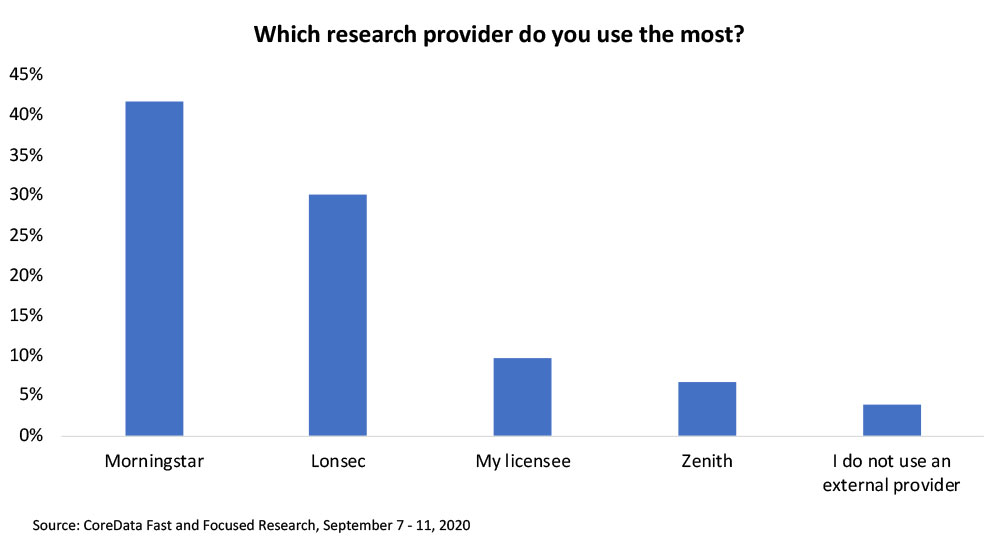

Morningstar and Lonsec are the external research providers used by most financial planners, and most planners offer managed funds as their core investment solution for clients, according to CoreData’s latest Fast and Focused research.

CoreData asked advisers between September 7 and 11 to tell us which investment research providers they used most. Around 7 per cent of advisers said they use Zenith. Almost 4 per cent of advisers say they no not use a research provider at all.

Half (50.7 per cent) of advisers said they are authorised by a licensee that has an in-house research team, yet only one in 10 (9.7 per cent) say they use their licensee’s internal research team most often. However, that figure doubled (19.2 per cent) when advisers were asked which research provider they use second-most.

Even so, the results suggest that a reasonable proportion of advisers who have access to a licensee’s internal research team are not using them, either at all or as their first two choices of research provider.

Additionally, almost two-thirds (64.1 per cent) of advisers said their advice fim does not have an independent research panel or board/committee. Just over a quester (27.2 per cent) do have such a structure; but 8.7 per cent of advisers said they were unsure whether their practice did have one or not.

Most advisers (56.3 per cent) nominated managed funds at the core investment solution they offer clients, with just over one in six (17.5 per cent) saying their core offer is made up of direct securities.

Separately managed accounts (7.8 per cent), managed discretionary accounts (5.8 per cent) and individually managed accounts (4.9 per cent) rounded out the offers.

This week’s CoreData fast and focused research is examining the business outlook for financial advice practices. You can take part in the 60-second survey by finding the New Model Adviser newsletter in your email inbox, and following the link.