Much has changed in the world since we published the 2021 UK adviser platform report. Indeed, the investment industry has been buffeted by a toxic combination of inflation, slowing growth, central bank rate hikes and the Ukraine crisis. These hazardous headwinds have sent markets into a tailspin and investors running for cover.

It’s a very different picture from last year when markets rallied on the back of societies reopening, central bank stimulus and a wider sense of optimism. And while the platform sector was able to both navigate and take advantage of the challenges presented by the pandemic, this year has thrown up a whole new set of challenges.

Furthermore, while investors last year were able to unleash savings built up during the pandemic, the inflation and cost of living crisis currently gripping the UK means the sentiment is now decidedly risk-off. And this has impacted both platform flows and assets under management, with CEOs keen to point to these difficult market conditions in interim results.

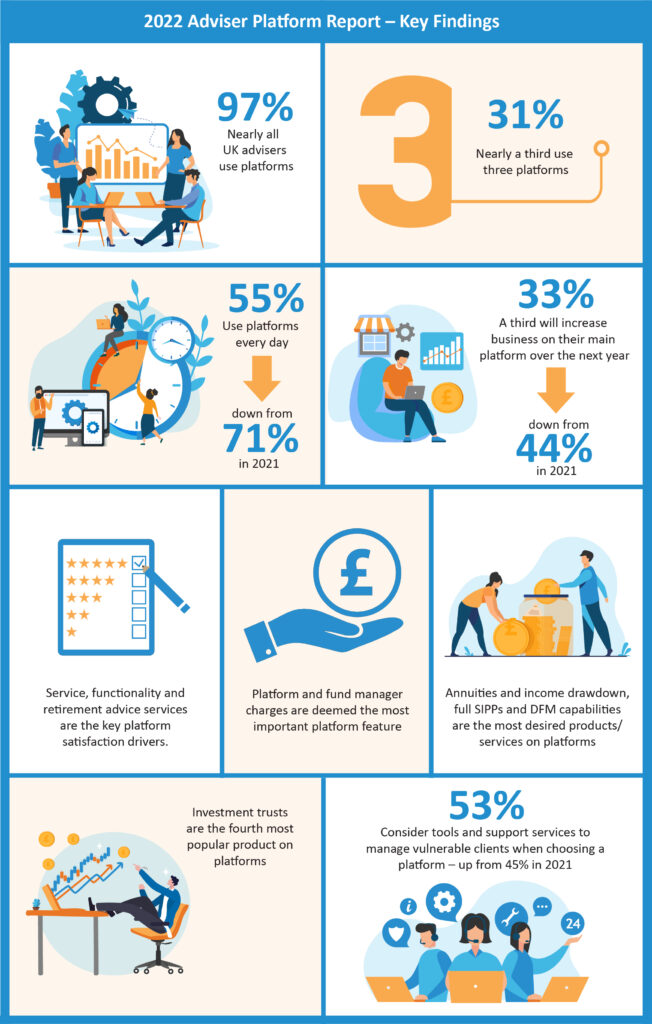

This year’s CoreData Research study shows UK financial advisers are scaling back the amount of business placed on platforms as the cost of living crisis bites. The study, which surveyed 420 financial advisers in the summer, finds only a third of advisers will increase business on their main platform over the next year – down from nearly half in 2021.

The slowdown in expected platform flows is already translating into less frequent usage. The proportion of advisers using platforms on a daily basis has plunged from 71% in 2021 to 55%. Daily platform usage among advisers focused on mass market clients — those most exposed to the cost of living crisis – has fallen even more sharply (48% vs. 73% in 2021).

The CoreData study also shows that while the overwhelming majority of advisers still use platforms, the percentage has fallen slightly. This could be a function of more advice firms developing their own in-house, bespoke platforms as they seek greater control over client investments and related services.

Meanwhile, the report reveals that annuities and income drawdown remain the most in-demand products on adviser platforms. This reflects better annuity rates in 2022 which are linked to rising gilt yields and interest rates.

The second most popular products on platforms are full SIPPs. This is followed by discretionary investment management services as advisers continue to outsource the investment function to navigate volatility, de-risk advice businesses and focus on financial planning.

But adviser demand for investment trusts and ETFs on platforms has dropped from last year as macroeconomic uncertainty and falling equity markets dent demand for these listed vehicles.

Elsewhere, more advisers this year say they consider tools and support services to manage vulnerable clients when choosing a platform. These findings show advisers are taking greater steps to both identify and help vulnerable clients and are looking for platforms to play a key supporting role. The results also indicate a rise in the number of vulnerable clients on the back of the cost of living crisis.

These are just some of the key findings to emerge from this year’s study. The full CoreData study is a near 200-page report which provides invaluable insights into how advisers are using platforms and what they really want from them. And critically, the report crunches the numbers on a wide range of satisfaction metrics to determine which platforms are performing best in the eyes of financial advisers. To find out more about this report please get in touch.