Preliminary findings of the Professional Planner/CoreData Future of Advice Survey show that a useful first step a significant number of advice businesses could take to help them negotiate the uncertainty of the next several years is to create a robust business plan.

The research is revealing an industry largely underprepared for the changes set to sweep through it. Even as the industry plunges into a period of unparalleled turmoil, the research has found that a quarter (25.5 per cent) of financial advice firms simply have no formal plan for how they intend to deal with changes to education and professional standards and to whatever recommendations the Royal Commission runs up the flagpole later this month.

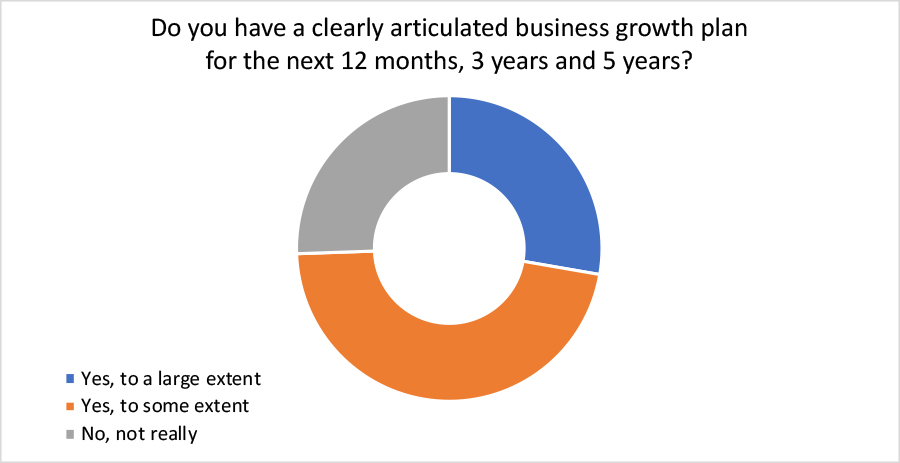

Fewer than half (46.7 per cent) of advice businesses say that “to some extent” they have a plan. So all up, more than 70 per cent of advice businesses have no or only some idea of how they intend to grow – whether they measure it by revenue, number of clients, funds under management (FUM), profit, or some other metric.

Effective planning is most important and most difficult when times are most uncertain. But to an extent, advice practices have rarely had to produce detailed business plans before – as a licensee head described it recently, “advisers don’t run a business, they run a revenue stream”. As long as revenue keeps rolling in, everything is fine. But at the end of the day if revenue doesn’t exceed expenses and produce a profit it’s a meaningless indicator.

Even so, revenue is still how most advice firms gauge success. It’s reflected in the practice of valuing advice businesses on a multiple of revenue, and it will remain a focus while it’s still the basis of buyer-of-last-resort (BOLR) agreements.

Almost three-quarters (73 per cent) of advice businesses say revenue is the most meaningful measure of growth, followed by number of clients (9.3 per cent) and FUM (8.1 per cent). Less than 4 per cent of nominate profit or earnings before interest and tax (EBIT) is the most meaningful measure. Some nominate “client satisfaction” and “quality of advice”.

Revenue at risk

There’s a number of reasons advice firm revenue might come under pressure in future. At a macro level, we’ve already seen trust in financial advice collapse during the course of the Royal Commission. Before the inquiry CoreData found that more than 60 per cent of people said they trusted financial advice (by ranking it six or higher on a scale from zero to 10, where zero is total distrust and 10 is total trust). By July the figure had fallen to 35 per cent. Yet the Future of Advice research shows that more than eight in 10 (82 per cent) financial advice firms expect growth in the next three years to come from new clients.

And the royal commission is expected to tackle both conflicted grandfathered remuneration and the industry structures that support the subsidisation of licensee fees, when it releases its interim report later this month. Removing both a source of revenue – notwithstanding the Constitutional issues surrounding a retrospective ban on contractually-agreed commissions – and industry subsidies will reduce revenue and raise for some businesses.

Even so, advice practices that expect revenue to grow over the next three years expect it to do so by, on average, 28.5 per cent. But there’s a cohort that expect revenue to decline over the next three years, and they expect the drop to be, on average, about 21 per cent.

This dichotomy illustrates a potential tear in the fabric of the industry, because in the coming years both groups may in fact turn out to be right in what they expect.