The aged care industry has seriously, and in some cases tragically, failed its most vulnerable clients, and the Royal Commission into Aged Care Quality and Safety, which kicked off in Adelaide last week, is seeking to pinpoint why and how the market has failed so spectacularly. But there is a risk that the inquiry’s terms of reference will mean it can’t address one of the fundamental causes.

In December 2016 the residential care industry was dealt a blow as the government announced cuts to the industry’s primary source of funding through the aged care funding instrument (ACFI). The policy was to save the government $1.2 billion to allocate to other parts of the health budget through freezing government payments. Well, technically, anyway.

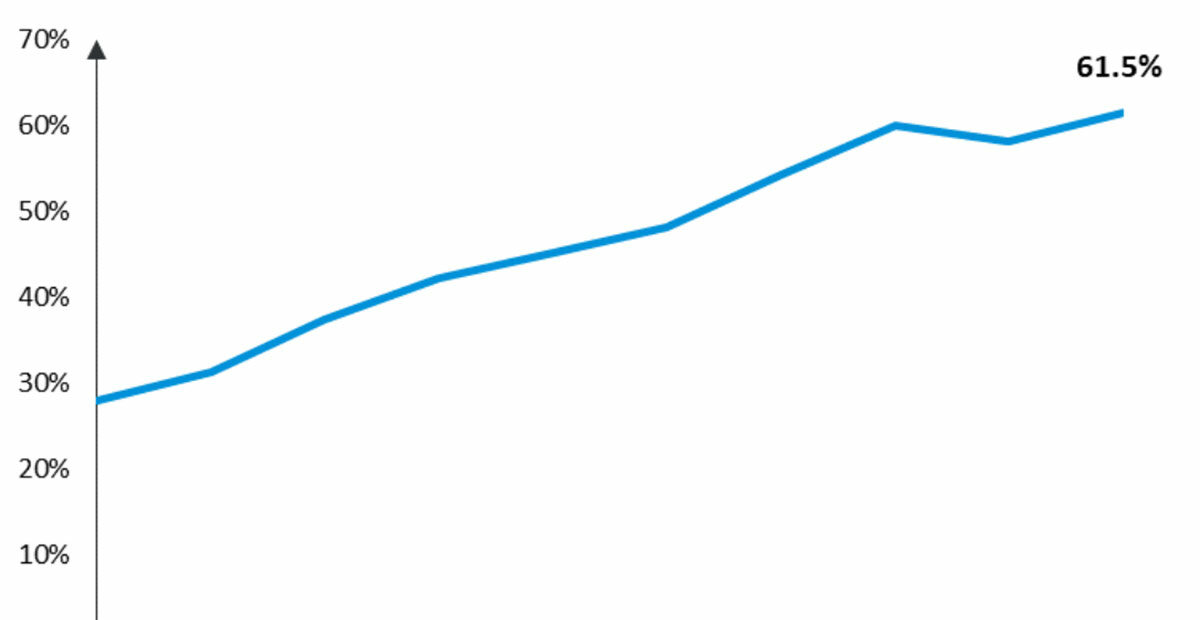

Aged care providers have other ways of increasing funding through the ACFI. The level of funding a provider receives from the ACFI, is dependent on their care needs which can ranges from low to high. Across Australia, the proportion of claims on the ACFI defined as high-dependency has increased substantially, from around 27.9 per cent in 2009 to 61.5 per cent in 2018.

Proportion of High Dependence claims for ACFI, 2009-2018

Residential providers are REALLY struggling. According to Stewart Brown’s latest September 2018 survey, two in five (41.4%) residential care facilities are operating at a financial loss, showing just how tough the market is for the underperforming providers in the sector. So it comes as no surprise that around one in eight ACFI claim submissions is wrong.

Providers operating in the red are under pressure, particularly not-for-profits and smaller providers who surely do their absolute best to care for their clients. Unfortunately, these providers are 41.5% more likely to receive a notice of non-compliance relative to for-profit providers.

We’ve always known the government wants to reduce the number of providers and fast-track consolidation in the industry. Financial pressures through ACFI freezing are a part of that process to get smaller inefficient providers to either sell out or close down, and drive efficiency in the industry.

The Royal Commission will show dramatically and tragically how this process is failing in aged care. Struggling providers can increase high dependency claims and reduce qualified-to-unqualified staff ratios, but ultimately, they are fighting against the market forces of encouraged consolidation.

Yet with all this taking place, the Royal Commission terms of reference failed to address these issues explicitly. To address them in any meaningful way, the Royal Commission must look at:

- The market rules that providers are subjected to and operate within

- Approaches to funding to improve long-run outcomes

- How consolidation is managed across the industry, in particular in relation to improving aged care service outcomes and standards

For the good of older Australians, serious incidents and burn-out amongst aged-care staff brought on by pressures of a failed funding model should not be the primary reason forcing the sale or closure of aged-care capacity or, worse, the appalling levels of quality and care that we’ve recently seen exposed.