During the next five years, the quality and capability of financial planning licensees will be tested, possibly like never before.

Demands on individual advisers to meet new education, ethical and professional standards will sort out the licensees that have genuine interest in supporting advisers from those which are in the business just to make a buck from offering the lowest possible support for the lowest possible cost.

Some advisers will need considerable support and guidance from licensees as they negotiate the transition to new minimum education standards, a new code of ethics, an industry-wide exam, and new continuing professional development (CPD) requirements. Not all licensees will be equally capable of providing it and the so-called licensees of last resort will be exposed.

Paying peanuts to a licensee puts advisers at risk of being supported by monkeys. What looks like a great fee deal now might look like a completely false economy in a few years’ time when a licensee is unable to support advisers through the process of meeting new standards and at the same time keeping the lights turned on in the advisers’ businesses.

It is not an overstatement to suggest choice of licensee today might be the difference between an adviser being in business or not, come 2024.

Better licensees are already on advisers’ backs and pushing hard for them to upgrade qualifications, if needed. The most progressive licensees are looking even beyond the bare-minimum requirements of the new law, to consider how a FASEA-developed code of ethics and CPD requirements might shape the process and the business of giving advice in five years’ time.

Advisers might be grumbling and moaning about it now, but it’s these licensees whose advisers stand the best chance of adapting successfully, while ensuring their businesses remain healthy and clients continue to receive great advice and service.

Deep down an adviser knows whether or not a licensee has their back. They know if they’re in the right place and if their licensee can support them as they transition to the new standard.

Here’s a tell-tale sign: if a licensee isn’t already talking about it or, even worse, if it agrees really experienced (but formally underqualified) advisers should be left alone to get on with it, big trouble is already brewing. So if there’s a nagging feeling that a licensee isn’t really on top of all this, it’s time to think about an alternative.

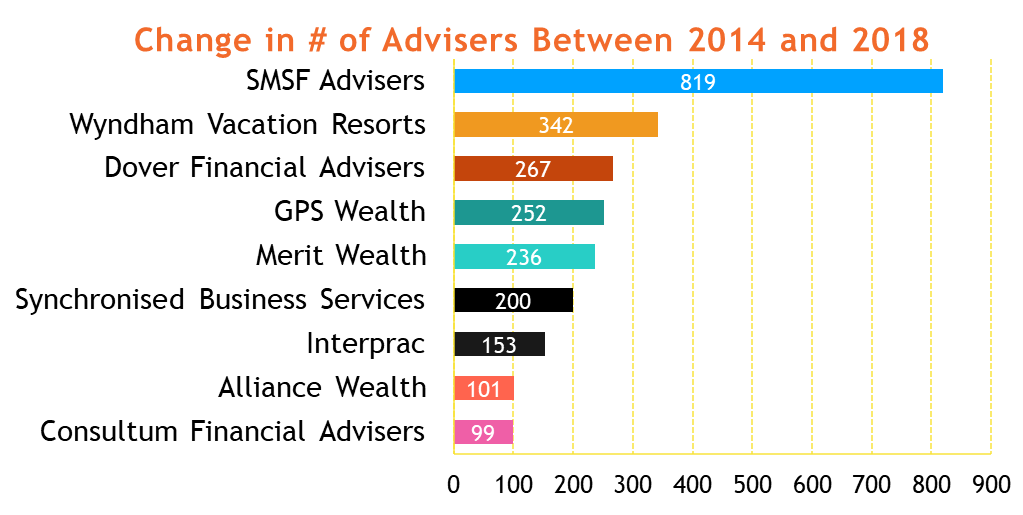

CHART 1: Top nine growers

Source: Anubis

Research by Anubis, a division of the CoreData group that produces insights into the accountant, financial planning, mortgage broking, SMSF trustee, high net worth and mass affluent markets, shows that between 2014 and 2018 the fastest-growing licensee was SMSF Advisers – set up by the National Tax and Accountants Association (NTAA) to provide a licensing solution for accountants to give advice on self-managed super funds.

SMSF Advisers attracted 819 authorised representatives over the period, more than Dover (267), GPS Wealth and Merit Wealth (263 and 236 respectively; both GPS and Merit are owned by Easton Investments and Merit is a licensee also aimed at accountants), and Synchron (200).

More than 342 reps joined Wyndham Vacation Resorts, a business that sells holiday time-share schemes.

Shifting to another licensee can be a complicated task at the best of times, but shifting from a licensee that was originally selected because of its light-touch approach to compliance or CPD or keeping up to date with industry best practice can be exponentially more difficult.

How well licensees support advisers through the coming period of change will go a long way toward demonstrating whether the licensee entity, in its current form, has a use beyond the implementation of the changes.

Already there’s a growing view that the days of licensees granting authority to individual advisers are numbered, and it should be replaced by a form of individual adviser accreditation (possibly handled by a beefed-up FASEA); and as discussion focuses more intensely on open-architecture advice models, the role of licensee as investment product gatekeeper is also being challenged.

If licensees have no long-term role in creating and maintaining approved product lists, and they are not responsible for authorising individuals to provide advice, then their value proposition must change to focus on providing groups of like-minded advisers with a community and a forum to promote professional and business development.

So consider the next five years a test of how licensees will adapt their range of services and redefine their essential role. Because if they can’t even support advisers and practices through something as fundamental as evolving to higher education, ethical and professional standards, then they might have no use in the industry at all.