Since emerging in 1999, the SMSF sector in Australia has continued to grow. According to the ATO, as at March 31, 2020, there were nearly 600,000 individual SMSFs and more than 1.1 million individual members.

Collectively, these SMSFs hold around $730 billion of assets, and account for more than a quarter of Australia’s $2.9 trillion superannuation sector.

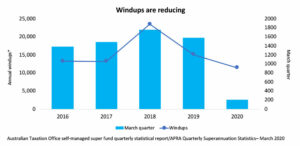

While the number of new SMSF establishments has slowed as the sector matures, the latest ATO data suggests the number of SMSF wind-ups has also slowed and is now at its lowest level in five years.

Furthermore, according to CoreData’s 2020 SMSF Research, intention to set up an SMSF among non-trustees has rebounded to its highest levels in three years, with 7 per cent likely to do so in the next year and 12 per cent likely to do so in the next five years. These figures are up from 3 per cent and 8 per cent, respectively, a year ago.

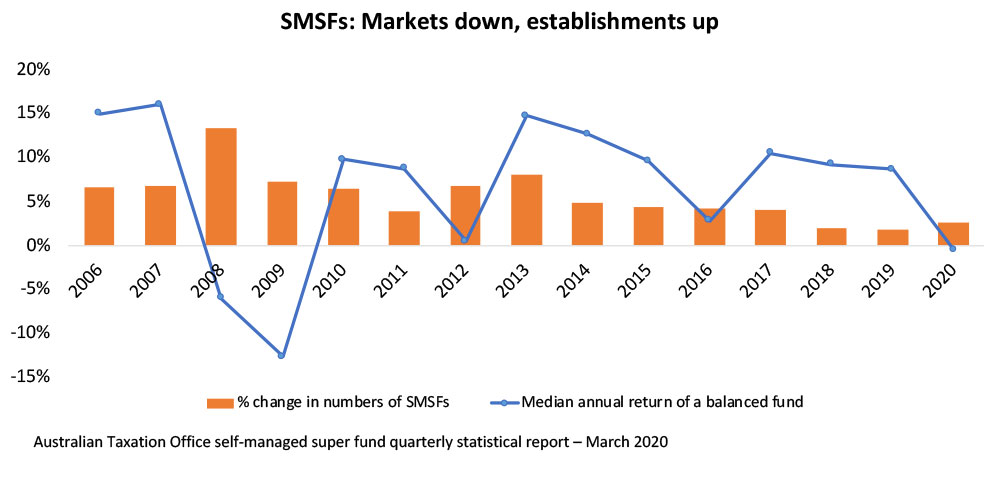

This can partly be explained by a growing desire to seek control amid the recent market downturn brought about by the ongoing COVID-19 pandemic. Indeed, according to ATO and APRA data, there appears to be a correlation between investment market returns (for which the median annual return of an APRA balanced fund can be used as proxy) and the number of SMSF establishments.

Although it is not a perfect correlation, it can be said that a year of downturn tends to result in more SMSFs being established the following year, while a year of strong performance tends to result in fewer SMSFs being established.

This observation reinforces what CoreData research has consistently found over the years. By far the number one reason for individuals to set up an SMSF is “greater control over investments”. Indeed, the proportion of trustees classified as “controllers” (those who are interested in and like managing their finances themselves) has grown to 41 per cent in 2020 from 35 per cent in 2019.

Financial planners, accountants and service providers who have an SMSF offer with a sound value proposition will continue to enjoy an advantage in the sector. Increasingly however, it will be critical for financial planners, accountants and service providers to support trustees by being cognisant of the changing needs of trustees and to be easy to deal with.

Specifically, providing reliable and trusted information on investment market updates and investment strategies and trends will go a long way to winning the hearts and minds of trustees as they seek to gain greater control of their investments.

These in turn, will be critical for the SMSF sector to continue to thrive in the COVID-19 age and beyond.

New Model Adviser is a website powered by CoreData, showcasing our research and insights on financial advice: the profession, advisers, advice practices, licensees, legislation and more.