“The nastiest, hardest problem in finance” is how Nobel Prize-winning economist William Sharpe described the difficulties of decumulation.

As this oft-repeated quote recognises, converting a defined contribution (DC) pension pot into a lifetime income is a particularly tough nut to crack. It involves balancing multiple variables, such as equity and bond market movements, the impact of inflation and the great unknown of an individual’s longevity as well as their particular circumstances.

This is a problem that the UK’s workplace DC pension providers are now gearing up to tackle as new legislation, in the form of the Pension Schemes Bill, will require them to offer decumulation options to members, with a default solution for any members not making an active choice. This is due to come into force in 2027 for master trusts, which increasingly dominate the UK’s DC market, and in 2028 for other DC schemes.

At present, many DC retirees find themselves between a rock and a hard place when it comes to decumulation. The rock is buying a lifetime annuity, which is an irrevocable decision. Annuities are unpopular with many because of their inflexibility and the declining incomes they provided as interest rates fell after the 2008 financial crisis – though higher interest rates have boosted annuity incomes and sales in recent years.

On the other hand, the hard place is taking an annual income which can be sustained throughout retirement, however long that may be. As a general rule of thumb, 4% has been regarded as a sustainable withdrawal rate but this relies on various assumptions and is by no means guaranteed to work.

If a retiree is unfortunate enough to see investment markets fall in the early years of their retirement, this has a disproportionately negative effect. A fall in the value of a DC pot in the early years of retirement due to falling markets – or sequencing risk – is hard to make up in future years and can mean that retirees risk running out of funds too soon.

Lessons from the advice market?

As UK workplace DC pension providers ponder how to optimise retirement income solutions, they are likely to consider approaches which have been used elsewhere. For instance, the UK’s self-invested personal pension (SIPP) market has approximately £600bn in assets from five million investors,[1] ranging from DIY investors using fund supermarkets, to affluent investors using SIPPs to consolidate and invest their pensions. Like the members of workplace DC pensions, SIPP retirees face the challenge of DC decumulation, albeit with greater access to advice and guidance from financial planners and wealth managers.

One strategy SIPP retirees can use is to ‘flex then fix’, meaning to use an investment portfolio flexibly before fixing an income with annuitisation later on. Buying an annuity at a later date should provide a higher annual income. And because cognitive decline means older individuals may find it hard to make tricky financial decisions, it can provide income certainty when this is needed.

Another approach is to split the DC pot into different buckets, such as one in highly liquid assets for short-term income, a medium-term bucket for income in the next few years and then a longer term growth bucket. In the UK, wealth managers are now offering this approach to their clients. In addition, cashflow modelling techniques can help by analysing different scenarios and adjusting asset allocation and annual withdrawals as market dynamics and client spending needs change over time.

Harnessing economies of scale

While financial advisers can help to implement retirement income strategies that mitigate sequencing risk and other risks, most members of workplace DC pensions will not have access to bespoke financial advice due to its cost and the limited supply of suitable advisers.

Instead, a new initiative of targeted support, or generic advice for the masses, may help to bridge the advice gap by enabling DC providers to make certain recommendations to the increasing number of people who will approach retirement relying solely on their DC pension fund.

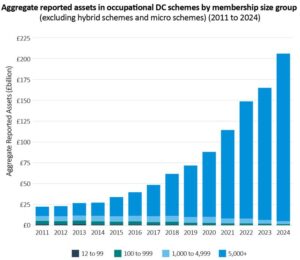

Further, the rapid growth of the UK’s DC market since auto-enrolment started just over a decade ago, as well as its consolidation around a small number of master trusts, means the biggest DC providers will have the benefit of economies of scale.

Chart: How the UK DC market has grown since auto-enrolment began in October 2012

Source: The Pensions Regulator

For example, Nest, the low-cost DC provider set up as part of the pension reforms that led to auto-enrolment, now has 13.8m members and £50bn in assets. Nest representatives have said it is looking at how its decumulation options can use longevity pooling for risk-sharing across its members.

Possible options for Nest could be through building an annuity or insurance component into its decumulation approach or by using a collective defined contribution (CDC) pension design. CDC has been widely discussed as a way to use risk-sharing among DC scheme membership but so far only one CDC fund, the Royal Mail Collective Pension Plan, has been created in the UK.

Another area where greater scale may support enhanced decumulation solutions is in facilitating more investment into private market assets. Over time, the inclusion of a wider range of investment instruments in decumulation solutions could help to deliver more resilient portfolios in retirement.

A range of solutions will likely emerge

As there is little detail in the legislation over how default decumulation solutions will work so far, it will be interesting to see what workplace DC providers offer when their retirement income solutions are unveiled.

As well as the approaches discussed here, there may be lessons from more established DC markets, such as the USA and Australia. The Netherlands, which is shifting towards a CDC pensions system, is another country that could offer insights into the effectiveness of pooling risks within a DC system.

A final point here is that the technical aspects of a retirement income solution are only part of the overall answer when it comes to pensions. As one industry expert told CoreData: “The pension industry is very good at defining a problem, such as the lack of engagement with pensions, and hypothesising why this is. The industry then thinks a new product will solve this problem, but it never does, because it is really a behavioural problem, not a product problem.”

And the behavioural problem covers issues such as pensions adequacy through to low engagement and a lack of trust in pensions. So even finding an answer for “the nastiest, hardest problem in finance” will not be a magic bullet for DC pensions but would help to improve outcomes, enabling millions of British workers to enjoy a more comfortable retirement in the decades ahead.

Matthew Craig is a senior consultant at CoreData Group, a global specialist financial services research and strategy consultancy. To find out more about our industry insights and research programmes, you can reach him at [email protected]

[1] SIPP market set to top £500bn from 5 million investors, Sipps Professional, 2025