The superannuation industry is in the rare position of being mandated to grow. It doesn’t have to compete, it doesn’t have to satisfy members, its simply needs to exist.

The compulsory 9.5% Superannuation Guarantee contribution has powered the industry grow to more than $2.1 trillion in funds under management, which has created an industry which has been very focused not on service but on product and operations.

But this world has changed, more and more people are making a choice about their super, and as funds begin to focus on member retirement strategies, they are beginning to realise that product is not enough.

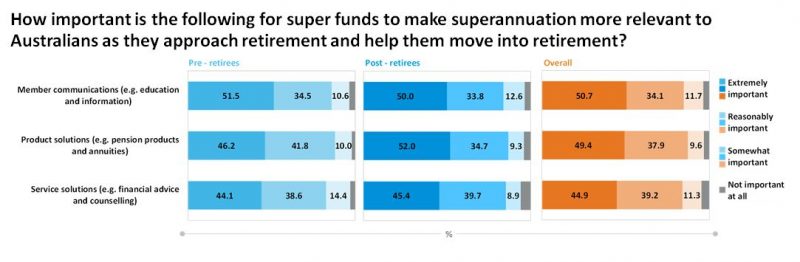

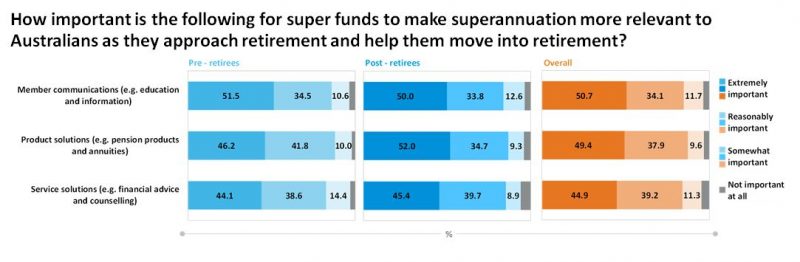

The latest CoreData Retirement Ready Research, in which we sampled more than 700 pre- and post-retirees, we found communication and services are just as important as product to improving the relevance of super.

The new world of super choice is forcing a fundamental change in the industry, a shift from being product providers to service providers, from a transactional to a relationship-building approach.

Super funds need a new retirement strategy

The typical objective of a super fund is to maximise the retirement outcome of its members. This is achieved through providing high long-term investment returns and low costs (i.e. high net returns) – clearly a worthy objective, but the next question is, what else can be done?

The research makes it clear that pre-retirees estimate they will need around $800,000 at the point of retirement to maintain the lifestyle they want, but according to ASFA Super statistics the average super balance at 60-64 for males is $293,000 and for women its $138,000.

So, clearly the majority of members in retirement will be on the Government Pension and/or will need to keep working.

Unlike our parents, where retirement meant stopping work, this next generation of retirees are redefining retirement; its no longer about stopping but a move to a “working retirement”. They will simply shift from full-time work when they are older to part-time or casual work.

This continuation of work to help fund retirement also has social connectedness benefits as well. The key issue for super funds, is they should focus on this paradigm shift to “working retirement” or the transitioning to retirement and not end point of retirement itself?

What should the super funds be doing?

1. Help members access the Government Pension

We would argue the most important thing a super fund can do, is help the majority of retirees who don’t have large super balances and who will be relying on the Government pension. Our CoreData Retirement Readiness Research found that a staggering 88% of pre-retirees have at best only a reasonable understanding of how to access and maximise the Government pension.

The challenge is how to provide this help in a low cost and scalable manner. Clearly this would need to be a key message for pre-retirees through the annual statements, the website and any contact with the fund’s call centre.

The other key point is that this advice needs to be pro-active. Members are very anxious about the issue of retirement and they don’t know where to start and don’t do anything. So, it’s important that funds “lead the dance” and find ways to pro-actively engage with members as they approach retirement.

2. Retirement Helpline

Super funds have a great opportunity to turn their call centres into a key element of their retirement strategy. Every contact a fund has with a member is an opportunity. Any member over 50 who calls the fund could be directed to a Retirement Helpline and the conversation about transitioning into retirement could be initiated.

From our recent research, we see that members are very keen to have someone to help and counsel them, with whom they can discuss ideas.

There is also demand for face-to-face advice service for super funds, but this service is expensive and is not scalable and as such would have to be on a user pay basis.

3. Super funds still have a problem with awareness

Recently super funds have done a lot of work to improve their marketing and communications with disengaged members, but from the research there still is a long way to go. Only 41% of pre-retirees knew their super fund offered a pension product.

Those funds that accept this new world of “working retirement” and adjust their retirement strategy have an opportunity to not only help members maximise their retirement outcomes but also to continue to grow their fund. Those that do not, will struggle.