It’s been a month since the Federal government took drastic action to stop the spread of coronavirus in Australia, mandating the closure of many businesses and implementing stricter social distancing measures.

While our outlook for our personal finances is largely unchanged, the nation’s mood is showing signs of improvement. Declining infection rates across the country are potentially giving many of us hope that the worst is behind us, and Australians are showing just how adaptable we can be.

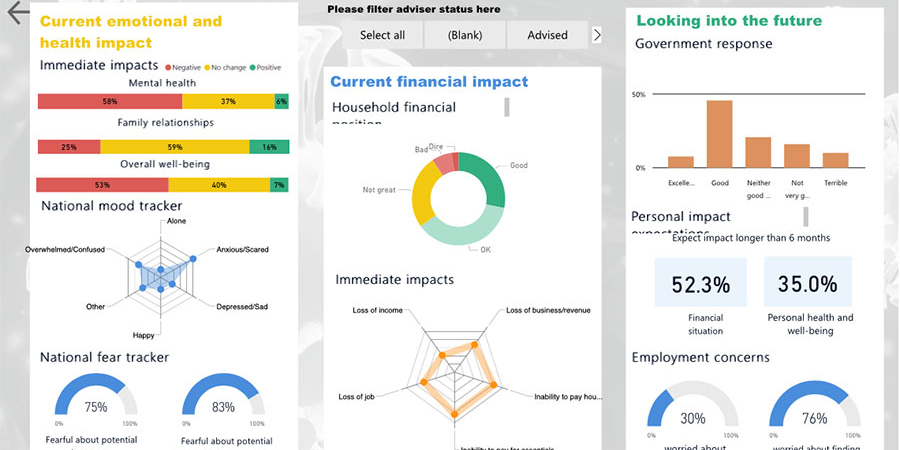

Four weeks ago, when CoreData published the first insights from our COVID-19 Impact Pulse Check 2020 survey of more than 1600 Australians, we noted that people were feeling anxious (36.8 per cent) and overwhelmed (16.6 per cent).

While the proportion who feel overwhelmed remains similar (18.5 per cent), fewer people feel anxious (25.1 per cent), and fear of the health impact of the virus is down, with the number of Aussies fearful of the potential health impact of the virus on them and their family falling to 62.9 per cent from 74.0 per cent a month ago. Conversely, happiness has increased to 25.8 per cent, almost double what was recorded in Week 1 (14.7 per cent).

However, nearly four in five remain fearful of the impact of the pandemic on our personal finances (79.3 per cent), down only slightly compared to a month ago (82.3 percent). One quarter of us are still expecting a longer-term impact on our personal financial situation of up to 18 months or longer (26.7 per cent), down only marginally from 28.4 per cent in late March.

Finances hit harder than health, wellbeing

It seems people are more likely to anticipate the virus will impact our financial situation for longer than 18 months (15.6 per cent) than our personal health and well-being for this length of time (5.6 per cent). This is perhaps unsurprising, as social distancing protocols and restrictions mean few of us have contracted COVID-19, but far more of us have been impacted by business closure, reduced work hours and loss of employment.

Nonetheless, many of us feel reasonably prepared to deal with the current threat to personal finances, the same mindset we encountered in our initial pulse check. Most (67.9 per cent) Australians admit that their household’s current financial position is good, or at least okay, and more than three quarters (76.9 per cent) claim they will not be taking the opportunity to access their superannuation early as part of the Federal Government’s stimulus package for Australians in financial distress.

However, more than two in five (43.3 per cent) Aussies are at least thinking of discussing a mortgage repayment holiday with their bank, down from 51.0 per cent in late March, while 7.3 per cent say they’ve already frozen repayments. This may indicate that while the stimulus measures introduced are easing the short-term financial burden, Aussies are preparing for a longer-term financial hit.

Economic outlook

Perceptions of the outlook for the global economy remain overwhelmingly negative, and in fact we’ve seen an increase in the proportion of people expecting the virus to negatively impact the global economy for up to 18 months or more in the last four weeks (64.5 per cent vs. 58.2 per cent). However, the outlook for Australia’s economy remains stable, with the majority still expecting a negative impact for up to 18 months or more (55.8 per cent vs. 55 per cent).

This could reflect the strong support for the Federal government’s response to the pandemic, with 76.2 per cent agreeing the response had been good or excellent, up from 52.4 per cent in late March. A number of welcome policy announcements over the past month (including the introduction of the JobKeeper payment and the Coronavirus Supplement for those already receiving income support) may be driving this sentiment.

If fewer cases of coronavirus are reported across the country each day, our outlook and mood will likely continue to improve. However, as talk of lessening restrictions ramps up, we open ourselves to new uncertainty; dipping our toes into a normal that comes with risk of a second wave of infections.

Over the coming weeks, CoreData will be monitoring the delicate balance between optimism and uncertainty, bringing you further insight into how Australians are faring as a nation and as individuals here via the CoreData COVID-19 Pulse Check Dashboard.