As the impact of new regulations and education standards weigh on the minds of Australian financial advisers, a trend of short-term pessimism is sweeping through the industry.

CoreData’s inaugural Adviser Sentiment Index for Q1 2020 has revealed the extent to which advisers are struggling to navigate the changes, and the potential impact on practice profitability.

The Q1 survey of more than 150 financial advisers across the country found overall adviser sentiment is being dragged down by advisers’ short-term outlook for the industry and their business.

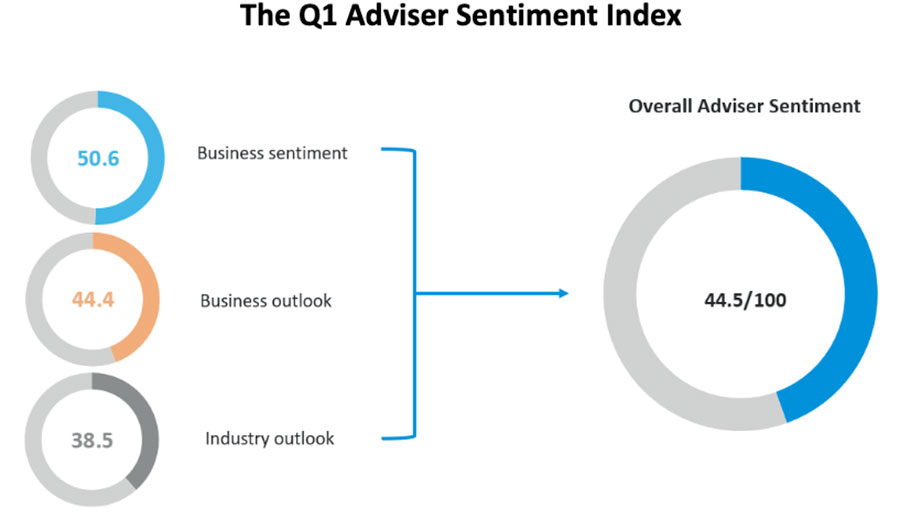

The Adviser Sentiment Index score is just 44.5 out of 100, suggesting many advisers have a negative outlook in the next three months.

Business sentiment, a measure of current business and operating conditions, faired best among the three sub-components of the index, supported by the majority of advisers (78.1 per cent) anticipating at least maintaining their current client base and revenue, or acquiring new clients and revenue growth.

However, operating conditions weighed on overall business sentiment, with more than two in five advisers (43.9 per cent) reporting losing process efficiencies and a downturn in profitability.

Business outlook, which encompasses advisers’ outlook for their business in the next three months and forecast for revenue growth, also suggests the industry expects the worst is yet to come. While one quarter (25.9 per cent) are expecting a better outlook for their business in the next quarter, more than two in five (42.6 per cent) expect the outlook to worsen. More than four in five (81.3 per cent) expect business revenue will either remain the same or decrease in the next three months.

Advisers were most pessimistic about the short-term industry outlook, with nearly half (49.0 per cent) expecting the outlook to be worse and a further third (36.8 per cent) expecting no change.

This doesn’t bode well for the future, given regulatory change typically creates greater administrative and compliance burden, in turn requiring new processes and procedures.

Nearly nine in 10 (87.7 per cent) advisers list admin and compliance burden as a concern for their business in the next three months, while three quarters (75.5 per cent) are concerned about the rising cost of doing business.

It’s little wonder then, that nearly one in three advisers (32.9 per cent) see the ability to deliver advice profitably as the single biggest risk facing the performance of their business in the short-term, while more than one in five (21.3 per cent) cite the regulatory environment.

Advisers also voiced concerns about the ability to attract new clients and serve existing clients, with many fearing a disproportionate impact on less affluent clients, who may become unserviceable as compliance requirements increase cost to serve and potentially place valuable advice out of reach.

The impact of changes will be felt hardest by those offering risk advice

Among advisers who offer risk advice, the most common insurance revenue model under which their practice operates remains commission only (42.6 per cent), followed by advice/implementation fee, plus maximum initial and ongoing commission (27.7 per cent).

While new models are not being considered by many advisers offering risk in the short-term, nearly half (45.5 per cent) say it’s at least somewhat likely they will change their model within the next 12 months. Most commonly, they’re considering shifting to an advice/implementation fee, plus maximum initial and ongoing commission (27.4 per cent), or advice/implementation fee only (24.2 per cent).

Many say they cannot deliver profitable risk advice under the Life Insurance Framework (LIF) (38.2 per cent). This may be why, nearly three in five (57.4 per cent) advisers overall expect to reprice their services in the next three months.

Advisers are price sensitive, and seeking support from life insurers

When it comes to comparing and choosing insurers, advisers are predominantly choosing one company over another due to pricing, with more than four in five advisers (80.8 per cent) listing this as one of the top three choice drivers. Also front of mind are product features (71.0 per cent) and general ease of doing business (46.8 per cent).

With many expressing concerns about the future of risk advice, less than half of advisers offering risk agree that they are adequately supported by life companies to provide risk advice (48.9 per cent).

Given the current landscape, they are most commonly seeking more favourable underwriter terms (44.0 per cent), administrative support (41.1 per cent) and better advocacy around regulation (36.9 per cent). Around one quarter highlight a need for better/more customer-centred product design (27.0 per cent) and better adviser communication around product features/changes (25.5 per cent).

Both insurers and advisers inevitably face further challenges in maintaining the viability of risk advice in the future, but additional support will be required to navigate short-term disruptions and ultimately ensure planners are able to deliver risk advice profitably.