Since emerging in the late 1990s, the self-managed super fund (SMSF) sector in Australia has shown uninterrupted growth. According to the Australian Taxation Office (ATO), as at 31 March 2019, there were nearly 600,000 individual SMSFs and more than 1.1 million individual members. These SMSFs hold nearly $750 billion worth of assets, which account for more than a quarter of Australia’s $2.9 trillion superannuation sector.

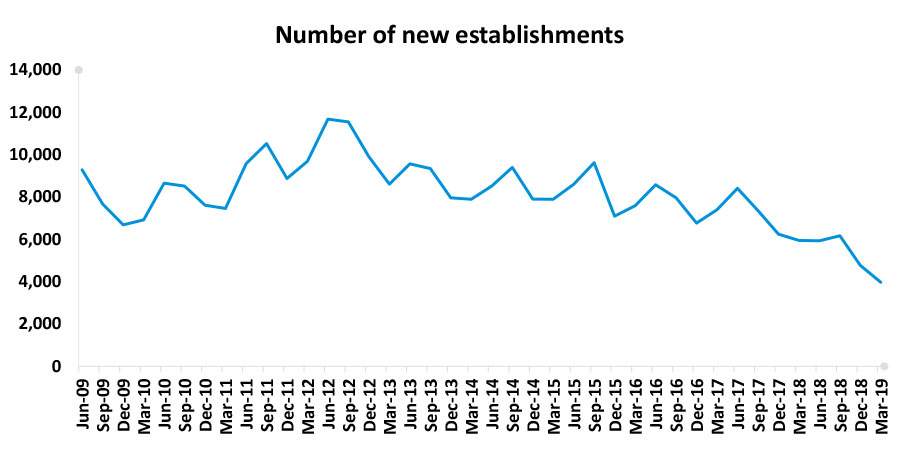

However, while the number of SMSFs continues to grow, the pace of that growth has slowed considerably as the sector matures, with the number of new establishments reaching a 10-year low in the March quarter. The slowing growth has seen the industry fund sector, which up until 2012 was around 40 per cent smaller in size, quickly catching up to the SMSF sector, having already overtaken the retail fund sector in 2018.

One likely reason behind this trend is that Australians who are naturally suited to an SMSF – namely the so called “controllers”, who are interested in and enjoy managing their superannuation themselves – already have an SMSF.

The rise of the coach-seeker and outsourcer

As the number of controllers setting up new SMSFs has been gradually shrinking, two new types of SMSF trustees are gradually emerging, namely the so-called “coach-seekers” and “outsourcers”. Coach-seekers are those who prefer to manage their superannuation themselves but need informational support or support from someone else in their decision making, while outsourcers are those who would rather someone else manage their superannuation for them.

CoreData’s SMSF Research found that more than half (53.7 per cent) of SMSF trustees can be classified as a coach-seeker, up slightly from 50.4 per cent in 2018. Likewise, nearly one in eight (11.8 per cent) can be classified as an outsourcer, up slightly from 7.2 per cent in 2018.

Reflecting the shift in behavioural profile within SMSFs, although the majority of trustees remain personally involved in managing their SMSF, the proportion of trustees who do so has continued to shrink as more choose to share their involvement with, or outsource everything to, others whom they believe can provide the necessary support, particularly accountants and financial planners.

Given their desire for support, the new breed of SMSF trustees would be more likely to become disengaged or even leave their SMSF if their need for support is not being adequately met. Indeed, aside from cost, “too much hassle” is consistently found to be the greatest trigger for trustees to leave their SMSF.

Growing demand for service and support

Looking ahead, it appears that more coach-seekers and outsources are set to enter the SMSF sector. Indeed, nearly three in five financial planners and accountants believe that there is an increasing demand for SMSF and the associated support services from coach seekers and outsourcers (57.9% and 56.3% respectively).

Financial planners, accountants and service providers who have an SMSF offer with a sound value proposition will continue to enjoy an advantage in the sector. Increasingly however, being cognisant of the changing needs of trustees and being easy to deal with, will be critical for financial planners, accountants and service providers to effectively support and more importantly, ‘take away the hassle’ from trustees. These in turn, will be critical for the SMSF sector to continue to thrive well into 2020 and beyond.

For more information about the SMSF Research, please contact CoreData.