Across the financial planning industry an estimated 10 per cent of all practice revenue is grandfathered conflicted remuneration. If this stream of income were to be turned off tomorrow it would have a devastating effect on many advice businesses.

But all business owners should assume that grandfathered conflicted remuneration will be banned, and probably sooner rather than later. A recommendation of this type is thought possible from the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

Peloton Partners co-founder Rob Jones says that in extreme cases, grandfathered conflicted remuneration accounts for as much as 65 per cent of an advice firm’s revenue and 100 per cent of profit. He says practices Peloton has worked with are a good proxy for the industry overall, and once grandfathered remuneration is stripped out about half of the firms’ profit goes with it.

The good news is that an advice practice can be transformed more easily than many business owners imagine. Jones says once the business owner gets their head around turning off passive income stream and moving as many clients as possible onto an active-advice footing, the rest of it is relatively straightforward, if time-consuming.

A six-step fee transition plan

• Flag each client as “active” or “inactive”;

• Quantify how much revenue the client generates – an active-advice fee should at least match and preferably exceed grandfathered revenue, reflecting cost to deliver plus a healthy profit margin;

• Observe any taxation or insurance needs and implications that may prevent a move to active-advice fees;

• Redesign a value proposition and present it to the client;

• If they accept the new proposition, turn off the grandfathered revenue;

• Restructure the client’s investments if doing so is in their best interests.

Often the biggest challenge is getting advice business owners to think like business owners rather than advisers, so they can assess clients and their value to a business objectively.

“We demonstrate to them the maths,” Jones says.

“But then we have to get over the big hurdle of their insecurities, because they think they’re going to be put on trial by their clients and their clients are going to decide whether they value them or not. That doesn’t sit well with the average adviser.”

He says practices generally lose very few clients when they go through this exercise.

“On average 1 to 2 per cent of clients walk,” he says.

“And they’re clients who probably shouldn’t be there in the first place.”

The basic underlying problem is an advice-fee model that is neither sustainable nor profitable in its own right. Advice to active clients is mis-priced – usually underpriced – and subsidised by the grandfathered remuneration.

When commissions were banned in the UK under the retail distribution review (RDR) in 2013, advisers moved effectively to replace the lost commission income with fees paid by the client.

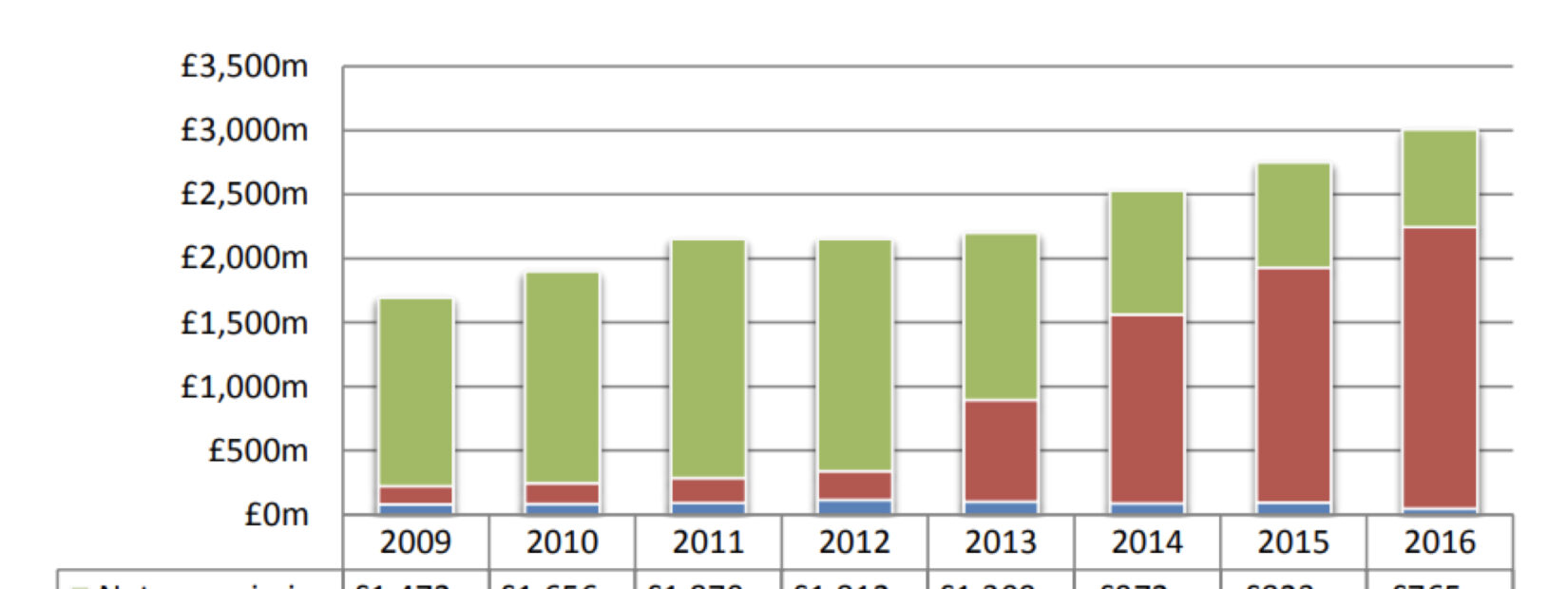

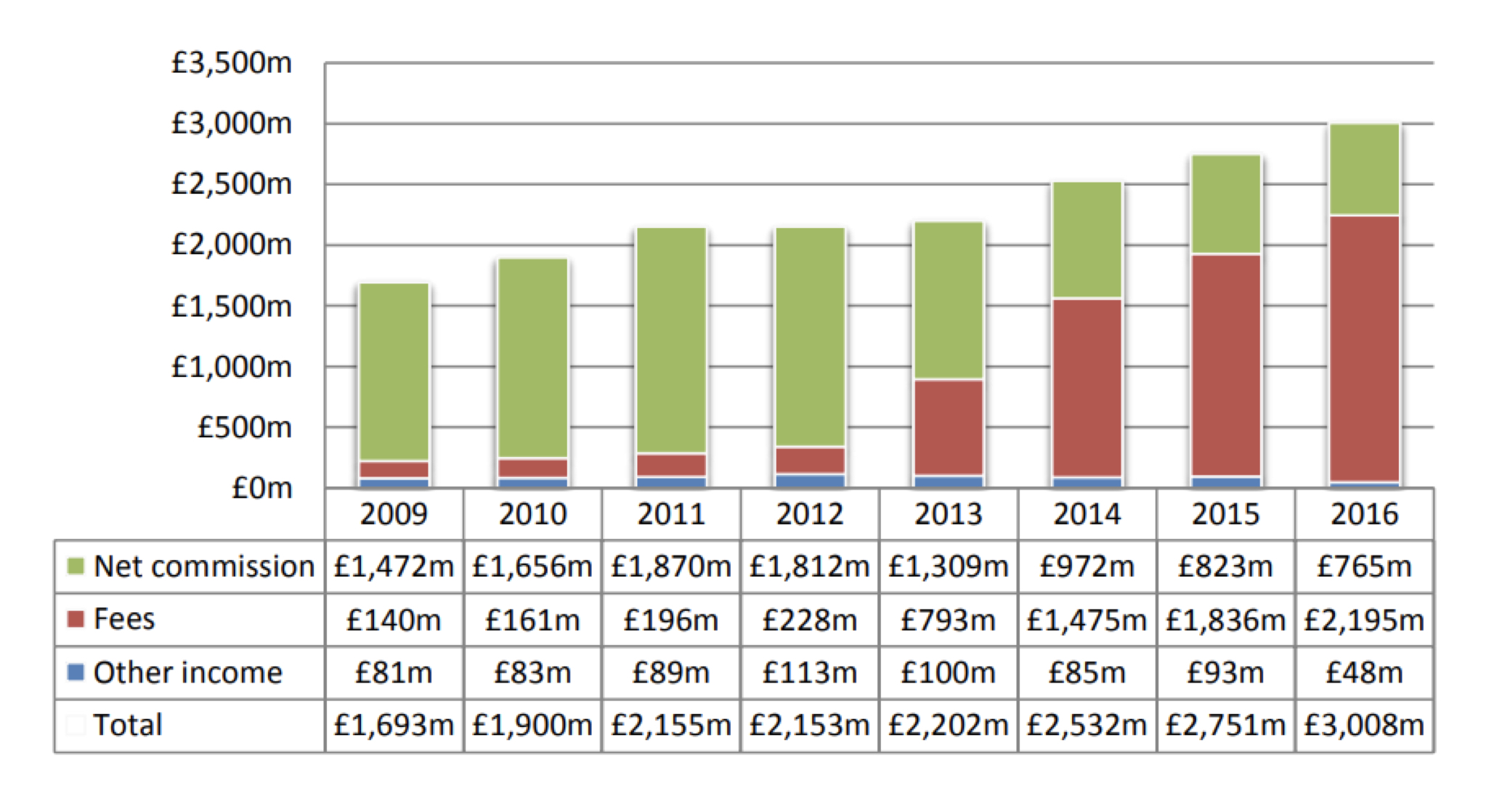

Data from the UK shows that in the year of the changes the advice industry earned net commissions of £1.3 billion and fee income of £793 million. Just three years later net commissions had fallen to £765 fee income increased to 2.2 billion. Over the same period total revenue for the industry increased from £2.2 billion to £3 billion.

Consolidated business revenue figures show a fall in commission and corresponding increase in fees after RDR implementation in January 2013. Source: Association of Professional Financial Advisers – The Financial Adviser Market: In Numbers (2017)

In her closing statement to the royal commission’s public hearings on financial advice, counsel assisting, Rowena Orr QC, invited written submissions on three questions: whether clients receive any meaningful benefit from ongoing service arrangements; whether grandfathered commissions create a disconnect between community expectations on fees and the tolerance of licensees for charging fees for no (or little) service; and whether grandfathered commissions should cease.

The failure to include sunset clauses in the Future of Financial Advice (FoFA) laws is one of the legislation’s failings and reflects poorly on those sections of the financial planning industry that lobbied to protect conflicted remuneration.

ClearView managing director Simon Swanson says sunset clauses would have been a legitimate way to wind-up conflicted remuneration – including commissions – once and for all.

“People will argue it should all be grandfathered, that’s how it has always worked,” Swanson says.

“But you can put sunset clauses in, and I reckon part of the problems in the royal commission [reflect the fact] those sunset clauses weren’t put in. That conflict has been allowed to permeate.”