As the community’s focus shifts from protecting our health to kick-starting our economic recovery, new research has reinforced the role of financial advisers in supporting not only the financial resilience but also the mental health and well-being of Australians.

CoreData’s COVID-19 Pulse Check survey of more than 3500 Australians has found those without a financial planner are more likely than those who have a financial planner to have suffered negative mental health impacts during the COVID-19 pandemic.

More than half (53.1 per cent) of those who have no relationship with a financial adviser have suffered negative mental health impacts due to the virus, compared to less than half (45.4 per cent) of those who have an adviser.

The unadvised more commonly reported feeling depressed (9.7 per cent versus 7.5 per cent), overwhelmed (16.2 per cent versus 12.0 per cent) and anxious (28.3 per cent versus 26.2 percent) and are also less likely to feel happy (24.6 per cent versus 32.8 per cent) during the crisis.

Unadvised Australians experiencing wider spread financial impacts

Unadvised Australians are more likely to feel insecure when it comes to their financial situation, with more than four in 10 (41.7 per cent) predicting the worst is yet to come for their finances, compared to fewer than three in 10 (28.2 per cent) advised respondents.

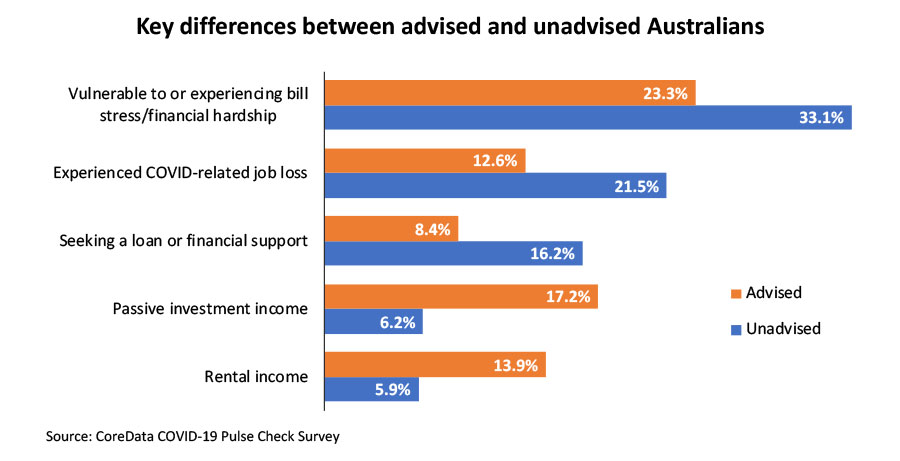

Further, one in three (33.1 per cent) unadvised Australians is in a financial position that indicates they’re either experiencing or vulnerable to bill stress and financial hardship, compared to fewer than one in four (23.3 per cent) of those who are advised.

The greater insecurity and prevalence of bill stress is likely being driven by financial difficulty, with unadvised Australians more likely to have experienced job loss (21.5 per cent versus 12.6 per cent). Conversely, unadvised Australians were less likely to report loss of business revenue (19.9 per cent versus 25.4 per cent), an indication that business owners are more commonly accessing financial advice.

Given the financial strain many unadvised households are under, they are more commonly taking action to tighten their belt, such as decreasing their spend on essential items (54.4 per cent versus 46.4 per cent). Unadvised Australians are almost twice as likely to be applying for financial support and loans (16.2 per cent versus 8.4 per cent advised).

Nearly one in 10 say they have taken up the government incentive to access their superannuation early (9.0 per cent versus 6.0 per cent), while one in five are seeking additional work (22.8 per cent versus 16.3 per cent).

The advised are benefiting from pre-established passive income streams

Reports of income loss due to COVID-19 were similar across advised and unadvised Australians (38.9 per cent versus 39.5 per cent). However, the source of this income loss is less likely to be employment, or solely employment-related for the advised.

While savings are the most common ‘safety net’ for all Australians, those without an adviser are less likely to have any safety net at all. Only one in five (20.9 per cent) advised respondents admit to having no financial safety net to fall back on, but this jumps to a third (32.6 per cent) of those without an adviser.

The advised are much more likely to have personal savings (57.5 per cent vs. 48.8 per cent), however the real difference lies in passive income. Advised Australians are almost three times more likely to receive income from investments (17.2 per cent versus 6.2 per cent) and more than twice as likely to get income from rental properties (13.9 per cent compared to 5.9 per cent). Meanwhile, the unadvised more commonly rely on financial assistance from family (19.1 per cent versus 12.6 per cent) and side hustles (8.2 per cent versus. 5.4 per cent) as their financial back up.

Financial advisers play a key role in fostering Australians’ wellbeing

While the research clearly demonstrates the value of advice in building confidence, security and in turn overall wellbeing, the advised are not immune from the negative impacts of COVID-19 on mental health.

Nearly two in five (41.7 per cent) report feeling socially isolated during the crisis, compared to just under half of unadvised Australians (47.9 per cent), while more than three in five (62.6 per cent) are fearful of the virus’ potential impact on their health and the health of their loved ones, slightly lower than for the unadvised (67.2 per cent).

Our research reveals those aged 60 and over represent more than a third of advised respondents (35.2 per cent), compared to only 17.3 per cent of unadvised respondents. With older Australians in the higher risk demographic for COVID-19, and typically overrepresented in advisers’ client bases, advisers have an important role to play in supporting older clients during this uncertain time.

The impact of the pandemic on personal finances and the economy is expected to continue for many months to come, with further pain expected when the government stimulus measures begin to unwind in September and banks cease offering customers mortgage repayment holidays.