It’s official. There’s a furore building among financial advisers over proposed education standards. And the big surprise is that the noise isn’t coming from the usual quarters.

We’re not hearing from uneducated advisers arguing against minimum standards requiring all planners to have a degree. That battle is old, has been fought and lost, and now things have moved on.

No, it’s the highly educated, experienced advisers who are now upset. The champions of professionalism.

You see, the newly formed standards authority for financial advisers, FASEA, has proposed that only shiny new, recently completed qualifications should be counted for existing advisers.

If it goes ahead it means that the financial planners who embraced professionalism early, and have studied financial planning degrees and postgraduate degrees, will need to go back to school if they want to operate beyond 2024.

I know this to be true, because I’m one of them. As a CFP® Professional (recently non-practising), my Master of Commerce in Financial Planning degree, commenced in 2001 and completed in 2005 is not on the approved register.

Requiring educated, experienced advisers to cover old ground is a waste of their potential.

FASEA needs to think differently about professionalism. Yes, we should lament past advice failures and learn from them. Yes, we should be concerned that according to ASIC around 75% of advice coming out of the institutions fails to meet the best interests duty. And yes, academic competency is an important component of professionalism.

But professionalism is about much more than just being educated. True professionals respect the past, but they don’t look backwards.

Professionals have a growth mindset, they’re continually seeking to improve how they serve their clients. They’re part of a community that holds itself accountable, is supportive and nurturing, but continually demanding of excellence. Professionals are confident in the value they add to clients and society.

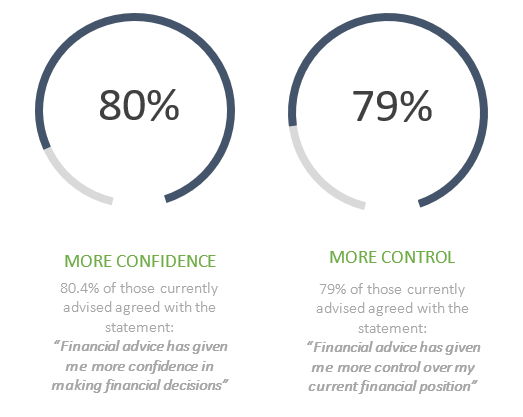

Professional advisers have good reasons to be confident and embrace the future. The value they add to their clients is real and meaningful. And CoreData has proven it.

In research conducted for Sunsuper, CoreData found that compared with the unadvised, clients of financial planners can sustain a higher quality of life, have more overall financial wellbeing, feel more financially secure, and feel they have enough money to do what they want in life.

Experienced advisers who already have degrees in financial planning, and have stayed up-to-date with their ongoing professional development should not be required to study financial planning again.

As professionals, what they study next should be entirely up to them.

In the words of David Maister, author and former Harvard professor, “… what you do in your non-billable time determines your future”. Experienced, educated advisers should be set free to learn to serve their clients in new and better ways.

Now there’s still time to address this issue. The great news is that FASEA has said it will consult industry about its proposed guidance for existing advisers.

Well, FASEA, in preparation for your consultation, here’s my message to you. And with apologies to Bob Dylan for mashing his lyrics and for singing flat,

You say you’re looking for someone

To look back and cover old ground

To scorn what I’ve learned over the years

To probe what I know and make no sound

Someone to re-learn the basics an’ nothin’ more

But it ain’t me, babe

No, no, no, it ain’t me, babe

It ain’t me you’re lookin’ for, babe.