There are more Australian first home owners in the market today as a proportion of all home buyers than there have been for more than five years.

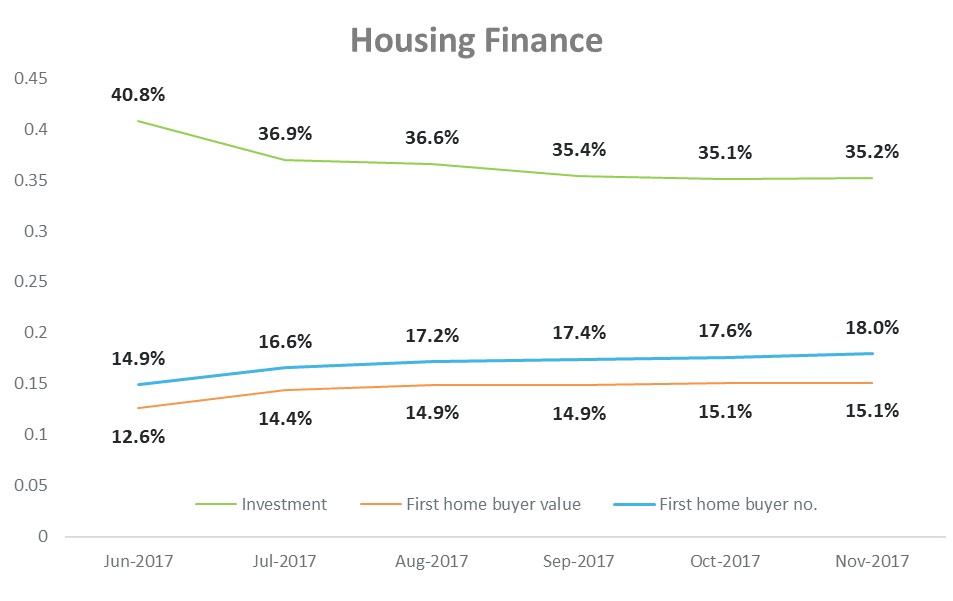

The uptick – which reverses an eight year downward trend and sees first home owners make up 18% of buyers in the market – has caused much excitement among commentators. And when you look at the growth figures, it’s hardly surprising.

In the year to date, the number of first home buyers per month has increased a staggering 25%. There are 2,800 more first home buyers in the market today than in November 2016.

However new ABS data reveals that just looking at the number of first home buyers does not tell the whole story.

Source: ABS Housing Finance, Australia, November 2017

During the same period, home prices nationwide have experienced an increase in value of 5.5%, according to CoreLogic. The average home loan size of non-first home buyers has increased accordingly at an annualised rate of 5.5%.

However, the average loan size of a first home buyer has increased less than 1% – well below the house price appreciation experienced during the period. This number reveals that first home buyers in Australia have not been able to keep up with increasing property prices nationwide, and instead have begun settling for less.

The flatlining value appreciation of first home buyer financing implies that they have decreased their debt exposure relative to dwelling prices and are purchasing less expensive homes. First home buyers are still feeling the squeeze in the current market and are being forced to move to cheaper suburbs or to buy apartments.

In the last 12 months, the increasing number of first home buyers has gone hand in hand with with a decreasing number of investors in the market. However, investor loans have halted their year long slide since Australian Prudential Regulation Authority measures released in March 2017, with investor financing increasing by 0.1% over the prior month, indicating previous tightening of lenders’ lending policies had gone too far and are this tightening is starting to be eased.