Sometime probably during the third quarter of 2020, a shift will take place in the balance of power in what will by then be the $2.9 trillion superannuation system. Industry super funds will overtake self-managed super funds (SMSFs) to become the largest industry sector.

Industry funds overtook retail super funds during the first half of 2018, and SMSFs are the next target. Analysis by CoreData suggests the assets of industry funds will draw nearly level with SMSFs in June next year. By September, assets of industry funds will exceed SMSFs by about $10 billion, at which point it appears to be game over.

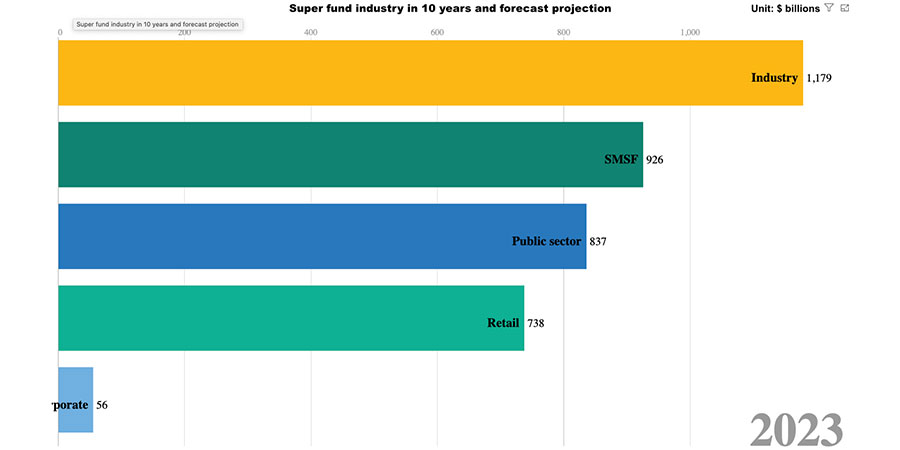

Industry funds will account for 26.7 per cent of all superannuation assets, while SMSFs will account for around 26.3 per cent. Retail funds will be languishing by comparison, with assets of $655 billion, or 22.2 per cent of the industry total, and a significantly less rosy growth outlook than industry funds, forecast to fall behind even public sector funds by 2023.

Watch how industry funds have grown to become the largest industry sector in this data animation. And have a look at other aspects of how the make-up of the superannuation industry has evolved since 2009 in CoreData’s Super Insights Market Intelligence Dashboard.

The superannuation system is, by most sane assessments, a massive success story. From nothing in the early 1990s, it has grown to become the fourth-largest private savings pool in the world, and the envy of many other countries.

Even though its various shortcomings have been well documented and continue to be picked over in report after report, the fundamental fact remains that almost $3 trillion has been set aside to meet Australians’ retirement income needs. And that’s $3 trillion that won’t need to be directly funded by taxpayers – a tremendous relief for the Budget. And yet.

A divisive debate

The growth of industry funds epitomises how far and wide the Australian superannuation industry reaches, yet at the same time highlights how divisive some of the debate about the structure and operation of the industry has become.

Industry funds connect with the community in a way utterly necessary and quite unlike retail funds and SMSFs. Retail funds generally are sold by financial advisers; and SMSFs are established by individuals often seeking greater control over how their assets are invested (even though the outworking of this “control” is a sector-wide preponderance of exposure to Australian equities and cash).

Industry funds, more like corporate funds and public sector funds than retail funds and SMSFs, connect to members in a different way; namely, though their workplaces or through the industries in which they work. But industry funds reach a section of the community that would not be covered by a public sector fund or a corporate fund, and which may find financial advice unaffordable or deem it to be unnecessary.

The rise of industry funds is now central to an ideological and political debate over the economic power of the funds and the presumed flow-on benefits to the trade unions believed to “control” them. But this control is illusory. It is clear – or at least it should be clear – that the assets of all super funds whether they are SMSFs or industry funds, belong to the members of the funds, and only to the members of those funds. Legislation makes that clear, and the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry made it clear as well.

Excellent, but not perfect

Claims that unions control industry funds and can use this resultant clout to wreak economic chaos says more about the relationship the proponents of that argument have to other people’s money than it does about union influence per se.

In other words, if you think control of other people’s capital gives you a weapon you can wield to achieve your own ends, then you’ll more readily ascribe the same motivations to others. In other other words, it takes one to know one.

Australia’s superannuation industry is excellent but it isn’t perfect, and issues remain to be solved relating to fund costs and expenses, trustee responsibilities, investment strategies and the provision of adequate financial advice to fund members. These are genuine issues and relate directly to ensuring the savings of all super fund members are put to work as efficiently as possible to achieve the objective of supporting them in retirement.

But these issues pertain to every fund. Of all the ills that are perceived to blight the superannuation industry, the spectacular rise to the top of industry funds isn’t one of them.