Well then. What a whirlwind the royal commission’s public hearings on financial advice were. Heads rolled – not least of all, the AMP chairman and CEO – and billions of dollars of market value was wiped off the country’s biggest wealth managers. Even the government was forced to acknowledge the naivety of its indifference to the inquiry.

Over the past two weeks we’ve tried to assess the reputational damage of the royal commission at an industry-wide level. The findings paint a bleak picture for financial advisers, but they’re not without few constructive takeaways.

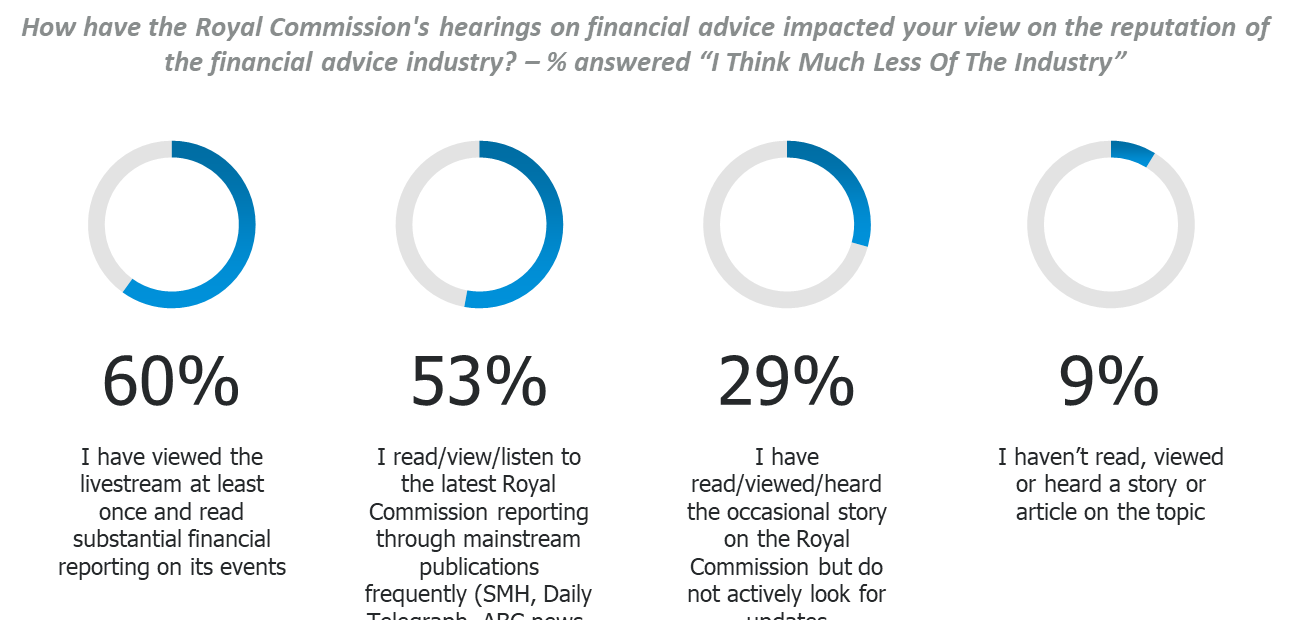

The more they watch, the more damage is done

A core, although relatively obvious, repercussion is the impact on clients and prospects according to how closely they followed the inquiry. Some three in five respondents who had viewed the live stream of the public hearings felt considerably worse about the industry.

Moreover, increasingly less outrage is felt among those less engaged with the hearings. This should ring alarm bells amongst advisers – someone’s status as “currently being advised” was a strong predictor for how closely they followed the hearings.

In other words, the current clients of financial advisers were most likely to have followed the hearings closely, and were most likely to have a poorer opinion of the industry as a result.

Don’t assume the reputational fallout is limited to advice

Although the leadership and service providers in other silos would see their business and reputation as mostly insulated from the grilling that financial advisers have faced in the royal commission, clients and prospects less frequently see it that way.

In fact, more than seven in ten respondents say the fallout from the inquiry will adversely affect the reputations of other areas of the service providers’ businesses. As a result, these businesses also have work to do to restore credibility.

Those that have reached out to clients

Conducted about ten days after the royal commission’s hearings on financial advice concluded, the survey found that less than half of advised clients had been contacted by their financial adviser. The research and consulting we provide to planner firms consistently reiterates the proposition that clients appreciate proactive contact around major events relating to advice services. No wonder, then, that 85 per cent of the clients who had been proactively contacted found the communication reassuring. In fact, not a single respondent indicated that the communication left them less reassured about the hearings of the royal commission.

Manage the conversation – demonstrate why you’re not a ‘bad apple’

These, among the other findings in the research, prove the need to manage the conversation around the royal commission. Rather than sit back as a passive service provider while your clients watch and read about the inquiry, allowing it to mould their perspective of the utility of advice from the most egregious examples of poor conduct, manage how your clients see it. Be proactive in confronting the nefarious conduct uncovered in the hearings and explain the safeguards that you have in your practice which ensure the same mistakes can’t be repeated there.

Although this conclusion is drawn from the data captured in our advice-focused survey, it carries a lesson that can be easily extended to the other services that will be put under the spotlight of the inquiry over the next eight months. Be proactive in managing the reputational fallout of the royal commission.

Just because your firm or line of business isn’t named, doesn’t mean it’s immune from the consequences arising from the coverage of the inquiry.

Follow CoreData on Linkedin: www.linkedin.com/company/coredata-group/