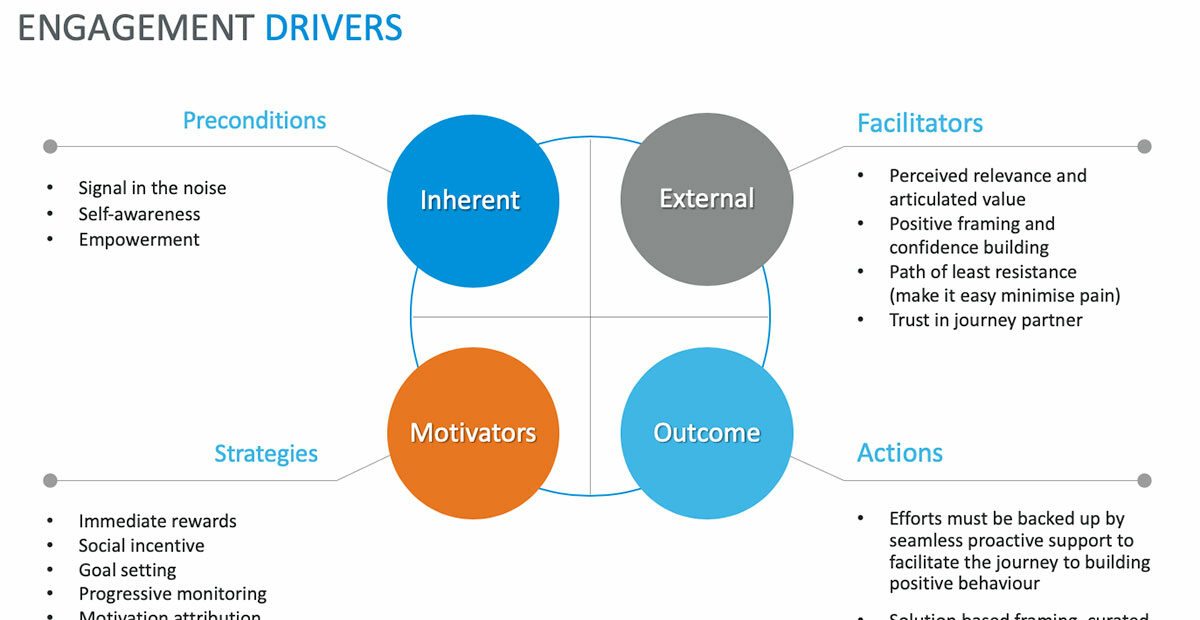

To put all this theory into action, and demonstrably move the dial on customer engagement, we must first satisfy some critical preconditions to get the ball rolling – for example, get the customer’s attention and create some internal readiness for change.

There are then a number of facilitating conditions we can nurture an environment conducive of embracing engagement. Several behavioural science strategies then provide practical hacks for influencing perceptions and motivating action. We then need to pull all these elements together to provide a seamless experience for the customer – see the chart below.

Feel good, do good, be good

The aim is not just to maximise engagement for its own sake, but to use engagement to achieve specific outcomes for different types of customer needs.

Superannuation is a long-term proposition and often the best discipline is to set up defaulting behaviours (especially in accumulation phase). Most people don’t need or want to be in constant interaction with their super, just when it matters most.

Successful engagement focuses on customer benefit – whether it be an objective improvement in retirement outcomes or a more subjective improvement in building confidence and peace of mind. Successful engagement recognises the relative circumstances of customers and their personal journeys to more positive behaviours. When it’s done right it’s a win-win for everyone.

The question is not whether we should strive to engage, the only question is how to make sure we manage the nuances of engagement to get the results we need, for both business and customers.