CHALLENGE

REI Super is an industry fund for professionals working in the real estate industry. The fund recognised that its broad 30,000-strong membership base had varying needs, but lacked the foundations for creating a more targeted approach to communication and engagement. In 2014, the fund approached CoreData with a vision to develop segment profiles of members, using the existing REI Super database. The results of the segmentation were to be used by the fund to establish tailored messaging for both existing and new members.

APPROACH

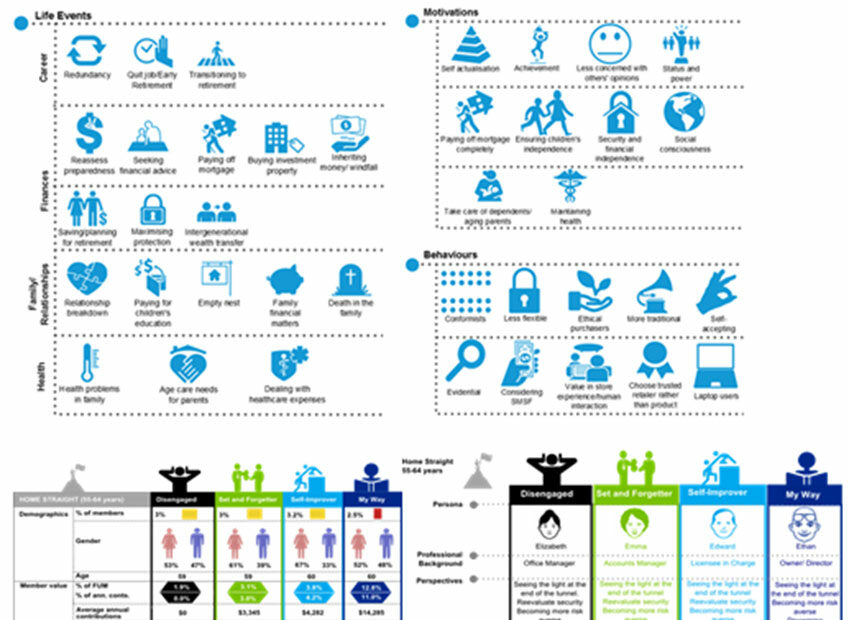

CoreData worked with REI Super to analyse available data from the fund’s database based on segmentation objectives that revolved around member engagement. CoreData further combined this analysis with insights leveraged from previous research around behavioural segmentation. In turn, engagement segments were identified and defined to assist in building conversations with these potential segments. To complement this approach to segmentation, CoreData worked with REI Super to gain a detailed understanding of its members and prospects. CoreData further developed the segmentation model for existing members to include consideration for demographic, socio-cultural and behaviour factors. The overarching objective for REI Super was to enable tailored communications and end to end customer relationship management offerings specific to a range of customer profiles.

RESULTS

CoreData developed a segmentation model solution which incorporated life stage, wealth and engagement dimensions. The segmentation model served as the strategic basis for matching the needs of various members and potential members with more targeted communications and service offerings. The model included highly developed visual representations of key ‘personas’ within the segments, including motivations and life perspective. The model also delivered key predictive analytic scores at an individual level that facilitated highly accurate targeting of the best prospects for various cross-sell activities and switching risk retention strategies. Subsequent testing of the analytics confirmed remarkably accurate predictions, often within a 5% accuracy tolerance. For example, the organisation was able to effectively target members for insurance and advice conversion with great success. The organisation was also able to stem the increasing tide of self-managed super fund (SMSF) departures with customised retention campaigns.

EXAMPLE SEGMENT PERSONAS

EXAMPLE PREDICTIVE ANALYTIC TOOLS

*Visuals blurred for privacy reasons.