One in two Australians struggling with household bills admit if they were eligible to access their super early, they would be more concerned about reducing their retirement wealth than about not having the money to cover current expenses.

CoreData’s COVID-19 Pulse Check Survey provides insight into the impact of coronavirus on the financial position of households, and the trepidations of struggling Australians in utilising the stimulus made available by the Federal Government.

The latest figures released by APRA show that more than one million applications for early super access had been paid as of May 10, totalling $9 billion at an average withdrawal of approximately $7500.

According to CoreData’s research, almost a third (28.9 per cent) of Australians in bill stress (those who report being in a bad or dire financial position) have already accessed their super, with three in five (58.7 per cent) expecting that they may have to do so in the next 12 months.

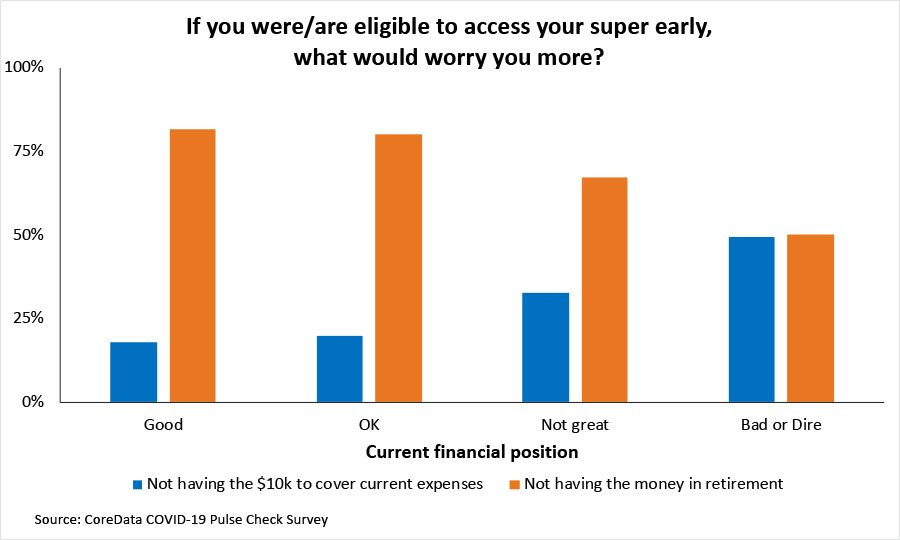

Despite living in a precarious financial position, half (50.4 per cent) of those suffering bill stress say they would be more concerned about not having the extra wealth in retirement. This number is even higher for those who describe their household position as not great but having enough to pay the bills, with two-thirds (67.2 per cent) of these Australians also more worried about the impact on their retirement nest egg than their current cashflow.

This sentiment is unsurprising given the apathy many hold towards the compulsory savings scheme, and the argument promulgated by industry that accessing retirement wealth early is short-sighted.

However, recent CoreData research reveals money and wealth are in fact not the biggest driver of retirement satisfaction. The research suggests that due to the impact that financial stress can have on our health and overall wellbeing, accessing super early may be the best decision a member can make right now.

One in six (16.3 per cent) Australians experiencing or at risk of bill stress are expecting the impact on their personal finances to last up 18 months, and one in four (23.1 per cent) expect it to last longer. Within this cohort, nearly three in five (57.5 per cent) agree that the worst is yet to come regarding the impact of COVID-19 on their personal health and finances.

This is a worrying sign given that many households are already struggling to stay afloat, and a prolonged economic downturn would hamper the ability for those hardest hit to get back on their feet without further assistance.

Almost three-quarters (72.2 per cent) of those experiencing bill stress have suffered loss of income, and three in five (59.8 per cent) have been unable to pay for essential items like groceries and medication.

The significant toll of financial stress

Financial stress takes a significant toll on various facets of an individual’s mental health and wellbeing. Almost a third (29.7 per cent) of Australians in bill stress say they currently feel anxious, with around one in five feeling overwhelmed (22.8 per cent) or even depressed (20.5 per cent). A majority (69.8 per cent) of these people say that COVID-19 has negatively impacted their overall wellbeing.

Although drawing down on retirement savings may be far from ideal, the reality is that for those who are struggling now, the benefit to their current mental health and financial position may outweigh the loss of wealth suffered in retirement. Aside from directly paying down debt or unpaid bills, a drawdown of $10,000 each of this year and next, can provide various other benefits and opportunities that may have otherwise been unavailable.

For example, more than half (55.8 per cent) of Australians in a not great, bad, or dire financial position, do not currently own their own home. Almost two-thirds (60.4 per cent) of non-homeowners within this group say it is because they are unable to save for a deposit, while only one in five (18.6 per cent) say they aren’t interested in saving for a deposit or owning a home.

Home ownership is a crucial part of securing a stable and satisfactory retirement. Accessing up to $20,000 (or $40,000 for a couple) from super to put towards a house deposit, may allow Australians to enter the housing market when they would have otherwise been unable.

Although some will argue that early super access will lead to worse retirement outcomes, an extra $10,000 to $20,000 could make a big difference to the health and wellbeing of those in particularly vulnerable financial positions.