In a world where constant changes and an increasing compliance burden on both lenders and brokers are the new norm, careful consideration and implementation of policy and process changes post-royal commission can have a large impact on a bank’s home loan market share.

Banks that have been able to provide a fast and consistent home-loan approval process during the constant changes have outperformed, with CBA increasing market share over the past year, despite the backlash against major banks from consumers due to the royal commission and not passing on all rate cuts in full. Macquarie Bank also has significantly outperformed the non-majors over the same period.

Over the past year both CBA and Macquarie have been able to maintain turnaround times for credit decisions to within a few days. Currently CBA’s time for credit assessment for brokers is within three days, and Macquarie’s within a day, compared to some banks whose decision times have blown out to 18 business days.

Turnaround time becomes an increasingly important consideration on where to place a loan for brokers, especially for purchases where standard settlement times vary between states from 30 to 90 days.

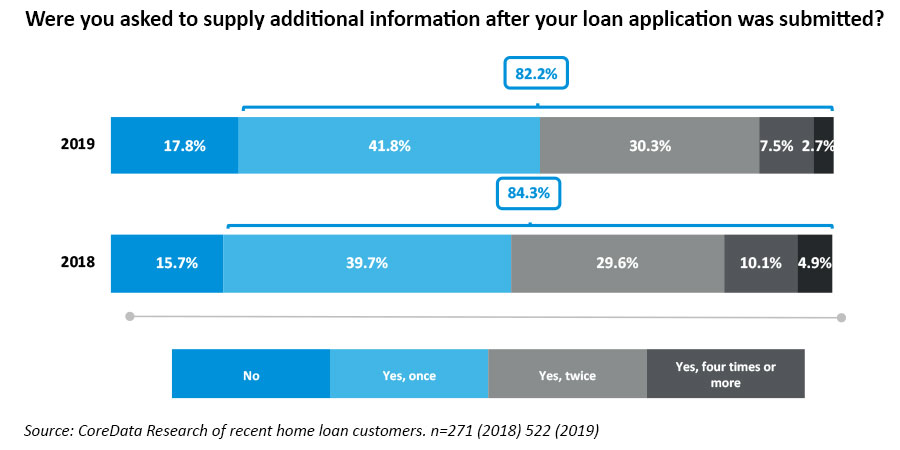

Compounding the issue is the likelihood of the bank asking for more information before making a final decision to approve a loan. Our research of recent home loan customers shows that in more than 80 per cent of home loan applications more information is required before decisioning the loan, and more information is required two or more times for just over 40 per cent of loan applications.

Assuming that it takes around five business days to lodge a loan application after meeting a broker or lender, that it takes a further 10 business days to get a decision and 10 days on top of that for the loan to be approved after providing more information, and if it takes a further two days to receive loan documents, that’s 27 business days already gone and the loan documents still have to be certified and settled.

Unless the customer already has pre-approval from the lender, they would be reluctant to go with a lender with longer processing times for fear of missing settlement.

The lender’s interpretation, implementation, communication and subsequent consistency could have a major impact on future market share growth. After all, when faced with the trade-off of a cheaper rate and possible settlement delays, a home buyer will not want to put settlement at risk.