It turns out that stockbrokers might not be as bad at ethics and incompetent at basic financial advice as they would have us believe.

Claimed exam failure rates of as high as 100 per cent have been challenged, with suggestions the actual stockbroker failure rate is closer to around 15 per cent across all exam sittings to date. That puts them on a par with the financial advice industry more generally.

Stockbrokers who are named on the ASIC financial adviser register are required, like all financial advisers on the register, to meet education, professional and ethical standards that come progressively into effect up to January 1, 2026. And the body that represents stockbrokers, the Stockbrokers and Financial Advisers Association, may have a point when it says the content of the exam is not relevant to stockbrokers.

But the segment of the SFAA’s membership that fits the “FA” part of the name can’t really claim the title but not comply with the same standards as all other financial advisers, which includes meeting continuing professional development (CPD) requirements, attaining a degree or equivalent, or higher, qualification and, of course, passing the exam.

Quite apart from its supposed relevance, non-financial-adviser stockbrokers might have objections to the exam similar to other financial advisers’, namely, the time taken and cost of studying for and sitting the exam.

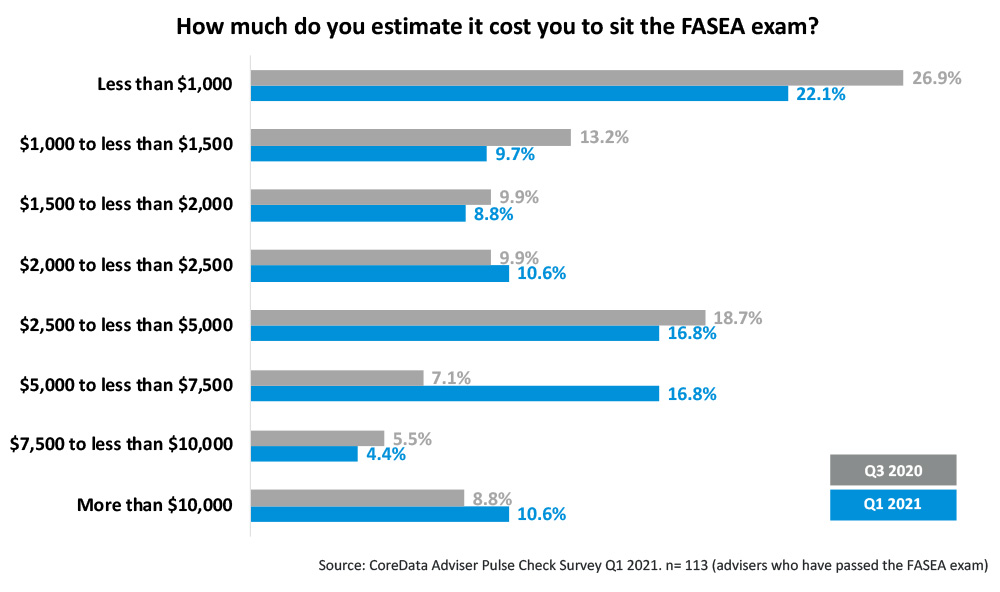

In the third quarter of last year we asked financial advisers how much time and money it had cost to sit the exam. Let’s just say the results we reported weren’t met with universal agreement, even though they accurately represented the responses we received.

The main bone of contention was that the way we’d asked advisers to report the cost might have meant they hadn’t factored in opportunity cost: the money they could have made, assuming every moment they spent studying and sitting the exam was instead spent generating revenue from clients. With hourly rates of more than $300 suggested, it was argued this could be a significant sum, not reflected in the reported results.

So in February this year we asked the question again, and this time made it explicit that opportunity cost should be factored into the answer:

How much do you estimate it cost you to sit the FASEA exam?

When answering this question please consider:

- The direct cost of sitting the exam

- Direct costs of studying (e.g. courses/materials)

- Non-client-facing time spent/opportunity cost of studying for the exam – including travel to exam location (if time not allocated to study/professional development)

- Non-client-facing time spent/opportunity cost of sitting the exam – including travel time to exam location (if time not allocated to study/professional development)

- Any other costs related to preparing for or sitting the exam

At a high level these are the results, compared to the results we got last time around:

There are some shifts in the distribution of responses. Even so, more than one in five advisers still report it cost – all up, including opportunity costs – less than $1000 to study for and sit the FASEA exam. But at the other end of the scale, one in 10 advisers report it cost more than $10,000. In Q1 2021 around two-thirds of advisers say the cost has been less than $5000, compared to three-quarters of advisers who reported the cost was less than $5000 in Q3 2020.

This article was originally posted in Professional Planner.