The “fees for no service” failures uncovered by the Royal Commission were deeply disturbing. But equally concerning is a narrative that has arisen in the financial services community as a result. People are questioning the validity of ongoing advice services themselves.

But these issues are separate. The fact that financial institutions failed to deliver services that were explicitly agreed with their customers is different to whether or not those customers would have benefited from ongoing services had they been provided.

Life happens so retirees need to be adaptable

Retirees are an experienced lot. They’ve seen life’s ups and downs, and they’ve all managed to survive. They’ve survived by being flexible, rolling with the unexpected, and changing course when required.

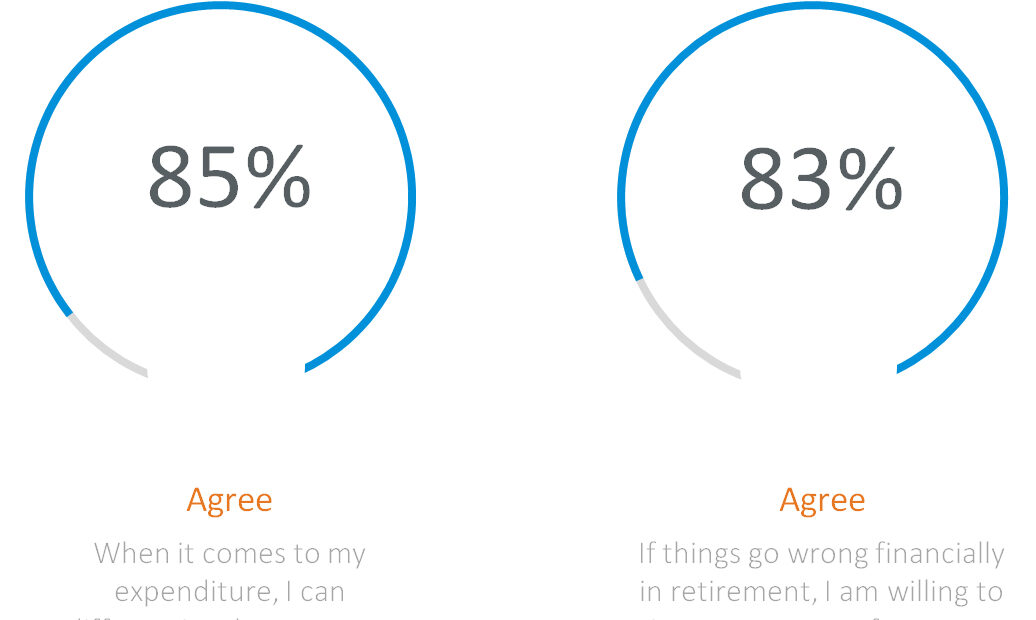

It makes sense that people will take this same mindset into their retirements and CoreData research confirms it. Most retirees are confident they can differentiate between wants and needs, and they’re willing to cut back on their expenditure if their retirement plans go off track.

There’s nothing new under the sun

The 1960s folk song “Turn! Turn! Turn!” is about the seasons of life. Its lyrics were written around 3000 years ago; they’re verses from the biblical Book of Ecclesiastes. According to the song, there will be times to laugh and times to weep; times to plant and times to reap; times to dance and times to mourn. There’s “a time for every purpose”, as the song goes. You just need to recognise where you’re at and accept it.

It’s ageless advice. And retirees get it. Retirees know that they’re going to be retired for a long time, and that they can’t possibly foresee the challenges they will face. They know that there will be moments when they will need to draw down capital, and maybe even opportunities to inject capital. Occasionally they will need to dial up or dial down their regular payments to make ends meet.

We know that retirees are willing to be flexible because CoreData has researched it. According to this year’s Post Retirement Survey, the vast majority (85 per cent) of retirees are able to differentiate between their discretionary wants and their essential needs. Further, they’re willing to act when things go off track. Around 83 per cent of retirees say they are willing to cut back on expenditure if required.

Retirees require flexibility and control

Retirees don’t know how long they’re going to be retired and what worries them most is running out of money and not having enough to grow old with dignity. So, retirement portfolios need to solve for longevity risk.

It’s not as simple as purchasing an annuity and watching the payments roll in. Lifetime annuities and deferred lifetime annuities play a role in most retirement portfolios by taking care of the great unknown – time – but life happens and retirees require more flexibility and control than an annuity alone provides.

Retirees should to set aside a separate pool of money that provides for the unexpected. It needs to be liquid, so that assets can be sold down quickly, and it must allow regular payments to be dialed up or down by the investor, as required.

But there’s more to it than product.

A total solution involves a combination of effective communication and service offers as well as product. Retirees need to know when their retirement is running off track and they need to know what actions to take.

CoreData research tells us that most clients don’t want face-to-face ongoing service. While eight in ten people prefer face-to-face advice initially, five in eight are happy to be serviced via other channels from then on.

One approach to providing ongoing services more efficiently is to use digital projection tools, informed by data and coupled with targeted communications. Managing the data is simple. There are only two possible causes for retirement plans running off track: investment returns; and expenditure. Financial planners track both data points and can reach out to clients via their preferred channel to make them aware it’s time to act.

Whether or not professionals provide agreed services is a different issue to the benefits of that service when it’s provided. Here are five steps to providing ongoing advice professionally:

- Have confidence: clients value your ongoing advice

- Segment your clients based on their communication and service preferences

- Understand the value of your ongoing advice; it’s about keeping retirees on track

- Be explicit and transparent about the costs and services you provide

- Provide the services in line with each client’s preferences.

There’s no doubt there are benefits to an intimate, ongoing relationship with a financial planner. But it’s important those services are provided in an efficient and fair manner. Technology can help there, and can provide clients with peace of mind from knowing they’re still on track, without the need for face-to-face meetings every time.