As the world bunkers down in an effort to bring the coronavirus (COVID-19) pandemic under control, Australians are taking their own steps to mitigate its impact on their financial and mental wellbeing. For many, the effects of the pandemic are taking their toll. While the crisis isn’t resulting in widespread bill stress just yet, mental and overall wellbeing is suffering.

A range of issues currently affecting both investors and consumers are reflected in CoreData’s COVID-19 Impact Dashboard, which will track in coming weeks and months how the Australian community is responding to the COVID-19 pandemic.

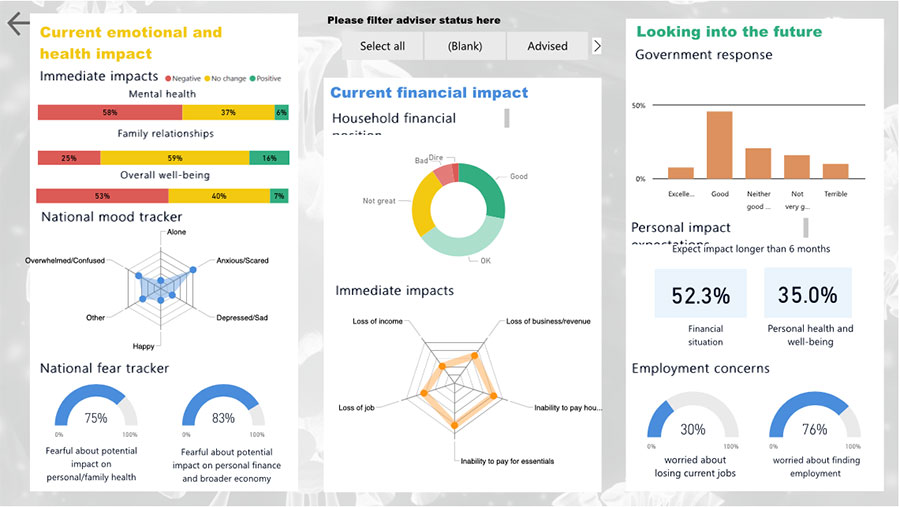

The inaugural CoreData COVID-19 Consumer Impact Pulse Check Survey results reveal nearly seven in 10 (68.6 per cent) Australians report their household financial position is okay or better. When asked to consider their situation, and that of their immediate family, more than eight in 10 say they are able to afford household bills (82.2 per cent) and basic essentials, including groceries and medication (86.4 per cent). Early findings indicate, however, that a growing number of Australians are experiencing financial difficulty.

Tellingly, it appears many Australians are sacrificing to try and maintain their financial position. More than seven in 10 (71.9 per cent) have reduced discretionary spending, half (51.8 per cent) have intentionally reduced expenditure on some essential items, and a third (33.0 per cent) have cancelled memberships or subscriptions (gym, streaming services etc.) These numbers appear to be growing.

Another 12 months of this

Looking to the future, more than half (57.0 per cent) expect the pandemic to continue to impact their financial situation for at least 12 months, with around a third (32.1 per cent) foreseeing negative impacts on the Australian (32.1 per cent) and global (35.4 per cent) economy for longer than 18 months.

The actions Aussies are taking to preserve their financial situation are likely driven by this pessimistic economic outlook. However, fear and anxiety are also playing their part. Nearly three in five report the pandemic has negatively impacted their mental health (56.5 per cent), while more than half say their overall wellbeing has been negatively impacted (53.6 per cent).

At the time of completing the survey, nearly two in five (36.8 per cent) respondents reported feeling anxious.

More than seven in 10 (74.0 per cent) Australians say they are worried about the virus’ potential impact on their own and their family’s health, and eight in 10 (82.3 per cent) worry about the impact it could have on their finances and the broader economy.

While at this stage we aren’t seeing the drastic financial impact that might be expected from a global crisis such as the coronavirus pandemic, CoreData’s research suggests this may be yet to unfold.

Nearly three in five (58.8 per cent) say they, an immediate family member, or both, have experienced loss of income, while nearly two in five (37.1 per cent) have lost a job. A similar proportion (37.7 per cent) say they or a family member has experienced loss of business revenue.

Support for government measures

However, Australians are generally supportive of the Federal Government’s response to COVID-19 to date, and optimistic about its potential impact. More than half (52.4 per cent) of survey respondents describe the Government’s response as good or excellent, and more than three quarters (77.0 per cent) say the $189 billion fiscal stimulus package will be at least somewhat helpful for Australians.

Perhaps in this time of uncertainty, a Government that provides clear directives and advice to Australians for looking after our mental health during the coronavirus pandemic is just what we need to ensure our wellbeing stays on the same secure track as our finances.