Almost three quarters of Australians now experiencing financial vulnerability or hardship were able to pay their bills with money to spare before the COVID-19 pandemic struck.

CoreData’s latest COVID-19 Pulse Check of more than 1100 Australians reveals the extent to which the pandemic is impacting everyday Australians, with the proportion who claimed to be in a “good” financial position, able to comfortably pay their bills with money left for discretionary purchases, plummeting from nearly half (48.4 per cent) pre-pandemic to just 30.8 per cent in late July.

At the same time, those experiencing financial vulnerability and hardship more than doubled, soaring from just 13.3 per cent pre-COVID to 31.1 per cent.

This “emerging hardship” group accounted for almost a quarter (22.4 per cent) of the Australians we surveyed, with those who are unemployed due to COVID-19 unsurprisingly over-represented, along with those working in tourism/hospitality and retail.

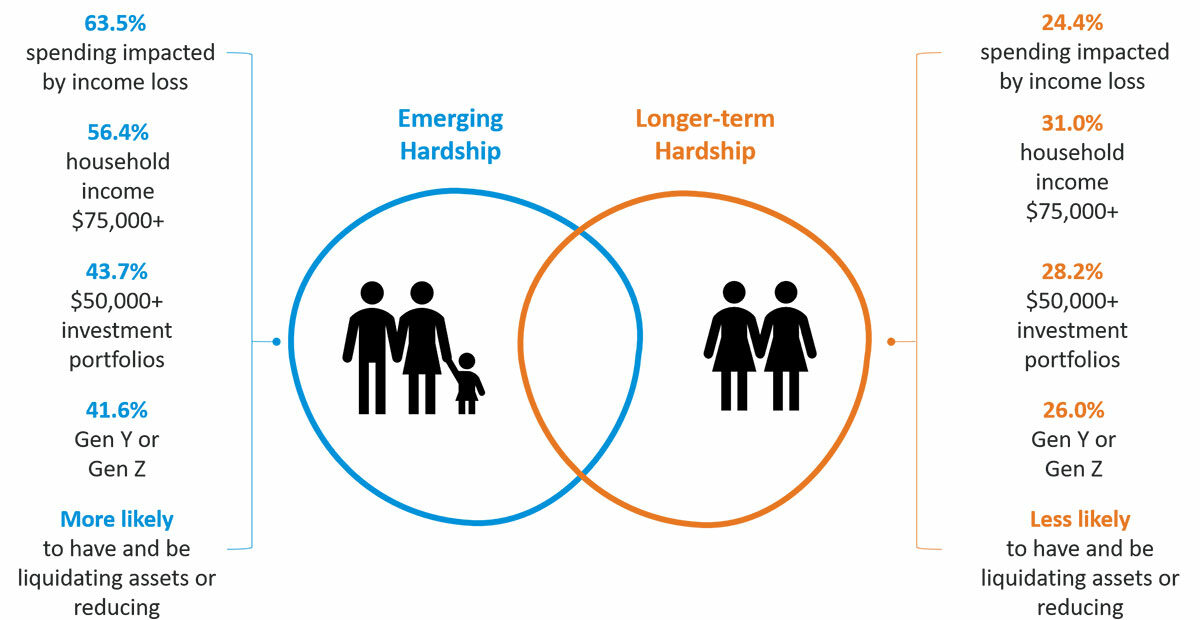

Overall, those who have been experiencing financial hardship and vulnerability since before the pandemic look more like the general population than those in emerging hardship, in terms of their COVID-related financial behaviours. Conversely, those in emerging hardship are in a vastly different position than their peers in longer term hardship:

- Of those unemployed, 84.5 per cent have recently lost their job due to COVID-19. They are short-term, rather than long term unemployed

- The majority still have household incomes over $75,000 a year (56.4 per cent, compared to 31.0 per cent of those in longer term hardship).

- They have options to mitigate financial decline, with the sale of tangible assets and taking out of loans far more prevalent than among those in longer-term hardship.

- More than four in 10 (43.7 per cent) of those in emerging hardship have investment portfolios worth $50,000 or more, compared to just 28.2 per cent of those in longer-term hardship. In fact, almost half of those in emerging hardship are affluent (48.1 per cent).

- They are more likely to be younger Australians, with Gen Y in particular over-represented (29.9 per cent of emerging vs. 19.4 per cent) meaning they are more likely to also be parents of younger children.

Taken together, the findings show clearly that falling into a situation where income and bill payment capability is compromised will be something many in emerging hardship were never expecting and are likely ill-prepared to cope with. A considerable number appear to be over-leveraged, as evidenced by their affluence and access to, and selling of assets. So how are those in emerging hardship coping?

Working hard to mitigate the financial impact of COVID-19

Those new to more precarious financial positions are working hard to control the havoc wreaked on their finances by the pandemic. While more likely to be renters, among those with mortgages, uptake of repayment holidays is double that of the general population (24.7 per cent vs. 11.4 per cent). Half of those that have deferred expect to extend their repayment holiday beyond September 2020 due to continuing inability to meet their repayments. And despite evidence fear of retribution is stopping many renters from seeking rent reductions, more than a third of those in emerging hardship did (34.6 per cent), although just half were successful.

Their success has been limited and pessimism is widespread

Overall, this group of Australians are also far more pessimistic about their financial future, with half (50.6 per cent) expecting things to worsen for them over the next 12 months, compared to just 30.4 per cent of the general population and 35.1 per cent of those who have been in a precarious financial position since before the pandemic. This is likely because the actions they have taken to minimise the financial impact of COVID-19 have not been successful. While practically all those in emerging hardship took some action (97.1 per cent), more than two thirds (68.0 per cent) were not able to maintain their financial position despite this, compared to 40.2 per cent of those in longer term difficulty and 36.4 per cent of the general population.

There is a desire to close personal financial capability gaps

One promising finding is the desire among those in emerging hardship to take steps to improve their financial capability, with almost a quarter (22.4 per cent) saying their experience has prompted them to learn more about personal finances. A fifth (20.8 per cent) believe mentoring and coaching would help them strengthen their financial position, and almost as many (18.9 per cent) say affordable financial literacy education would help. Conversely, these are all less common among those in longer term hardship, suggesting this group has less hope that they can improve their position.

There is also evidence that those in emerging hardship retain greater capacity to recover than those in longer term hardship, being far more likely to be saving more on a regular basis (42.2 per cent vs. 28.6 per cent) and seeking professional advice (9.9 per cent vs. 3.7 per cent).

Managing emerging hardship among your customers

Those new to financial vulnerability and hardship are experiencing a situation they did not anticipate, and in many cases did not prepare for. For the majority, loss of income is the key contributor to their situation, and the factor most likely to be preventing them from returning to their pre-COVID-19 spending habits (63.5 per cent, compared to just 30.8 per cent of the general population).

The key take-away is that people who have never experienced hardship in the past but are now indicating they are struggling, or unable to pay their bills on time, are distinct in many ways from the customers businesses have previously flagged as vulnerable or in hardship. Not only in terms of the driver of hardship, which is less likely to be income loss for existing hardship customers (24.4 per cent) than for emerging hardship customers, but in capacity and actions taken to improve their position moving forward.

Despite all this, experiencing hardship for the first time brings more than just practical challenges. In managing these emerging hardship customers, care must be exercised, given not only the higher levels of pessimism, but likelihood that the customer is also experiencing negative mental health (73.1 per cent) and well-being impacts (69.1 per cent) as well as family relationship impacts (47.9 per cent) than either the general population or those in longer term hardship.

However, with their clear desire to recover and embed personal spending and financial habits that will provide more resilience in the face of future financial threats, there is good reason to invest in supporting and retaining these customers into the future.