At the moment around the world, financial services is an industry in transition from being a product provider to a service provider, and if the first wave of data is any indication this spells real trouble for retail super funds.

While financial service companies have always claimed to be service providers, most of them weren’t, they were product providers dressed up as service providers so that they could be better at selling products.

Well that game is over. A combination of structural and legislative change – combined with shifting consumer behavior as well as more and more choice of product type, service type and channel type – means that real change is finally happening in the industry.

Now the big question is – who has got the right to ask customers to shift from product provider to fully fledged service provider?

This question isn’t that easy to solve and there are a lot of competing data points about who has the right to ask for the customers’ business.

The most common score businesses use to assess this is the Net Promoter Score (NPS) which is a proxy for likability. Across the banking industry, the Big Four banks have relatively low NPS scores, while the smaller banks have high NPS scores.

But bigger banks are growing faster and charging more than smaller banks, so NPS scores are actually a poor indicator of anything other than likability. The single question in an NPS measure for banking is: “How likely are you to recommend this bank?”

While NPS measures likability, at CoreData we measure authenticity. Authenticity has two inputs; is this business who they say they are? and does this business they do what they say they are going to do? These inputs are two of the critical drivers of trust between humans and business.

On those questions the Big Four banks score very well. On a 10 point scale where any score above six should be read as a positive, CoreData’s latest research reveals they rank in this order: CBA 9.2, WBC 8.8, NAB 8.2 and ANZ 7.9.

Credit unions and second tier banks didn’t perform quite as well. In terms of authenticity they scored, as a group, 7.2.

For statisticians that’s a pretty meaningful spread and indicates that there is a two-speed industry at work.

The other important measure is customer satisfaction. Our customer satisfaction data shows that the band of performance is pretty narrow – CBA has an 82.1% satisfaction rating, Westpac is second at 80.8%, ANZ follows at 78.9% and WBC’s rating sits at 78.2%. Statistically speaking, these results are too tight to be of any real interest.

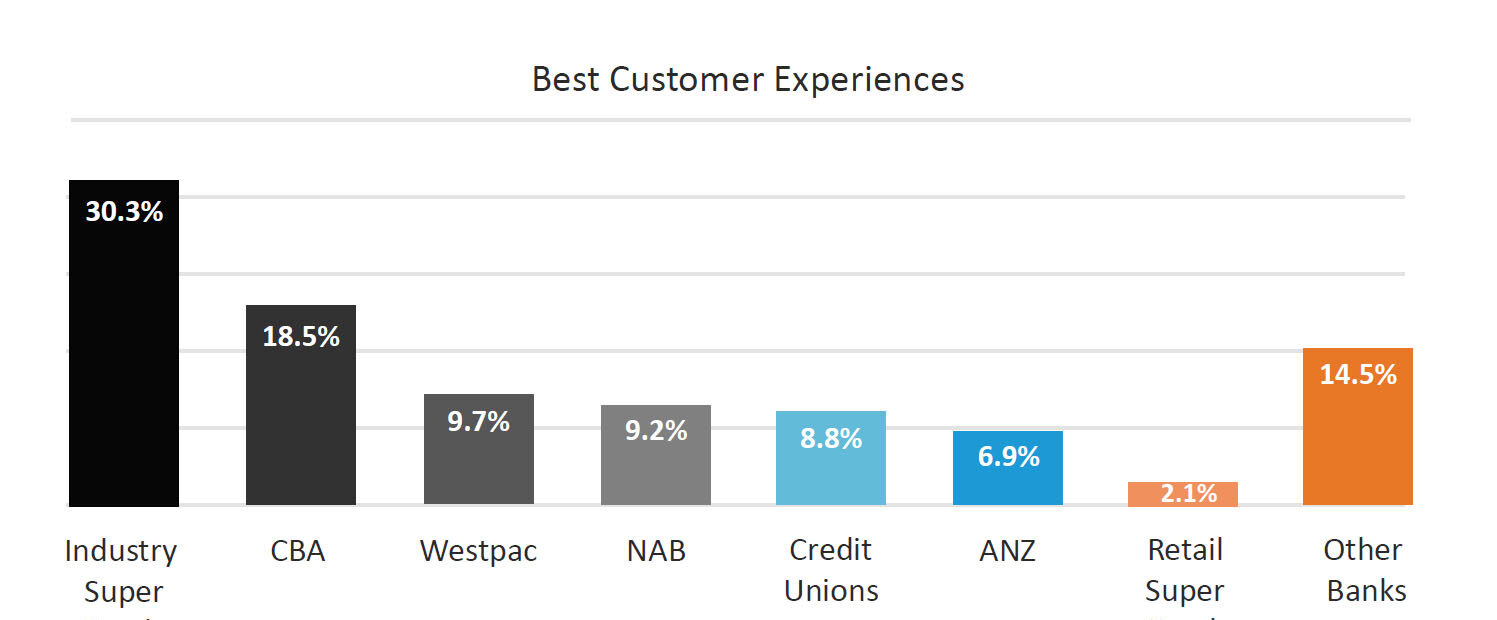

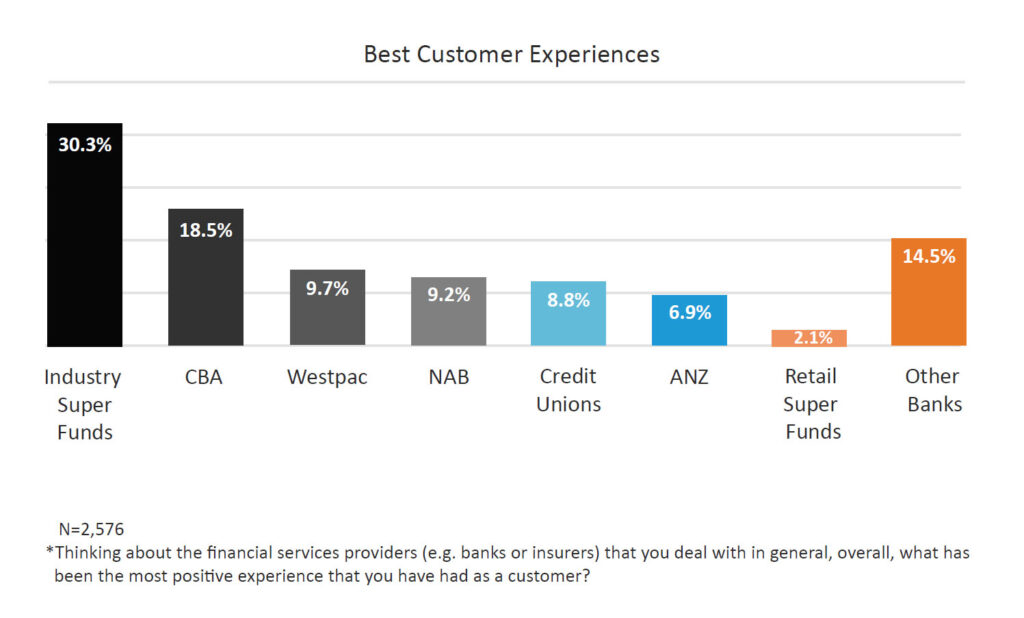

But in the past quarter we asked a different question. In a bid to understand who is going to win the race from product to service, we asked our panel of 170,000 Australians where they had their best ever financial services service experience.

There were two clear winners: 30.3% of the people that responded said that their best ever experience had been with an industry super fund. Second was CBA, where 18.7% of the respondents had their best ever service experience.

Some 14% of respondents listed smaller banks and the rest of the Big Four banks received between about 10% and 7% of responses. Way down the bottom was retail super funds at 2.1%.

Effectively, what that means is that almost no one has had their best ever financial services experience at a retail super fund.

So if you are going to bet on who is going to win the race from product to service in financial service then the odds are clear. Industry funds will have to fail hard to lose and of the Big Four, CBA is lengths and lengths in front.