The pseudo-lockdown of Australia’s economy has changed everyday life dramatically, and while social media will emphasise the extreme behaviours, CoreData is focused on the practical actions Australians are taking to protect their finances.

Despite the bleak outlook, Australians continue to adjust to the new normal, taking the measures they deem appropriate to tryand secure their financial position.

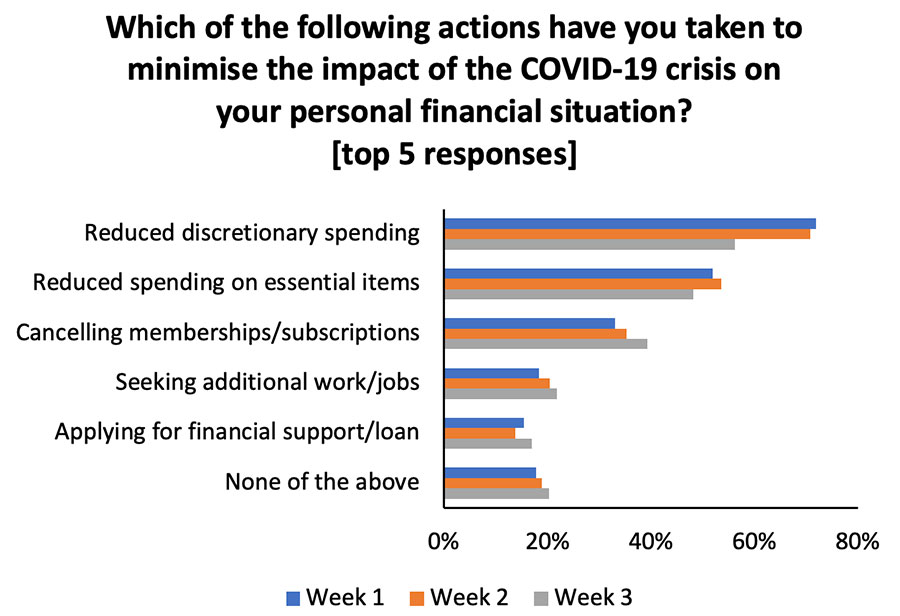

Approximately one in five are seeking additional work (21.8 per cent) or applying for direct financial support (17.0 per cent). Around half have taken the apparent low-hanging fruit by reducing their essential (48.1 per cent) and discretionary (56.2 per cent) spending. However, fewer appear to be doing this now than earlier, suggesting Australians were quick to act to reduce their cash expenditure.

CoreData’s COVID-19 Pulse Check has surveyed a total of 1811 Australians over the past three weeks, including 292 in the week ending April 15. The COVID-19 Impact Dashboard is updated weekly, providing public access to some of the most powerful insights from our research.

The various domestic stimulus packages appear to have softened the community’s fear of the virus and its impact on their finances and the broader economy, with about three-quarters (75.9 per cent) of Australians saying they are fearful, down from 82.3 per cent a fortnight earlier.

Australians have become increasingly fond of the government’s response to COVID-19, as the war-footing approach has delivered strong results following a summer in which public sentiment towards the Liberal Government appeared to wane.

Almost seven in 10 (69.4 per cent) respondents think that the Australian Government’s response to COVID-19 has been good or excellent, up on two weeks ago (52.4 per cent) and one week ago (64.6 per cent). Fiscal stimulus, highlighted by the wage subsidy package, has also been well received, with nine in 10 (88.8 per cent) thinking it will make a difference to people’s livelihoods.

However, uptake of some government incentives appears lower than expected, with a large and rising number reporting no plans to access their super savings (77.3 per cent, up from 65.5 per cent two weeks ago) or take mortgage repayment holidays (52.6 per cent, up from 49.0 per cent two weeks ago).

Even as we approach its April 20 introduction, fewer than one in 10 (7.8 per cent) have, or plan to, utilise the COVID-19 concession allowing for the early release of super.

Financial safeguards have unsurprisingly begun to dissipate as the crisis has unfolded. The number of Australians without a safety net has risen to almost one in three (30.9 per cent) from closer to one in four (27.0 per cent) two weeks ago.

Fewer have the security provided by investment income (7.1 per cent, down from 15.2 per cent late last month) or personal savings (47.9 per cent, down from 53.8 per cent), as financial pressures force some to draw down on their reserves to stay afloat.

Some Australians are planning to seek professional assistance, with close to one in 10 (9.8 per cent) unadvised individuals planning to consult a financial adviser in the next three months – up from approximately one in 20 in previous weeks (5.4 per cent and 4.4 per cent in weeks one and two respectively).

Whilst recognising the correlation to wealth, financial advice is likely to prove invaluable as the crisis continues, as partly illustrated by the growing gap between the number of advised and unadvised Australians with at least some form of financial safety net.

Given the uncertain short-term, taking immediate action with a longer time horizon appears to be the favoured approach. Many Australians may be appropriately considering the opposing long-term impacts of drawing down superannuation versus seeking financial advice to navigate the way forward.