Few emerging products have generated the hype that surrounds robo-advice in 2017.

Federal Treasurer Scott Morrison backed robo-advice at a G20 conference in Germany earlier this year as a solution for meeting the advice needs of communities across Australia. Two of the big banks, Westpac and NAB, have already rolled out robo as part of their product suite.

In principle, the product offers a host of advantages over traditional financial advice. It is low cost, high volume and has the potential to guide the investments of a massive ‘dark pool’ of unadvised Australian assets, estimated by CoreData to be somewhere in the vicinity of $1.9 trillion.

Despite the high hopes that politicians and product developers have for robo-advice, the market is yet to be revolutionised in the way that many suggest it will be, and these platforms are yet to gain a significant foothold in the advice market. Overseas, the UK’s first Robo-Advisor, Nutmeg, is suffering from growing losses.

Generational differences and the lack of a tailored approach by robo providers may be one reason that robo-advice is yet to hit the mainstream. We live in a time where the differences between age groups have never been more stark, driven in part by the rampant development of digital offers.

The one-size-fits-all approach is out of touch with the reality of the type of relationship and customer service consumers want. The ability to identify and effectively service customers’ different needs simultaneously is the ultimate test as to whether a digital product is successful, but based on the existing evidence, today’s robo-advice offers are yet to truly overcome this challenge.

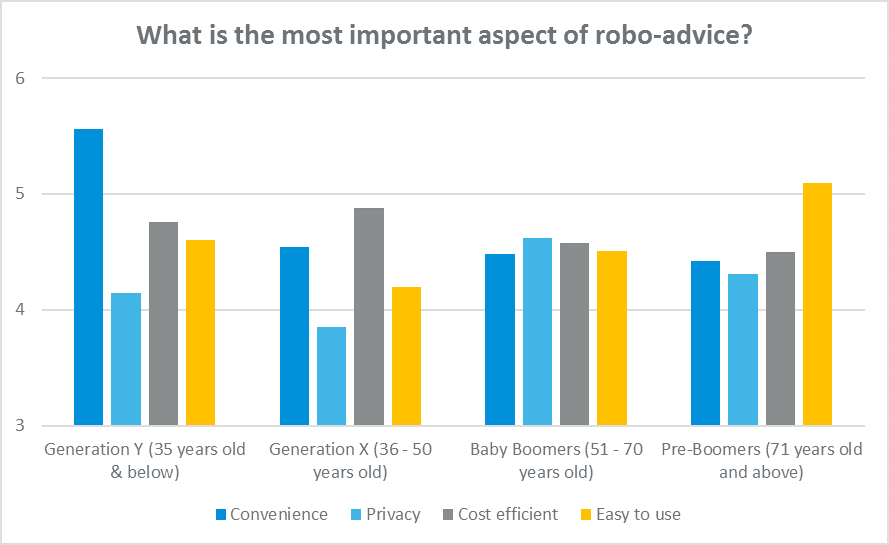

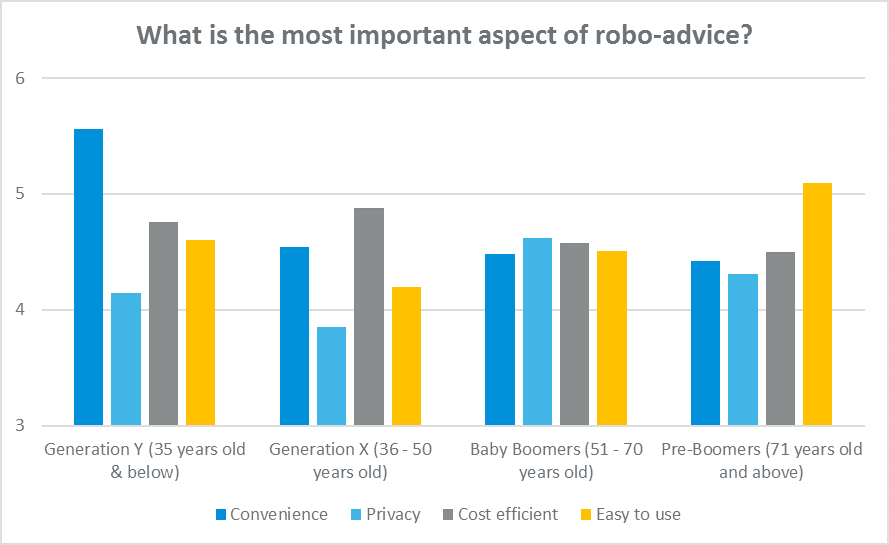

For Generation Y – those who barely remember a world without the Internet – robo-advice must demonstrate its convenience. This is by far-and-away the most important aspect for this age group.

As we move up the age curve, for Generation X – those likely to be raising families and paying a mortgage – affordability is of high importance. Baby Boomers, for whom digital technology has led to a new world of risks, value privacy and data security, while later-stage pre-boomers want ease of use.

There is an inherent difficulty in servicing all these desires and preferences effectively.

At present, the robo-advice platforms available are attempting to grow through broad appeal across generations, rather than targeting specific age groups. While they’re thought by some pundits to have greater appeal among younger generations, none of the offers are currently acknowledging the different needs of the various age cohorts and tailoring their marketing and value proposition accordingly.

If robo-advice providers can start to do this well, we may see the shift from face-to-face advice into the digital world accelerate more quickly.