CoreData’s Q3 Investor Sentiment Research shows that high net worth individuals (HNWIs) are hesitant to invest more in risky assets, especially international equities, in the short term. As the pace of economic recovery has been stalled by a second wave of COVID-19, investors are becoming increasingly sceptical about the sustainability of stock market growth that has been turbocharged by massive fiscal policy support and considerable liquidity.

The strong and quick rally of the stock market in the second quarter has slowed in the third quarter. The ASX200 has been flirting around the 6000 points mark for a few months and the Dow retreated below its 50-day moving average in September.

Equities have become less of a bargain compared to the March trough. The volatility index, or VIX, measuring near-term market volatility, is an indicator commonly used to track market fear. The higher the VIX, the more volatile the market is expected be the next 30 days. As shown in Chart 1, between the ASX 200’s high on February 20, 2020, and its low on March 23, 2020, the VIX spiked from 12.4 per cent to 53.1 per cent. Even though it has dropped to around 20 per cent in Q3 from its high, it is still high relative to its pre-COVID level.

At this juncture, when central banks have shifted away from the mindset of “whatever it takes” and real economic conditions do not seem to support the anticipated “V” shaped recovery that the market rally has been based on, the market may be perceived as being at greater risk of falling.

Cash is getting increasingly unattractive

Investment markets reward risk taking, but risks can change dramatically as new signals emerge unexpectedly. Our Q3 HNW research found that those investors who have chosen to bear high risk and exploit the market downturn, more likely being the wealthy than the mass, are satisfied with their investment. But investment intention for Q4 is low even for these investors who are happy about their current investment.

Cashing out could be a solution when weakening fundamentals and economic conditions do not seem to support equity valuations, but more HNWIs have started to find cash unattractive due to the increasing opportunity cost of holding it to protect downside risk.

Cautious investors who have already cashed out and been waiting on the sideline face a dilemma in an environment where low interest rates are the status quo, and may even face further downward pressure. According to our Q3 HNW research, 44.9 per cent of HNWIs want to reallocate their cash holdings to other investment classes. But there seem to be limited alternatives.

Where to find real value?

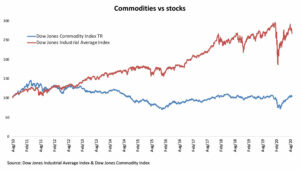

Chart 2 compares the Dow Jones Commodity index with the Dow Jones Industrial Average index over the past 10 years. The dynamics of demand and supply that determine commodity prices are complex, but the widening gap between commodity prices and stock prices signals stocks’ relatively overvalued prices.

Given that expansionary monetary policies and fiscal policies have been set to encourage inflation, most (68.7 per cent) of HNW investors expect so-called safe-haven assets such as gold to perform better in Q4, despite its already soaring price. But despite their expectation, not many investors intend to actually invest in gold.

Commodities provide a good hedge against inflation, and exhibit lower correlation with the US stock market compared to correlations between equity markets worldwide. But investing in commodities simply because of their relatively attractive price is risky. The bitter memory of commodity price speculation is still fresh for many Chinese individual investors who bought Bank of China’s Crude Oil Futures – a structured derivative product – and suffered mass losses when oil futures collapsed to the negative territory in April.

It is increasingly challenging to find a real rate of return in a fragile investment environment. Investors really need to have a clear understanding of what they are getting into. Perhaps in this sense, their hesitation is not a bad thing.