THE CHALLENGE

State Plus (formerly State Super Financial Services) is a financial advice and investment service traditionally catering to public sector employees. Facing fundamental changes to the organisation, the public sector and central client stream, in 2014 SSFS embraced the adoption of major restructuring under their future operating model. Underlying this shift was the need to develop a comprehensive client and prospect segmentation model that could be utilised at all levels of the organisation. This included the need for retrospective database tagging (based on customised algorithms); the ability for client-facing customer service officers (CSOs) and advisers to ask a simple set of questions interweaved into customer liaisons to assess and assign prospects to segments and confirm the classification of existing members; development of interactive end to end CRM systems designed to capture segments and provide actionable intelligence to client facing staff; guidance for expanding into non-traditional markets and the ability to identify high value customers and the most appropriate way to target them.

APPROACH

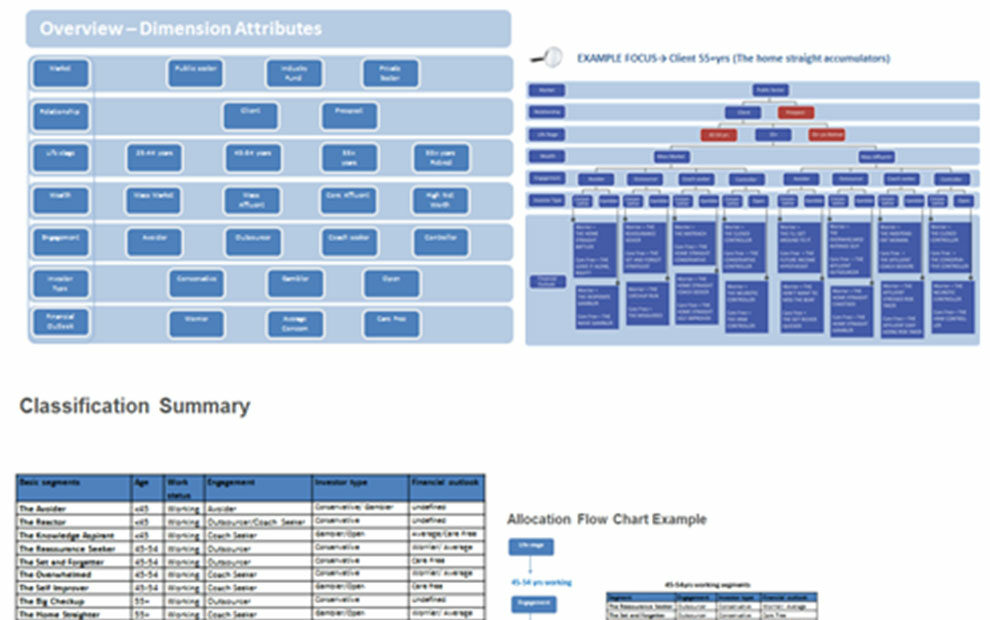

The greatest challenge with this task was the multifaceted utility required of the model, which would be used in many applications by various levels of the organisation from high level strategy, marketing communications, CRM integration and customer service. This meant the solution had to satisfy many different stakeholders with varying agendas and business needs. The research undertook extensive stakeholder consultation across the organisation from marketing, financials, product, advice to IT at various levels to ensure clarity of priorities and expected outcomes. This was followed by deep dive focus groups among key client and prospect life stages and wealth segments and a quantitative survey for members and prospects. Sophisticated statistical multivariate analysis was conducted including cluster and latent class analysis as well as choice modelling. In view of varied tasks required of this model, the need for practical utility and widespread stakeholder buy in, the segmentation model developed was structured as a scalable tiered model.

RESULTS

The segmentation solution was very well received at all levels of the organisation and adopted as a cornerstone of strategic development of the future operating model. The segmentation solution was applied retrospectively to the SSFS database and incorporated with the business’ end to end CRM IT systems. CoreData took (and continues to take) a critical role in assisting with the implementation of the model across the organisation. In addition to consulting on the design of the CRM IT systems and their utility, we took a leading role in educating the executive team about the model and developing training for advisers and CSOs, including manuals with developed segment personas, training workshops and developing/producing role play videos of typical segments’ interaction with staff to explicate how to identify and consistently respond to each segment. This work is ongoing and includes reviews of the model’s efficacy, related segment management KPIs, and refinement of model utility and application in novel settings with new service offerings.

Segmentation model framework overview

Persona profile decks example

Segment /Staff interaction Role pay video example