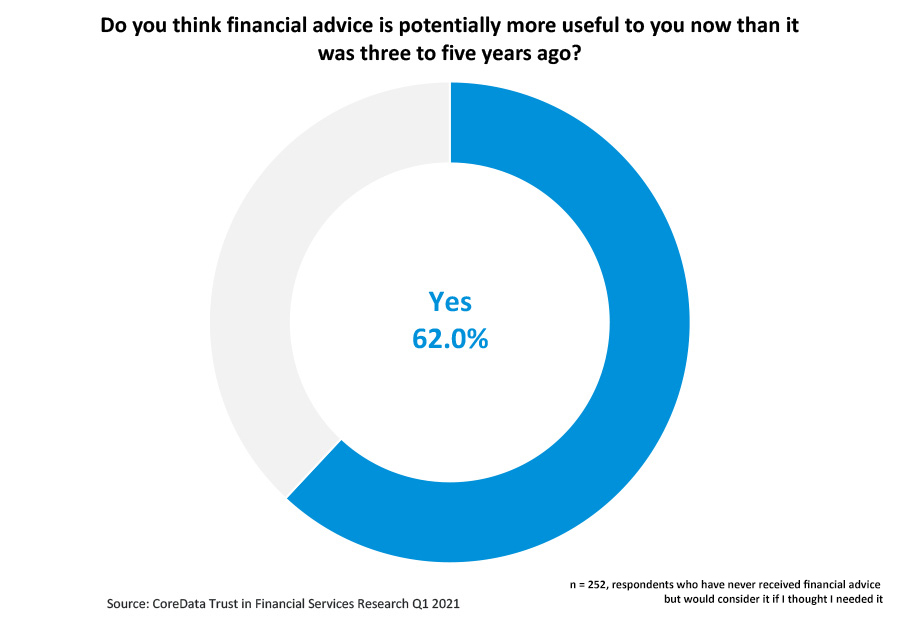

An understanding of the benefits of financial advice seems to be gaining ground, with CoreData’s latest Trust in Financial Services research finding a majority of Australians believe financial advice is potentially more useful to them today than it was three to five years ago.

Research focusing on the value of financial advice has been conducted and publicised consistently over recent years, and uncertainty engendered by the global COVID-19 pandemic appears to be behind a re-evaluation of financial advice and its perceived value.

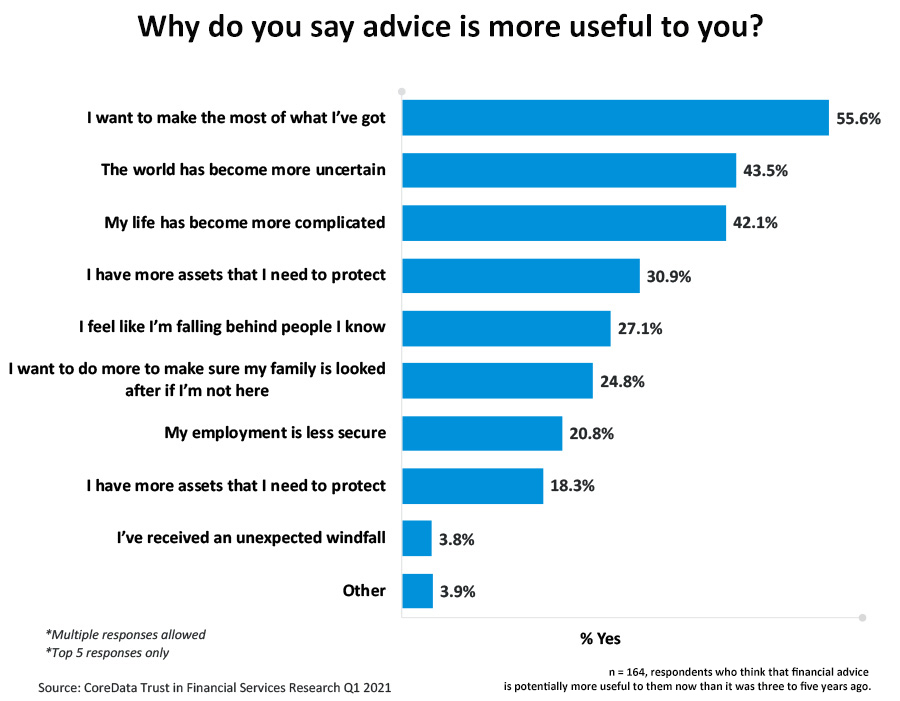

Overall, more than 60 per cent of people think advice is potentially more useful to them now. But the reasons they think that are varied. More than half (55.6%) say they think advice is more valuable to them now because they recognise the need to make the most of what they have.

Around a four in 10 (43.5%) recognise that the world has become more uncertain generally, and a similar proportion (42.1%) value advice more highly now because their individual worlds have become more complex – they’ve got married, had kids, received a promotion at work, or something like that. Lower employment security is a factor in around a fifth of cases (20.8%).

There are well-recognised triggers, or events in an individual’s life, when they become more receptive to the idea of seeking financial advice. But there are other factors driving the use of financial advice that come into the picture as well.

CoreData’s work with Netwealth on a ground-breaking report, The Advisable Australian: A new way to think about Australian investors, introduces the concept of “advice propensity” – that is, how likely any given individual is to seek financial advice.

In a nutshell, advice propensity encompasses an individual’s openness to using advice, taking into consideration their understanding of what financial advice is and their perceptions, sentiment, and barriers, or lack thereof, to seeking financial advice. It also considers their latent need for advice driven by the individual’s life circumstances.

Advice propensity is one of six dimensions identified in the report, along with financial capability, financial resilience, financial wellbeing, technology adoption and brand affinity. Together, these dimensions create a holistic picture of what the Advisable Australian looks like, how they behave, and how financial advisers can make themselves attractive and relevant to them.

CoreData has also worked closely with IOOF on its True Value of Financial Advice research report, which finds the value of financial advice transcends the age, wealth and gender boundaries traditionally thought to restrict its potential attractiveness.

That research found that younger and less wealthy Australians derive as much, and sometimes more, value from financial advice as older and wealthier Australians.

Trust in financial advice remains a key barrier to individuals actually going out and seeking advice, irrespective of whether they recognise they have a need for it. But the work being undertaken by financial advisers across the country to comply with beefed-up education, ethical and professional standards is likely to positively affect public sentiment towards advice.