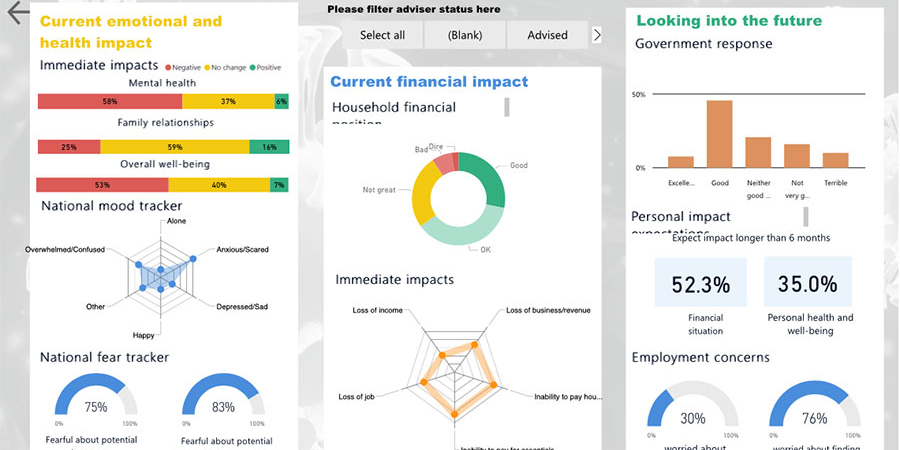

It has been three weeks since CoreData launched its COVID-19 Consumer Impact Pulse Check, and positivity about the Federal Government response continues to grow, as fear of the likely financial impact falls.

Despite this, an increasing number of Australians expect the economic impact to be prolonged, with more than six in 10 (63.3 per cent) now expecting the Australian economy to suffer for up to 18 months or longer, and more than seven in 10 (71.8 per cent) expecting the global economy to be negatively impacted for as long. This compares to 55.0 per cent and 58.2 per cent respectively in late March.

It appears that Australians are no longer panicking and as fearful of the unknown, and more resolved now to the need to weather a less severe, but longer-term storm. In a similar way that social-distancing and other measures have flattened the curve of infections, we have also flattened our financial outlook.

More than a third (34.6 per cent) are anticipating their financial situation will be negatively impacted for up to 18 months or longer, up from just a quarter (28.5 per cent) when CoreData’s initial pulse check was conducted. And while almost three-quarters of Australians (74.7 per cent) say they and their immediate family have not been unable to pay their household bills, this is a considerable decrease from 82.2 per cent in late March.

In line with this trend, the number of people reporting bill stress (those who are unsure they can pay their bills, or unable to and in debt) has jumped, from just 7.9 per cent in our first week of surveying, to 12.3 per cent – or more than one in every eight Australians.

Interestingly, our coping strategies to mitigate the financial impact of COVID-19 are also changing.

The number of Australians now seeking additional employment has risen to more than one in five (21.8 per cent). In addition, a similar proportion (18.1 per cent) are expecting to seek additional employment in the next month, up from 13.2 per cent in late March. This uptick in active and anticipated job-seeking activity coincides with the announcement from Treasurer Josh Frydenberg on April 8 of new legislation to support of the Morrison Government’s $130 billion JobKeeper package.

This appears to be counter-intuitive, given the JobKeeper payment is designed to enable businesses (ranging from sole-traders through to large employers) to retain their employees, through the provision of $1500 per fortnight for eligible workers. However, under the eligibility criteria, the payment only applies to full-time workers, part-time workers or casual workers who have been with their employer for 12 months or more.

It may be that businesses are needing or electing to reduce their workforce prior to reaching the revenue reduction threshold. Employees hired less than 12 months ago may be being let go, as they are not eligible employees for JobKeeper. Or it could be that employees earning more than $1500 per fortnight have had their hours cut, and are seeking something to top their income back up to the level they need to cover their outgoings.

Perhaps it is simply that Australian workers are not yet fully aware of how the JobKeeper payment works or whether they, and their employer are eligible. With more than one in three Australians (34.3 per cent) now worried about losing their job (up 6.3 percentage points over the past week) it is also possible that business owners and management are working with levels of uncertainty and change that make them reticent to communicate to, or reassure their workforce that their employment, or level of employment is secure.

Time will tell, and CoreData will be closely monitoring this job-seeking trend, and the impact of JobKeeper payments, in the coming weeks.