Speak to most licensees today and they’ll explain how their growth strategy for the coming 12 months includes (if it’s not entirely dependent on) recruiting new advisers and advice practices.

But look at the numbers from the past three years and extrapolate them into the future, or at least for the next 12 months, and a clear and obvious challenge to this strategy emerges pretty quickly.

At the end of December 2018 there were more than 28,500 financial advisers in Australia. By December 2020 the number had declined to less than 21,000, a fall of 26.5 per cent. If that trend continues the number of advisers will be closer to 18,000 by the end of 2021.

Licensees are competing with each other for a shrinking pool of available advisers. When they further define their target market as, for example, “high-quality” advisers and practices, then the pool is even shallower.

You don’t have to be a rocket scientist to understand the implications of increased competition among buyers for a dwindling resource. In a properly functioning market, resource scarcity leads to higher prices – it’s a seller’s market. In financial advice, resource scarcity leads to lower costs for advisers in the form of suppressed licensee fees, including discounts, holidays and in some cases a postponement of the full repricing needed to reflect the true cost of delivery. In that sense, at least, it’s a buyer’s market.

Many licensees will find themselves in a challenging situation trying to meet their growth targets, not only because they’re competing in many cases for the same advisers, but also because they still clearly have not yet fully repriced their services. Some will face the task of attracting new advisers to their networks through excellent service and support, while at the same time still not charging enough to be sure services and support can be delivered profitably and sustainably.

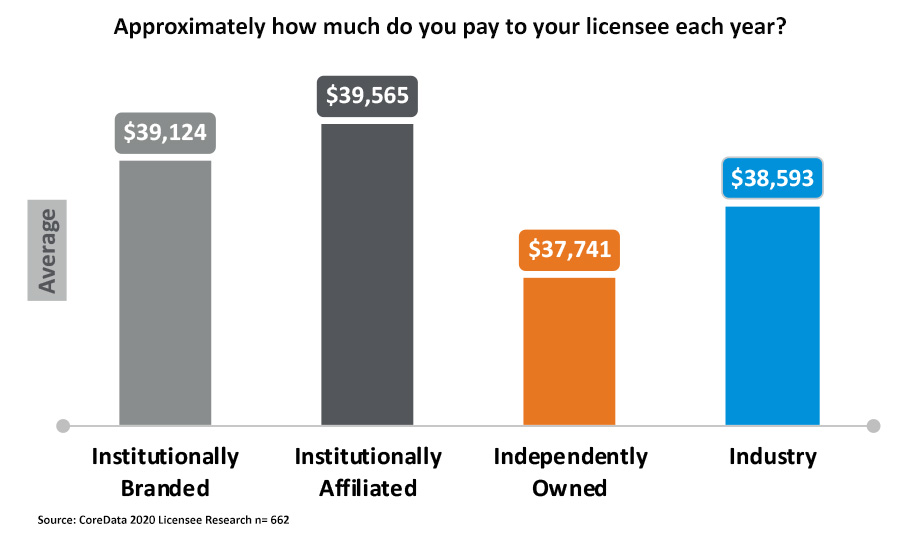

CoreData’s 2020 Licensee Research shows the average fee paid by an authorised representative to a licensee was around $38,500 a year. There was some variation in the fee paid depending on the structure of the licensee – institutionally branded, institutionally affiliated or independently owned. But we’re pretty sure (because several licensees have pointed out) that the cost of delivering robust and high-quality services to an adviser is more than $38,500 a year.

We’re preparing to launch the 2021 version of our annual Licensee Research, and we’ll be asking the same question again. It will not be a surprise if the impact of competitive forces in the advice market means licensee fees are either in-line or even slightly lower than in 2020. We expect the 2021 figure may reflect a few factors, including licensees postponing increases and fee discounts or holidays.

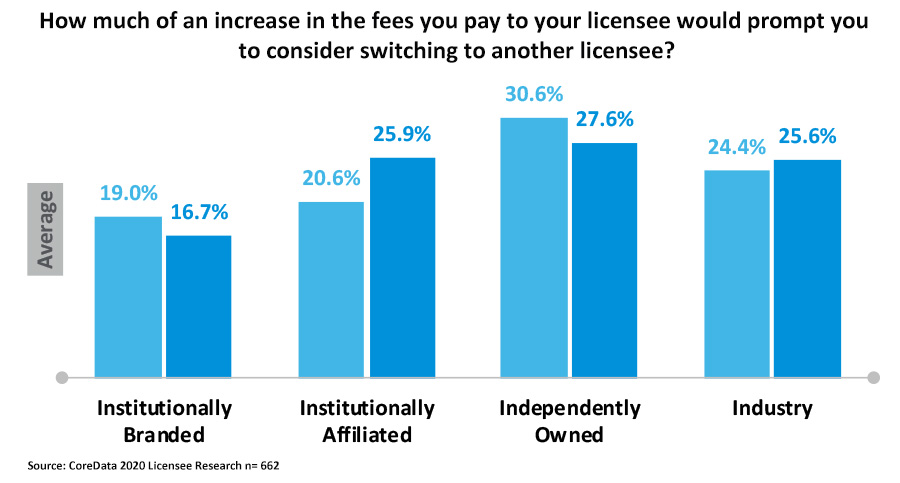

Progressive advisers recognise that a good licensee is a true partner in the growth of their business and in being a provider of high-quality advice services, and they’re prepared to pay a fair price for those services. The 2020 research found it would take, on average, a 25 per cent increase in a licensee’s fee before advisers started to look around for a cheaper alternative.

But we’ll wager there are enough advisers around who are still looking for a minimum-cost option. And we’ll also wager that the reorganisation of the advice market has distorted licensee fees, putting a brake on licensees’ ability to fully reprice their offers.

We’ll have a better sense of an answer to all of this in a few weeks’ time, when we launch the research and the results start to roll in. Last year more than 660 advisers contributed to this annual project by telling us how their licensee was performing and how it was supporting them to deliver great advice to clients. Keep an eye on your inbox for your invitation to participate in the 2021 version.