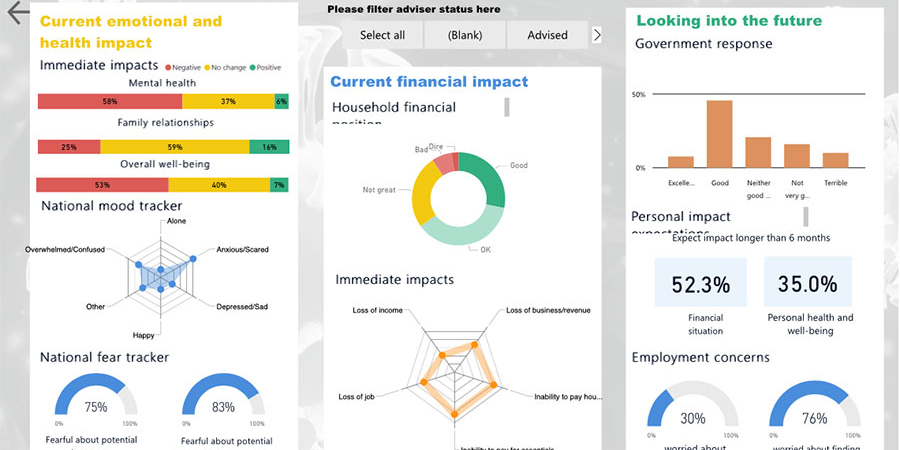

New research by CoreData reveals that the COVID-19 pandemic has seen the number of Australians in a ‘good’ financial position and comfortably able to pay their household bills decline to just one in four.

In contrast, CoreData’s COVID-19 Pulse Check has found that more than a third of us (34.9%) describe our financial position as not great, bad or dire. More alarming, however, is the staggering 54.4% leap in the number of those in those latter two categories, who are uncertain of their ability to pay their bills or, worse still, know they can’t and are going into debt. Together they now account for almost one in eight Australians.

Financial stress is nothing new for many Australians. The most recent wave of the NAB Australian Wellbeing Survey showed four in 10 of us had experienced financial stress or hardship in the last quarter of 2019. Even so, CoreData’s research shows, the majority of us (81.5%) have made at least small adjustments to minimise the financial impact of COVID-19.

For those experiencing bill stress, however, actions taken are more extreme, as 80.4% reduce their spend on essentials and close to half (47.3%) seek out additional employment. Concerningly, more than four in 10 have already resorted to applying for loans/financial support and a similar number plan to dip into their superannuation in the next six months (47.3%). The prevalence of these actions is out of step with those of the average Australian, and it’s taking a toll.The mental health and wellbeing impact of financial stress are well-known and widely reported. Australians experiencing bill stress are no exception. Frequently having no financial safety net at all (67.9%), they report their current mood as depressed (21.1%) in far greater number than the average Australian (7.9%).

Interestingly, as we reported previously (note 1), the average Australian appears to be shifting their economic outlook, as fear gives way to a more pragmatic, long term impact perspective. This is not the case for those experiencing bill stress, who remain more fearful than average and more likely to report negative wellbeing, mental health and family relationship impacts due to Covid-19.

The challenge moving forward is multi-facetted and complex. By its very nature, depression compromises a person’s ability to take active steps to manage their finances and wellbeing. In fact we are already seeing a decline in usage of financial counselling services (note 2) at a time when we know more people are in need of them. For those who are seeking the advice of their financial planners, advisors or accountants the question of their ability to pay for services within usual payment terms, particularly if restructuring and cashflow relief strategies are complex or require time, also arises. This presents a very real risk, particularly to those small businesses, with established relationships with mum and dad business owners, of delayed, or non-payment, resulting in their own cashflow and revenue challenges.

There are also a range of issues with the Morrison Government’s JobKeeper payments which may be fuelling fear among those in worsening financial positions. For many, financial hardship and bill stress is unchartered territory, for which they may be under- or ill-prepared. JobKeeper payments being only marginally above the national minimum full-time weekly wage, while a boon for casual and many part-time workers, present a very real shortfall for a considerable proportion of the workforce. Conversations with employers and businesses indicate there is both confusion around organisational eligibility and a raft of factors that further compound the issue, with many still unsure of their eligibility and/or unable to demonstrate requisite revenue decline before cashflow pressures force their hand in terms of lay-offs.

In 2019, 13.4 million Australians said they did not have emergency savings to fall back on, if they lost their job (note 3). The impact of this is now playing out before us, as the two principal fall backs, Government benefits and financial support of family and friends are swamped. As we continue to track the financial impact of Covid-19 on every day Australians, you can share your experiences and view our findings here.

Notes:

1: NAB Australian Wellbeing Survey, Q4 2019

2: Where “bad” indicated uncertainty that bills can be paid, and “dire” indicated inability to pay bills and in debt

3: Fear down, job-seeking activity up as Australians feel the financial impact of COVID-19