In September of 2015 Japan was in the third wave of Abenomics, an attempt by Shinzo Abe, the then Prime Minster of Japan, to lift the economy off its low-growth floor by unleashing government spending.

It didn’t work. Despite the fact Japan is a great export economy, has an educated and industrious workforce and has produce arguably some of the greatest patents ever, it didn’t recover and it continued to sputter for the rest of his time in power.

In a fit of economic arrogance I wrote a series of articles called “The end of the Cherry Blossom Empire,” predicting that if the economy continued to push along its current route and if the Diet (Japanese Parliament) continued to be gridlocked by indecision, then the economy would enter deflation and things would end badly.

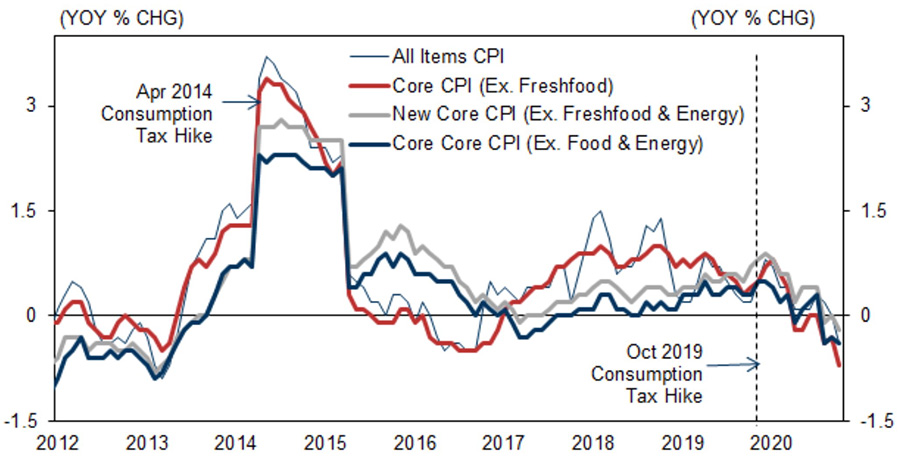

In the way that a stopped clock is correct twice a day, this “prediction” has proved to be right. It’s only taken me five years – have a look at the chart to the above.

But that’s not the point. The point of this is that globally the signals for investors at the moment are very uncertain, and multi-speed economies encompass the globe.

Like all researchers everywhere, at CoreData we are constantly looking to separate signals from the noise and trying to understand what is going on.

We know for example that Australians have been saving about 20 per cent of their income for 10 months now and that spending has collapsed. We know that even in states where lockdown has eased money is yet to recover. But we also know that in the global scheme of things that’s not important.

What is important is how quickly America seems to be recovering – economically, at least, even as they continue to pile up the bodies of their coronavirus dead (the World Health Organisation now estimates there is a COVID-19 death every 17 seconds in Europe alone).

But not all markets are treating this information equally.

One of the ways that you can gauge how an economy is recovering is to ask the professional asset management community how much cash they are holding.

The latest Bank of America Survey revealed that cash holdings in its 190-manager survey had dropped to 4.1% and there had been a sharp rotation into equities, particularly small-caps.

This shows two things. First, the belief that the worst is behind us; and, secondly, the hunt for returns means investors are seeking growth at any price.

This is doubly true, given the starting point for shares. The market has hardly re-set in the time of COVID-19, so the money coming back in isn’t coming back to a deeply scarred under-priced market, but one that has rebounded like a Russian gymnast in at an Olympic selection trial.

No lesser business than JP Morgan is now predicting a vanilla 60:40 global equities and US bonds portfolio will produce a return of just 4.2%. It’s worth noting that since 1980 a portfolio like that would have produced just over 10%.

This means that money is now chasing interesting returns, in particular the tech industry or anything “internet” at all, given the COVID-19-induced sprint to digital.

The other area that’s gaining attention is environmental, social and governance (ESG) investing, with no lesser light than Larry Fink of Blackrock stating that they will be carbon neutral by 2025, and a fast-growing fascination by everyone given the legislative changes in Western Europe. Here’s a link to Core Data’s report on professional asset manager opinions.

The final area that’s getting attention is medtech. The demographic tailwinds and the technology tailwinds will be with this sector for at least the next 20 years. The number of people over 65 in western economies will increase by 60 per cent to one billion people by 2030 and this will drive the confluence of age and technology.

What’s most interesting about healthcare stocks is that, unlike tech stocks, investors are seeing value growth, not from just an increase in price but also from an increase in profits, so super valuations are yet to arrive in this sector.