The four year retreat of first home buyers from market looks to have ended according to data released this week by the Australian Bureau of Statistics (ABS), indicating that the long boom is either over or First Home Buyers (FHBs) have drastically altered their purchase expectations.

According to Mr Simon Elwig, Head of Lending Research at CoreData Pty Ltd, the clues that the price boom may have topped out are clear in the latest ABS figures.

“The data is starting to show an uptick in the number of home loans being completed for first home buyers (FHBs) – which indicates the market is entering a new phase,” he said.

Mr Elwig said that more interestingly – the amount being borrowed by FHBs was broadly similar to the 2016 figure for March 2016, indicating FHBs have either started to move to more affordable types of housing and in cheaper suburbs or that housing prices had flattened wherer they were buying.

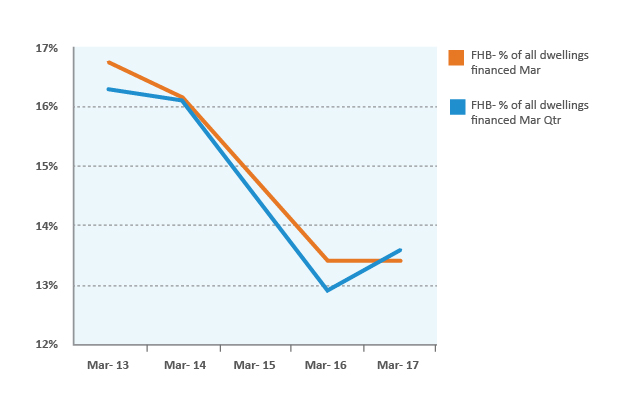

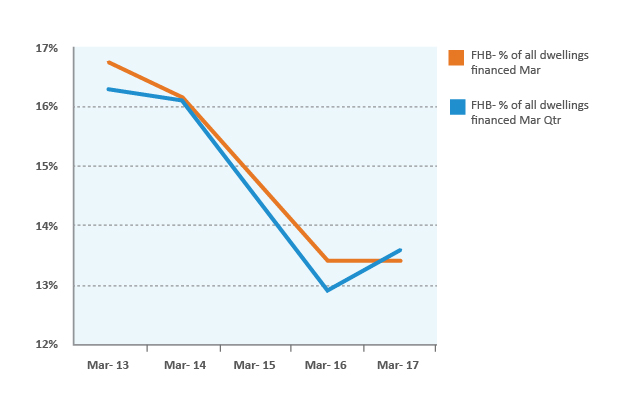

The data shows the number of first home buyer commitments as a percentage of total owner occupied housing finance commitments rose to 13.6% in March 2017 from 12.9% in March 2016.

The data also reveals the five-year decline in FHB lending was arrested in the March quarter, indicating a change in market dynamics.

This change has been driven by an increase in number of FHBs of 8.9% from 7,295 in March 2016 to 7,946 in March 2017, rather than a reduction in non-FHBs.

Drilling into the detail, the figures reveal that the average FHB loan size has remained relatively flat at $316,300, whereas the average non-FHB loan has increased by 4.3% to $375,800, indicating an increasing percentage of FHBs are embracing apartment living or moving to outer suburbs.

This trend is reinforced by recent CoreData research for Mortgage Choice into the Evolving Great Australian Dream, where a survey of more than 1,000 Australians was conducted to find out whether attitudes towards home ownership were shifting.

The survey showed 87.2% of Australians said it was too difficult to achieve the traditional home ownership dream of a freestanding house and 27.6% of FHBs would be happy to buy a smaller dwelling and 25.0% would consider buying in outer suburbs or further away.

For further Information call Simon Elwig, Head of Lending on 0417 236 538 or Andrew Inwood, Head of Research on 0425 339 888.