The CoreData Research platform study found that nearly half of advisers (44%) are set to increase business on their main platform over the next 12 months, up from 35% last year.

The study, which surveyed 661 respondents in June, also found that advisers are using platforms more frequently. Over seven in 10 advisers (71% vs. 68% in 2020) now use platforms daily.

And the daily usage among those focused on mass market clients has increased significantly.

Advisers are increasingly adopting a multiple platform strategy. Nearly one-third (31%) now use three platforms up from 27% last year.

While a higher portion use seven or more providers (5% vs. 2% in 2020).

A slightly higher percentage of advisers plan to add at least one additional platform to their proposition over the next year (15% vs. 13% in 2020).

As advisers use platforms more frequently and look to transact more business through them, the service element has become all-important.

In 2021, service is the prime driver (23% vs. 16% in 2020) in the Satisfaction Driver Model while retirement advice service was the number one driver last year.

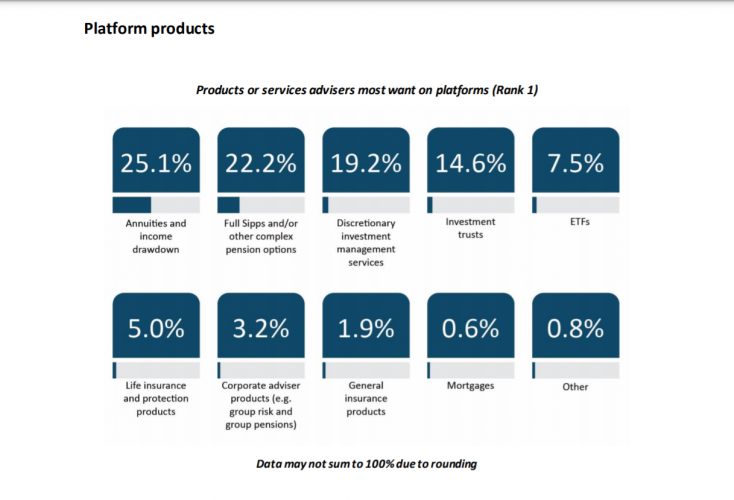

Elsewhere, annuities and income drawdown (25% vs. 32% in 2020) remain the most desired products on platforms, although demand has fallen.

This is followed by full Sipps (22% vs. 20% in 2020) and DFM services (19% vs. 18% in 2020).

Investment trusts, not included as an option in previous studies, are the fourth most popular product on platforms with advisers (15%).

Andrew Inwood, founder and principal of CoreData

Meanwhile, adviser demand for ETFs has fallen (8% vs. 10% in 2020). This year’s study also shows that nearly half (45%) of advisers increasingly consider tools and support services to help manage vulnerable clients when choosing a platform provider.

However, this is down on last year’s figure of 53%.